After one of the longest and most acrimonious campaign seasons in recent memory, the finish line is finally in sight. While we may not get a firm, unassailable answer about who will be the next POTUS on election night, traders are eager to start refocusing on market trends and traditional economic data after being glued to the political rollercoaster for months.

The Current “State of the Race”

So where do we stand with just one week until election night? Not much has changed since our last “State of the Race” report three weeks ago: Former Vice President Joe Biden has a commanding, but not insurmountable, lead over incumbent president Donald Trump. As it stands, Biden leads Trump 51-43 in the RealClearPolitics polling average and 52-43 in the FiveThirtyEight polling average. Based on these polls and other data, election models are suggesting that Biden has high chance of emerging victorious when the votes are totaled up, with FiveThirtyEight giving Biden an 88% chance of winning and The Economist pinning Biden’s odds at 95%(!) as of writing. Punters are a bit more conservative in their assessments, with Joe Biden implied at roughly 61% to be the next US President on PredictIt.

With all the hullaballoo about the high-profile Presidential contest, some readers may overlook the equally important race for control of the Senate. The GOP currently holds a majority with 53 senators but must defend 23 seats this cycle vs. only 12 Democratic seats up for grabs (note that the Vice President casts the deciding vote if there is a 50-50 tie, so the Presidential race will be key for the Senate as well). As it stands, FiveThirtyEight gives Democrats a 74% chance of taking control of the Senate, which combined with a Biden victory, would create a “Blue Wave” scenario where Democrats are able to enact more of their agenda (“Green New Deal”, aggressive fiscal stimulus, tax reform, greater regulation, etc). Once again, punters are more balanced, projecting 60-40 odds of Democrats securing control of the Senate.

What’s “Priced In” to Markets?

As any experienced trader can tell you, markets are always forward-looking; they don’t wait for a news announcement to become official before trading on it. Take the COVID-19 pandemic and ensuing economic shutdowns across the globe as an example. Global stock markets fell by roughly -30% across the globe in late February and early March as it became clear that the we’d see a steep decline in economic activity through the middle of the year. Traders didn’t wait for the July releases of the Q2 GDP reports to confirm that the economy was in the dumps; in fact, by that time, markets were already looking ahead to the potential for an economic recovery in 2021 on the back of unprecedented global monetary/fiscal stimulus and positive early signs toward a vaccine.

Likewise, the polling data and trends we outline above aren’t exactly proprietary information. Traders are already positioning for different scenarios on election night, so if the vote goes mostly “as expected,” market moves may be more subdued than some analysts fear. In fact, some of the recent shifts we’ve seen in polls have prompted traders to price in a LESS chaotic and volatile reaction to the election. Seemingly in response to the rising odds of a “Blue Wave” scenario, the prices on VIX futures for November and December have declined in recent weeks, signaling that traders are expecting less volatility around the election than they were back in August and September.

What does that mean for traders? If you expect a close, highly-contested result where neither candidate concedes, there may be more potential for a volatile, downside move in global equity markets and risk-sensitive currencies. Conversely, a clear landslide election victory could still lead to a “relief rally” in global risk assets as the risk of a contentious legal battle over the results is avoided, though the recent shift in futures prices suggests that traders are increasingly betting on that scenario, so it may not lead to as a big of a move.

Likewise, specific sectors like green energy and marijuana stocks may benefit from a Biden victory, especially if we see a full “Blue Wave.” On the other hand, more traditional energy/coal names and media companies could benefit from another Trump upset. Generally speaking, the market is looking at the same data we are to handicap the results, so any bullish moves in so-called “Biden trades” may be smaller than the potential rallies in “Trump trades” if the incumbent President is able to secure another term, mirroring the drastic unwind of “Clinton Trades” on election night four years ago.

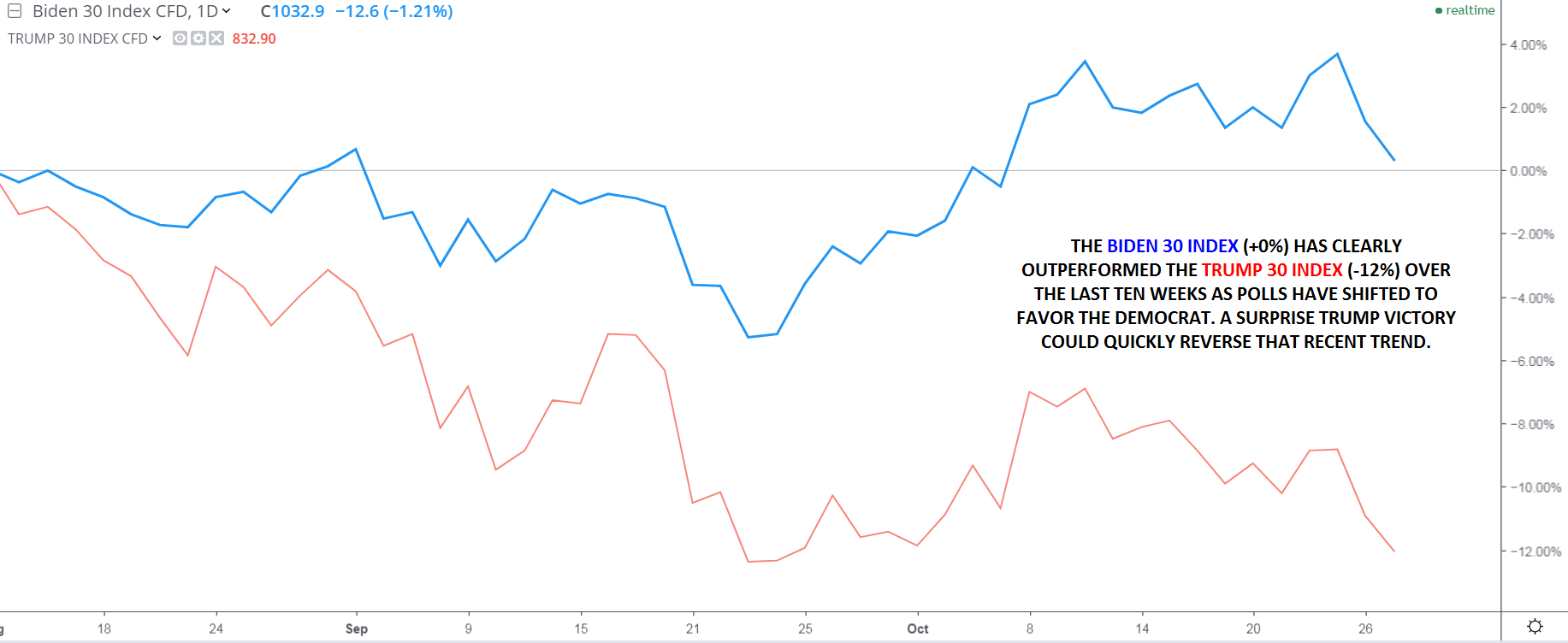

Our proprietary “Trump 30” and “Biden 30” thematic indices, which contain 30 stocks that may benefit the most depending on which candidate wins the election, support this notion (please note that these indices are not be available to trade in all regions). Since mid-August, the Biden index (+0%) is dramatically outperforming the Trump index (-12%), suggesting that traders have grown more pessimistic on Trump’s prospects over the last ten weeks. A surprise Trump victory could lead to a quick reversal in that trend.