KEY TAKEAWAYS:

● Markets expect another 25 basis point cut in October as growth and inflation have shown further signs of cooling in the Eurozone.

● Very limited forward guidance expected as ECB takes it meeting-by-meeting. Market-implied future rates could shift as data offers further insight.

● EUR/USD is likely to remain pressured by less favourable rate differentials, geopolitical tensions and risk aversion.

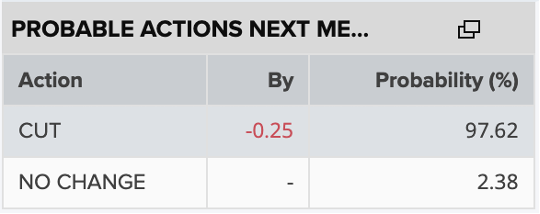

Markets are convinced the European Central Bank (ECB) will cut rates by 25 basis points again at Thursday’s meeting. Last month, the central bank gave very little away in terms of forward guidance, but at the time markets had thought a pause in the cutting cycle may be on the cards for October. However, this now seems to be off the table.

Market-implied probabilities for the October 17 ECB meeting

Source: refinitiv

Since the last meeting five weeks ago, there has been very little data released to provide further insight into the state of the Eurozone economy. However, the data available has offered signs of weaker growth and further moderation in inflation and the labour market, leading market participants to believe another rate cut may be coming.

Headline inflation dropped below 2% for the first time in over three years in September, coming in at 1.8% as anticipated. Moreover, month-on-month growth in consumer prices came in negative for the first time since January after it ticked higher throughout the year. Meanwhile, the growth in core CPI, which excludes volatile prices like food and energy, was smaller in September than August, with the year-over-year figure dropping to 2.7%. This was the level seen in April before the rise over the summer months.

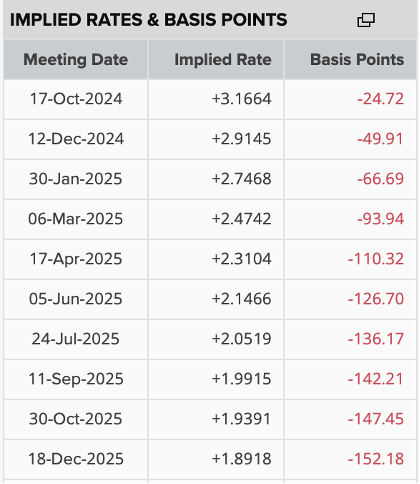

The positive inflation readings play into the rate cut rhetoric for the ECB, easing concerns of a potential resurgence in price pressures. Currently, markets have priced in an additional 49 bps of easing for this year, suggesting two rate cuts, one in November and one in December. Looking ahead, 152 bps of easing is expected by December 2025, which suggests a rate cut every quarter next year. The pace of these rate cuts is likely to drive market momentum, as it signals the central bank’s stance on the economy, giving investors either a sense of urgency or calm depending on the approach.

A reversal to this quarterly rate cut outlook could come from a weakening labour market, which has been somewhat stagnant in Q3. This could see rate cuts brought forward and more easing priced in. Alternatively, stronger growth or a pickup in inflationary pressures could see the rate cut cycle spaced out further.

Market-implied rates for 2024/25

Source: refinitiv

It’s likely that we see President Lagarde remain ambiguous with forward guidance at the meeting this week. The messaging has remained the same for the past few months with highlights on a meeting-by-meeting and data-dependent approach, and this is unlikely to change anytime soon.

With regards to the euro, we could see limited impact from the ECB meeting this week as a rate cut is so heavily priced in. A deviation from expectations – either no cut or a larger cut – would likely provide a high level of volatility, but this seems highly unlikely given the recent data. Any further update to forward guidance from President Lagarde could also see some momentum in European assets.

For EUR/USD, the path of least resistance is likely to continue lower. Less favourable rate differentials, as markets re-price expectations for Fed cuts given stronger data in the US, are likely to continue putting downside pressure on the pair. Geopolitical tensions and risk aversion also play against the euro versus the dollar.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.

Capital Com is an execution-only service provider. The material provided in this article is for information purposes only and should not be understood as investment advice. Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. If you rely on the information on this page, then you do so entirely at your own risk.