The Japanese Yen has been attracting increased buying interest over the past few weeks. What started with a pullback in USD/JPY following softer-than-expected inflation data released on July 11 has turned into a JPY-positive reversal that has spilt into other pairs like GBP/JPY and EUR/JPY.

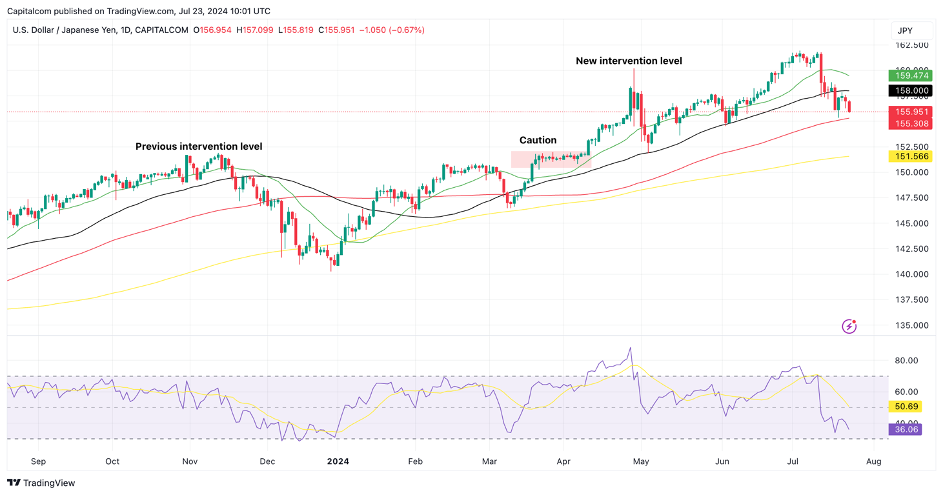

The magnitude of the pullback sparked speculation of Japanese intervention in markets, which has become somewhat of a norm as the yen has continuously depreciated over the past two years. It has also become common for Japanese officials to not confirm whether they have intervened in the market or not. Whilst this method does not offer long-lasting results, it does offer short-term opportunities for JPY buyers.

The continuation of the bearish trend in USD/JPY may also be attributed to a weaker dollar as markets ramp up expectations of a rate cut from the Federal Reserve in September. Softer inflation and labour market data have led many to believe that the US economy is primed and ready for monetary conditions to start becoming looser.

That said, the fact that both GBP/JPY and EUR/JPY are also seeing continued downside momentum alludes to some strength in the yen. Two factors could be causing this. One, there has been an increase in risk-off sentiment in global markets. Two, analysts are becoming more confident that the Bank of Japan (BoJ) could hike rates by 10 basis points at its meeting next week. Current market pricing shows a probability of 43% of this happening.

A combination of rising rates in Japan and falling rates elsewhere could see the long-term bearish trend in JPY start to reverse. If so, USD/JPY sellers could come out in force and attempt to bring the pair back below 150.

For now, the short-term bias remains positive for the yen, weighing on USD/JPY, GBP/JPY and EUR/JPY. That said, the fundamentals still support the other currencies versus the yen, so if we don’t see much commitment from the BoJ to hike rates next week then it’s likely that the reversals will start to lose momentum and the longer-term bullish trends in all three pairs will resume.

USD/JPY daily chart

Past performance is not a reliable indicator of future results.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Could another BoJ rate hike be in the works? USD/JPY, GBP/JPY, EUR/JPY latest

Published 23/07/2024, 14:01

Could another BoJ rate hike be in the works? USD/JPY, GBP/JPY, EUR/JPY latest

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.