Q3 results win on bottom-line growth

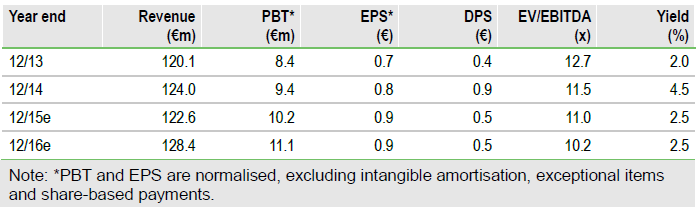

Cenit (DE:CSHG) has reported Q3 results showing 12.8% y-o-y growth in EBIT after a 2.9pp gross margin gain that offset the impact of a 4.5% sales decline. The results support the company’s full-year guidance of stable revenues and an 8-10% increase in EBIT, and have led us to increase our 2016 EBIT forecast by 1.5%. We believe that the recently announced acquisition of Coristo, a SAP product structure management specialist, should add value to the group by strengthening Cenit’s product offering and potentially leading to the creation of new proprietary software.

Operating profit up 12.8% on wider margins

PLM revenues, which make up 81% of total sales, rose 0.8% y-o-y in Q315 but a greater than expected 22% fall-back in EIM revenues resulted in total sales contracting 4.5%, which undershot our revenue estimate by 5.3%. Management’s focus on the bottom line, which has seen it avoid taking on some low-margin business, was reflected in the 2.9pp expansion in the gross margin to 61.5% in Q315, which flowed down to a 1.4pp gain at the EBIT margin.

To Read the Entire Report Please Click on the pdf File Below