- CAT earnings have returned to pre-COVID levels

- Valuation is considerably higher than before the pandemic

- Wall Street consensus outlook is bullish

- Market-implied outlook (calculated from options prices) is bullish to mid-2022 and neutral for full year

Caterpillar (NYSE:CAT), the Deerfield, Illinois-based farm and heavy machinery manufacturer, reported Q4 results on Jan. 28, beating expectations on earnings and revenue. The company also reported that $5 billion was distributed to shareholders through buybacks and dividend payments in 2021. The shares have declined 13% since hitting a six-month high close of $229.87 on Jan. 18, with about half this drop occurring on Jan. 28 in response to the Q4 earnings.

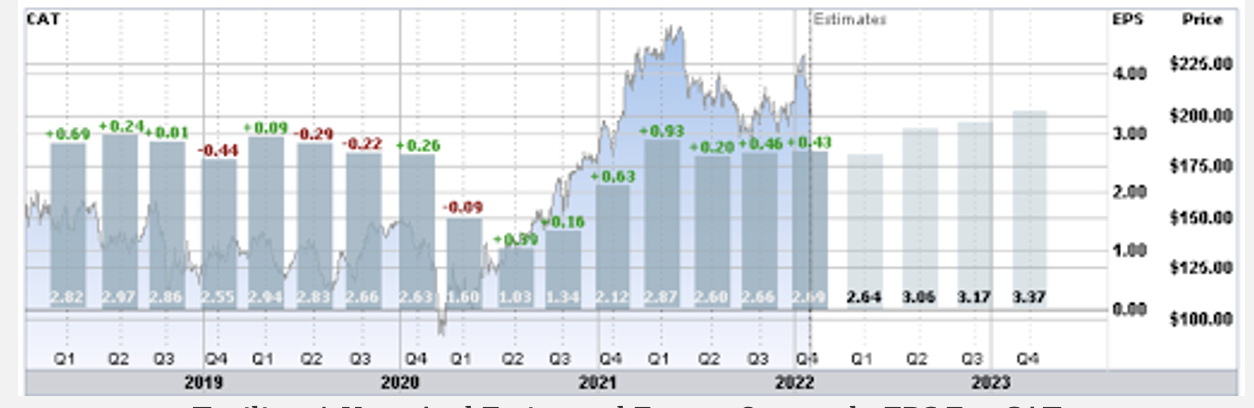

CAT shares rose dramatically after the COVID-driven market decline of early 2020, closing at an all-time high of $244.79 on May 17, 2021. This peak was reached following blowout earnings for Q1 2021, with EPS exceeding the consensus expectations by 48% (Source: E-Trade).

While reported earnings in the three quarters since have been solid, quarterly EPS for each of these has been lower than in Q1 2021. The shares have declined in response.

Source: Investing.com

After recovering faster than expected from the COVID-driven economic slowdown, CAT earnings have stabilized at levels comparable to where they were in 2018 and 2019. The share price remains far above where it was in those years, however. At the end of 2018 and 2019, CAT had P/E ratios of 11.4 and 13.0, respectively, as compared to 17 today.

Green (red) values are amounts by which quarterly EPS beat (missed) expected earnings (Source: ETrade)

I last wrote about CAT on June 30, 2021, after the shares had fallen about 11% from their 2021 high close. At that time, I upgraded the shares from a neutral rating to a buy rating on the basis of two main considerations. The first was that earnings had risen rapidly coming out of COVID and there was considerable optimism that the U.S. was about to make major investments in infrastructure. The second was that the consensus outlook from Wall Street analysts for CAT was strong. The counterpoint to the positive outlooks was a neutral to negative outlook from the options market.

The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) from now until the option expires. By analyzing options prices for a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that reconciles the options prices. This is called the market-implied outlook and represents the consensus view of buyers and sellers of options.

In June, the market-implied outlook for CAT to Jan. 21, 2022, (calculated using options that expired on this date) slightly favored negative price returns. The maximum probability outcome for this outlook corresponded to a price return of -5%. I interpreted this outlook as neutral because the market-implied outlook is expected to be somewhat negatively biased because risk-averse investors tend to pay more than fair value for downside protection (e.g. put options), which results in elevated implied probabilities of negative outcomes. The market-implied outlook to June 17, 2022, was also tilted to favor negative returns, with maximum probability corresponding to a price return of -13%. I interpreted this outlook as neutral as well, although (in retrospect) I probably should have given more weight to this negative inclination.

I have updated the market-implied outlooks for CAT and compared them to the current Wall Street consensus, as in my previous analysis.

Wall Street Consensus Outlook For CAT

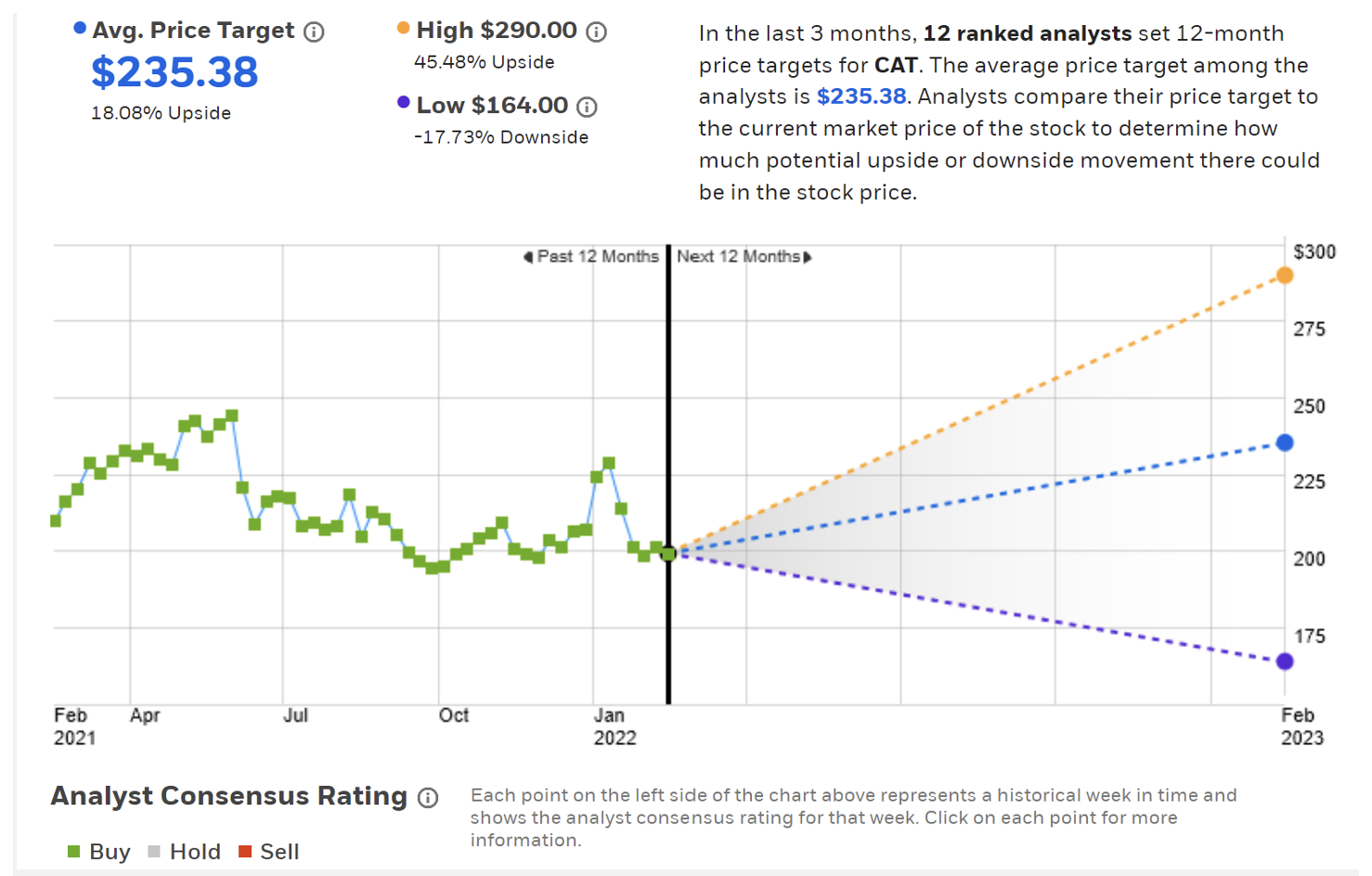

E-Trade calculates the Wall Street consensus outlook by combining the ratings and price targets from 12 ranked analysts who have published their views within the past 90 days. The consensus rating is bullish, as it has been over the last 12 months. The consensus 12-month price target is $235.38, 18% above the current share price. There is a fairly high dispersion among the individual analyst price targets, which reduces confidence in the predictive value of the consensus. When I last wrote about CAT in June, the consensus 12-month price target was $251.38.

Source: E-Trade

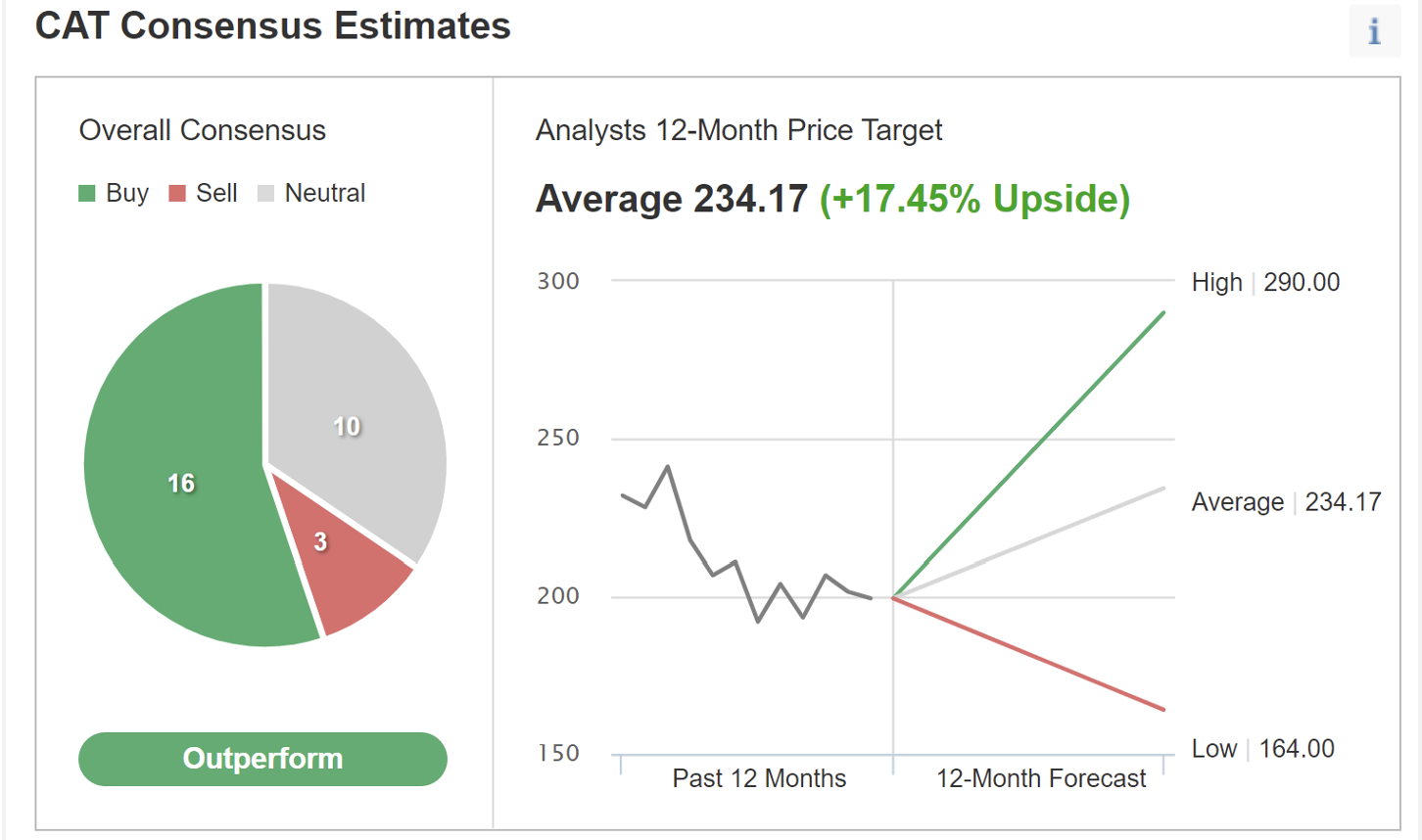

Investing.com’s version of the Wall Street consensus outlook is based on the views of 29 analysts and the results are almost identical to those from E-Trade, with a bullish rating and a 12-month price target of $234.17, 17.5% above the current price. Also consistent with the E-Trade results, the dispersion among the price targets is quite high, indicating a lack of consistency in estimates of revenue and earnings growth.

Source: Investing.com

In my analysis at the end of June, the Wall Street consensus was bullish and the 12-month price target was about 13% above the share price at that time. The shares have fallen since that analysis, as has the consensus price target, and the current expected 12-month price appreciation is 17.8% (averaging the two consensus values). Then, as now, the spread in the views of individual analysts was high.

Market-Implied Outlook For CAT

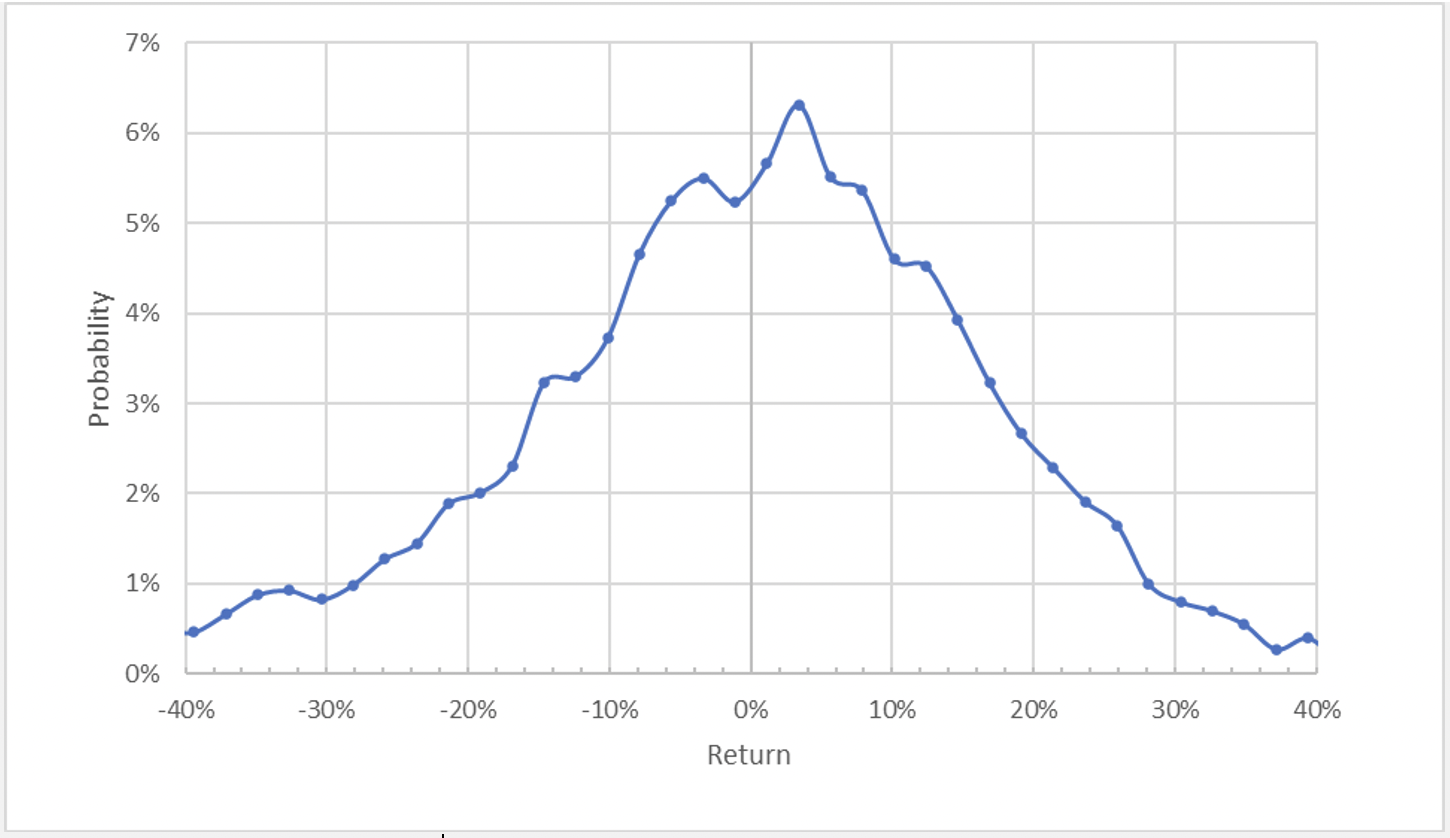

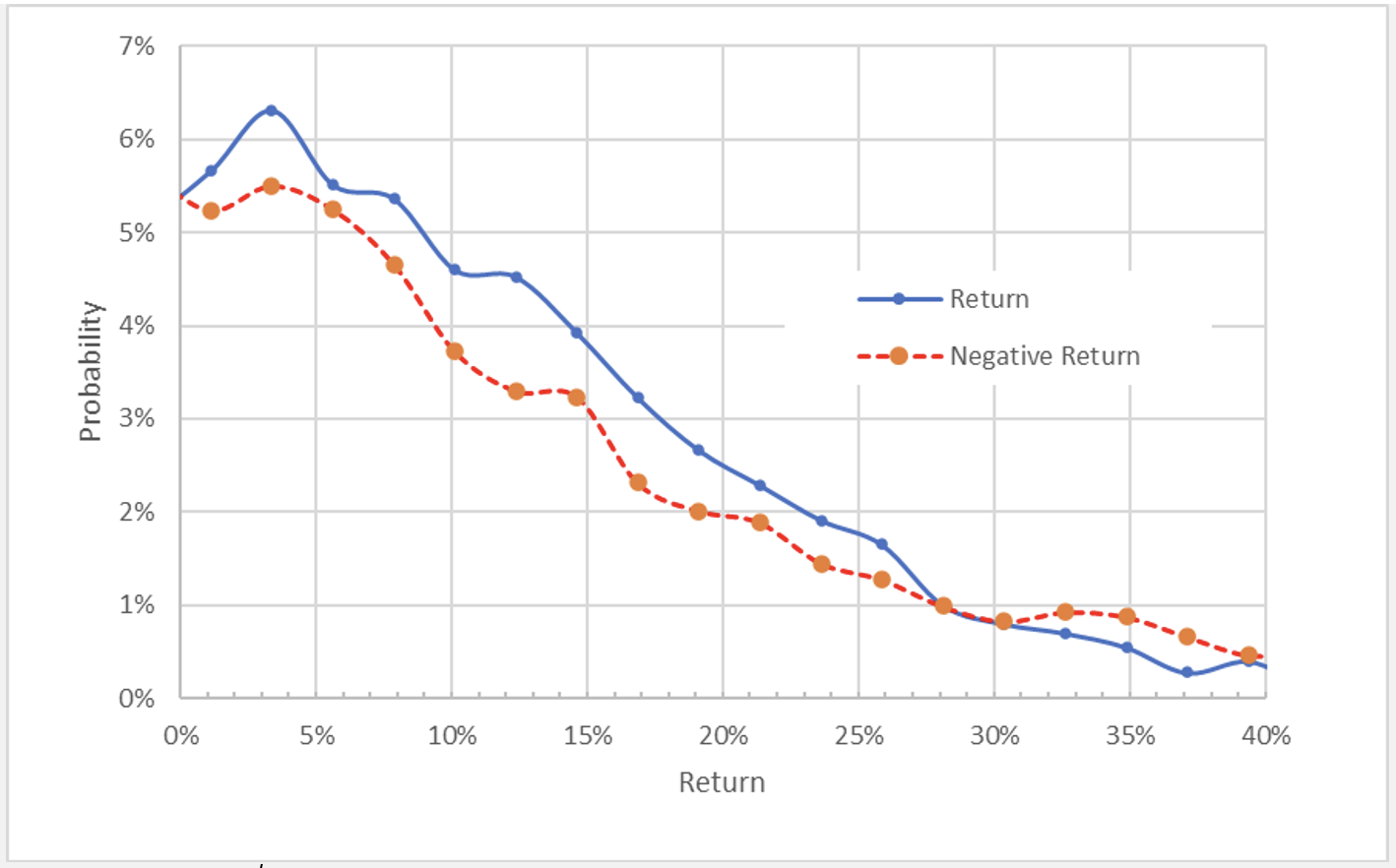

I have calculated market-implied outlooks for CAT for the next four months (from now until June 17, 2022) and for the next 11.2 months (from now until Jan. 20, 2023) using the price of options that expire on these dates. I chose these two expiration dates to provide a view to the middle of the year and for (almost) the next 12 months.

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook to June 17, 2022, is generally symmetric, although the maximum-probability outcomes are slightly shifted to favor positive returns. The peak probability corresponds to a price return of +3.4%. The annualized volatility calculated from this distribution is 34%, as compared with 30% from my last analysis.

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view shows that the market-implied outlook slightly favors positive returns for a wide range of the most probable outcomes (the solid blue line is consistently above the dashed red line over the left three-quarters of the chart). This is a bullish view for CAT, especially considering the expected negative bias in the market-implied outlook.

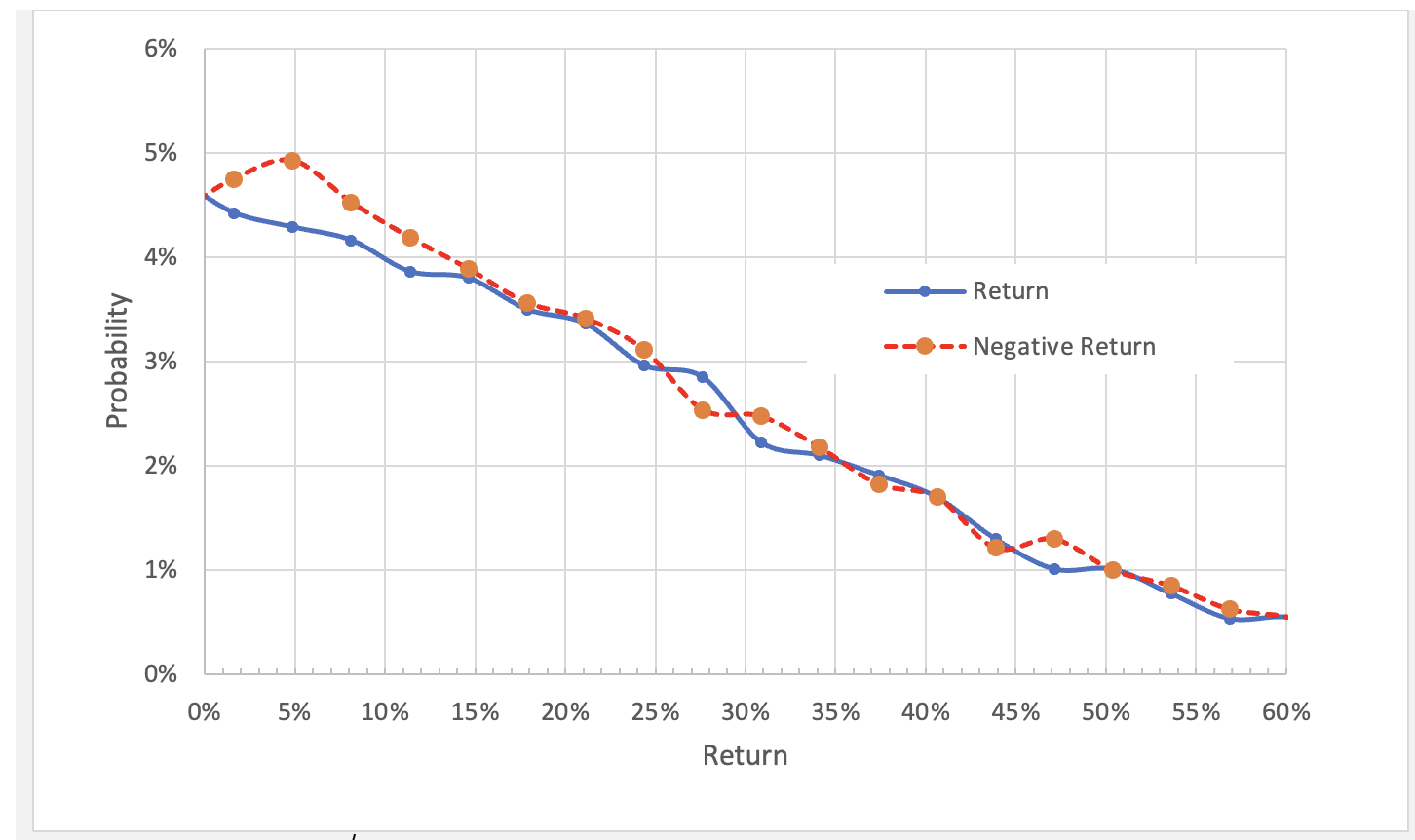

The market-implied outlook for CAT to Jan. 20, 2023, slightly favors negative returns for small-magnitude price moves (the dashed red line is above the solid blue line for returns from 0% to 15% on the chart below). Over the range of all other outcomes, the probabilities of positive and negative returns match very closely. Considering the expected negative bias, I interpret this outlook as neutral overall. The annualized volatility calculated from this distribution is 33%.

Source: Author’s calculations using options quotes from E-Trade

The moderately bullish market-implied outlook to the middle of 2022 and a neutral outlook for the next 12 months suggest that CAT shares offer a reasonable trade-off of risk and return. The expected volatility of 32%-33% indicates that the market does not anticipate elevated downside risks.

Summary

CAT shares are about 18.5% below their all-time high seen in May of 2021. The brisk rate of earnings coming out of the COVID-19 economic slowdown was not sustainable and CAT’s earnings have been hampered by the prevailing supply chain and inflation challenges, along with slowing sales in China.

The consensus rating on CAT from Wall Street analysts continues to be bullish, and the consensus 12-month price target is about 17.8% above the current share price. Combined with the 1.93% dividend yield, the expected 12-month total return is almost 19.7%.

As a rule of thumb for a stock to present an attractive risk-return trade-off, I look for an expected 12-month total return that is at least half the expected volatility. With expected volatility of around 33% from the market-implied outlook, CAT meets this criterion. The market-implied outlook for CAT is bullish to mid-2022 and neutral to Jan. 20, 2023. Although the fairly high valuation is a concern, the bullish Wall Street consensus and market-implied outlook to mid-2022 convince me to maintain my overall bullish rating on CAT.