The Brunner Investment Trust’s (BUT’s) two co-managers, Christian Schneider (deputy CIO global growth) and Julian Bishop (global equity specialist) are supported by deputy managers Marcus Morris-Eyton (European equity specialist) and Simon Gergel (CIO UK equities). BUT can be considered as a global equity fund for all seasons given its steady trend of outperformance in recent years despite volatile share prices and changes in stock market leadership. The trust stacks up well in both absolute and relative terms with double-digit annual NAV total returns over the last decade and above-average returns within the AIC Global sector over the last one, three and five years. BUT’s dual mandate of income and capital growth means it should appeal to a broad range of investors.

Why consider BUT?

BUT’s highly experienced managers have a shared investment philosophy, seeking quality companies with stable, above-average returns, operating in secular growth businesses, and which are trading at reasonable valuations. A company’s long-term free cash flow is a particular area of focus within the team. Investing for the long term is borne out by the trust’s relatively low portfolio turnover, which averages below 20% per year, implying a holding period of more than five years.

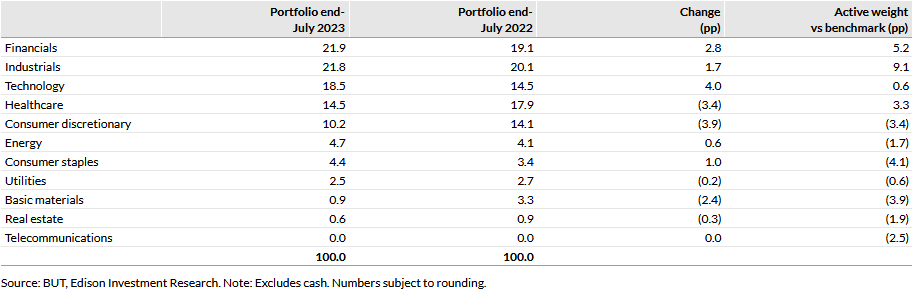

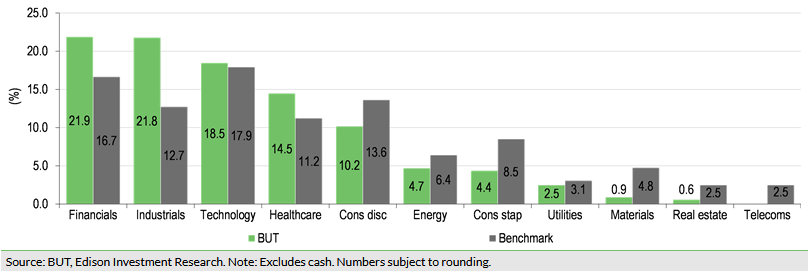

Stocks are selected on a bottom-up basis and in aggregate Brunner Investment Trust (LON:BUT) has meaningful above-index positions in two cyclical sectors, industrials and financials, while its largest underweight is to consumer staple stocks, suggesting the fund should perform relatively well ahead of an economic recovery.

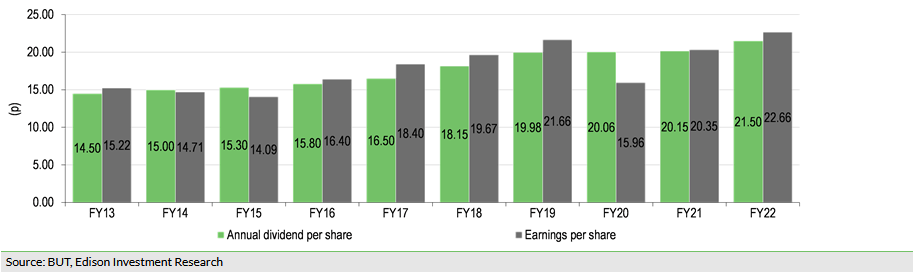

The trust has a commendable record in terms of its income growth. It has increased its annual dividend in each of the last 51 years, earning it seventh place in the AIC’s list of 20 dividend heroes, which are funds that have grown their distributions for at least 20 consecutive years.

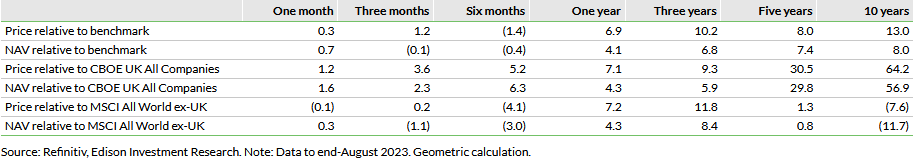

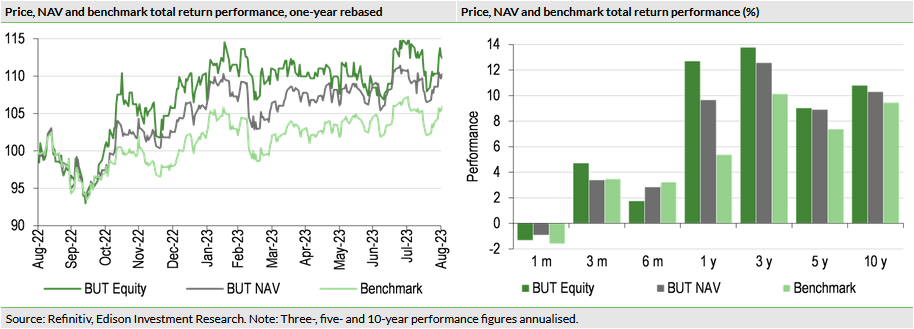

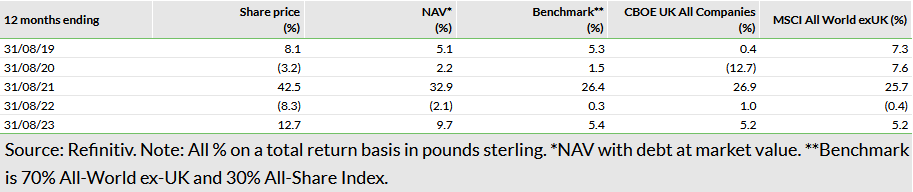

One could argue that BUT’s 13.0% share price discount to cum-income NAV, which is equivalent to around 20 years of its latest ongoing charges, looks overly wide given the trust’s straightforward high-quality equity portfolio, notable dividend record and strong record of outperformance. BUT has outpaced the returns of its composite (70% global, 30% UK) benchmark over the last one, three, five and 10 years in both NAV and share price terms.

NOT INTENDED FOR PERSONS IN THE EEA

BUT: A one-stop shop for a global investor seeking both capital and income growth

A straightforward global equity fund

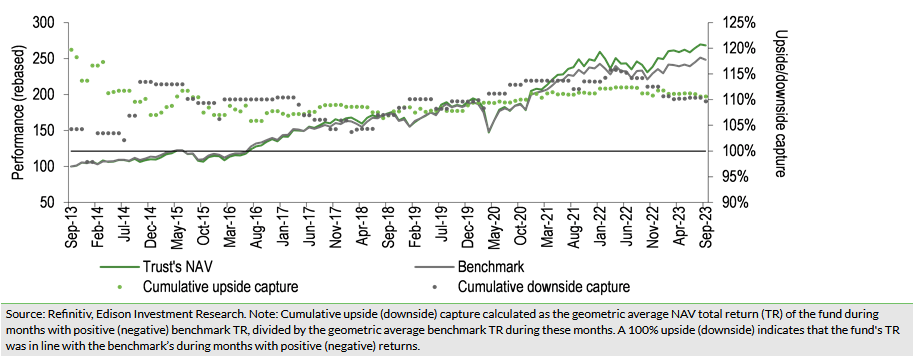

We highlight BUT’s upside/downside capture over the last decade in Exhibit 1. Unusually, the trust has a very similar rate of 111% in a rising and 110% in a falling market. The portfolio does not display any particular bias to rising or falling markets, partly due a 100% listed equity exposure, with no unquoted assets or derivatives.

Current portfolio positioning

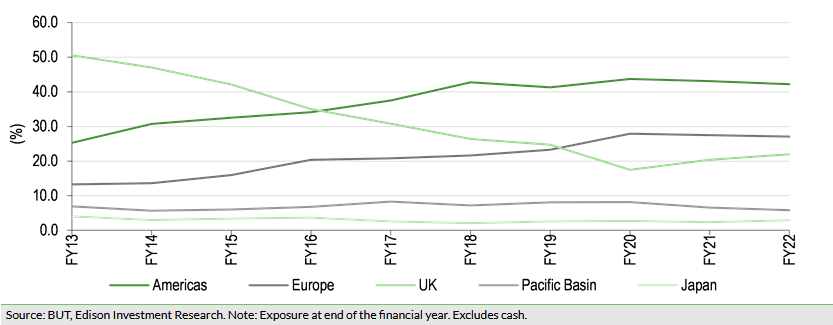

Exhibit 2 shows how BUT’s geographic exposure has evolved over the last decade. Compared with global indices the trust retains a relatively high UK weighting due to its composite benchmark, which is a combination of 70% of a broad global ex-UK index and 30% of a UK index (50:50 split until March 2017). Stocks are selected on a bottom-up basis but a comparison with the benchmark shows a notable overweight exposure to European stocks, while the UK allocation is below its benchmark weighting.

Exhibits 3 and 4 show that there were modest changes in BUT’s sector exposure in the 12 months to the end of July 2023 with the most notable being a 4.0pp higher weighting to technology stocks and a 3.9pp lower weighting to the consumer discretionary sector. Compared with the benchmark, the trust’s active weights are not dissimilar to when we published our last review in May 2023. The largest overweight sectors are industrials (+9.1pp) and financials (+5.2pp), with underweight exposures to consumer staples (-4.1pp) and basic materials stocks (-3.9pp).

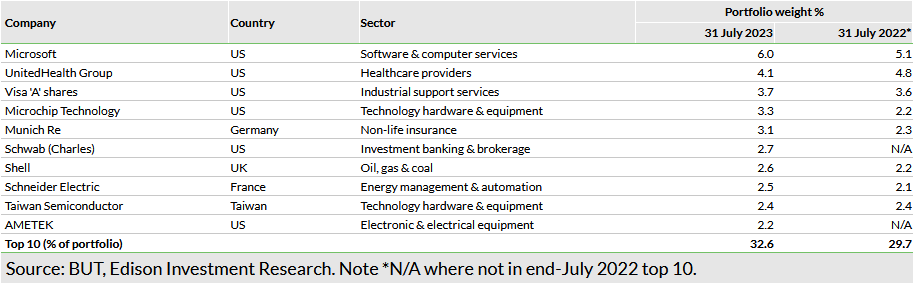

At end-July 2023, BUT’s top 10 holdings, over a broad range of businesses, made up 32.6% of the portfolio, which was a higher concentration versus 29.7% 12 months previously; eight positions were common to both periods.

Recent portfolio activity

Portfolio activity in recent months has been modest. In July, the managers initiated a position in Netherlands-based ASML Holding (AS:ASML), the market leader in photolithography equipment, which uses a light source to expose circuit patterns from a photomask onto a semiconductor wafer. ASML’s extreme ultraviolet lithology enables semiconductor manufacturers to increase the number of transistors on the same area of silicon. The considerable development cost of this technology affords the company a very high barrier to entry, while ASML has a high-quality earnings stream and a strong balance sheet. To fund this new holding, profits were taken in a range of positions including Microsoft (NASDAQ:MSFT), as it is deemed to be a lesser beneficiary of the growth in artificial intelligence compared with some other major technology companies.

In June 2023, the managers added to BUT’s holding in Microchip Technology, a US manufacturer of small, relatively simple semiconductors and microcontrollers that are used in a wide variety of applications, from electric vehicles to factory automation. Relatively low price points and small quantities limit pricing pressure, while as Microchip’s components tend to be designed for a specific device there is a high level of repeat business, supporting the company’s margins. Having made acquisitions and subsequently paid down the debt incurred, Microchip is now able to return cash to shareholders via higher dividends and share repurchases. The managers consider the company has a good balance of quality, value and growth. Funding for the increased allocation to Microchip came from taking profits in two European pharma companies, Novo Nordisk (CSE:NOVOb) and Roche Holding (SIX:ROG).

London-listed Intercontinental Hotels Group (LON:IHG) was added to BUT’s portfolio in April 2023. It is one of the largest chains in the world with c 6,000 current and a further c 1,800 hotels in the pipeline. The managers favour IHG’s franchise or fee-based business model with licenced brands including Holiday Inn, Intercontinental and Six Senses, which generate a reliable, profitable fee stream with opportunities for future growth. IHG has long-term contracts with hotel owners and its asset-light model means the company generates high levels of cash flow that can be returned to shareholders. This new position was partially funded by the sales of two small holdings in UK contract foodservice company SSP Group and Japan-listed Astellas Pharma.

Performance: Looking strong versus its peers

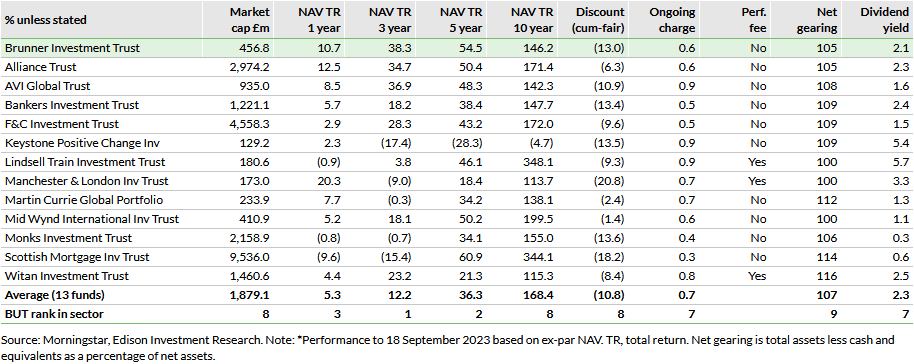

There are 13 funds in the AIC’s Global sector following a range of different mandates. BUT’s relative performance has definitely improved in recent months and its NAV total returns are above average over the last one, three and five years with very commendable rankings of third, first and second respectively. The trust’s performance is below average over the last decade. Despite its strong performance record, BUT’s discount is wider than average in a group where no fund is trading at a premium. Its ongoing charge is below average as are its level of gearing and dividend yield, although few of its peers can match BUT’s annual dividend growth record. There are only 20 AIC dividend heroes, which are funds that have a 20-year or greater record of annual dividend increases. There are six in the AIC Global sector; BUT has the fourth longest record.

With the trust aiming to generate both capital and income growth, BUT could be considered as a core or ‘all-weather’ fund. Its high-quality portfolio is straightforward, with no exposure to unlisted businesses or derivatives. Looking at the Morningstar style analysis of the companies in the AIC Global sector, there are three categorised as large-cap blended funds: BUT, Bankers Investment Trust (LON:BNKR) and F&C Investment Trust; most are categorised as large-cap growth funds. Comparing the performance of these three companies, BUT’s NAV total returns rank comfortably first over one, three and five years, while it is narrowly in third place over the last decade.

In H123 (ending 31 May), BUT’s NAV and share price total returns of +1.6% and +2.3%, respectively, outpaced the benchmark’s +0.3% total return. As shown in Exhibit 7, the trust is ahead of its benchmark over the last one, three, five and 10 years in both NAV and share price terms.

Over the last year, stocks that have made the largest contribution to BUT’s relative performance include the trust’s holding in Greek retailer Jumbo (year-to-date share price +71%), and top 10 holdings Munich Re (+24%) and Microchip Technology (+13%). The largest detractors to the trust’s relative performance include top 10 holding UnitedHealth (NYSE:UNH) Group (-6%) along with a lack of exposure to some of the US large-cap technology stocks that have performed particularly well such as NVIDIA Corp (NASDAQ:NVDA) (+203%) and Apple (NASDAQ:AAPL) (+42%).

Dividends: Progressive policy over last 50+ years

BUT has delivered higher annual dividends for the last 51 consecutive years, and is seventh in the AIC’s list of 20 dividend heroes. Also, the trust’s average annual dividend growth is higher than the average level of UK inflation over the long term.

At the end of FY22, BUT had 25.9p per share in revenue reserves, which is equivalent to c 1.2x the annual dividend. In H123, BUT’s earnings per share was 15.7p versus 13.5p in H122, a 16.3% increase. So far, two interim dividends of 5.55p per share have been declared in respect of FY23, which are 7.8% higher year-on-year. If the third interim dividend is also 5.55p per share and the fourth interim dividend of 6.05p per share is maintained, the total distribution would be 22.7p per share, which would equate to a 5.6% annual uplift.

____

General disclaimer and copyright

This report has been commissioned by The Brunner Investment Trust and prepared and issued by Edison, in consideration of a fee payable by The Brunner Investment Trust. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI