As of Monday, the Brent crude oil is trading at a steady rate around USD 93.40 per barrel. Despite the market’s anticipation for higher levels, investors are exhibiting caution, allowing time for confidence in purchasing to be restored following a recent correction.

Analysts suggest that the current prices of commodities are aligning well with both technical and fundamental signals, implying that Brent may continue to hover around these levels in the upcoming days. Recent data released by Baker Hughes indicated a decline in activity, with the number of active oil rigs decreasing by eight units over the week, reducing the total count to 118.

Technical Analysis of Brent crude oil

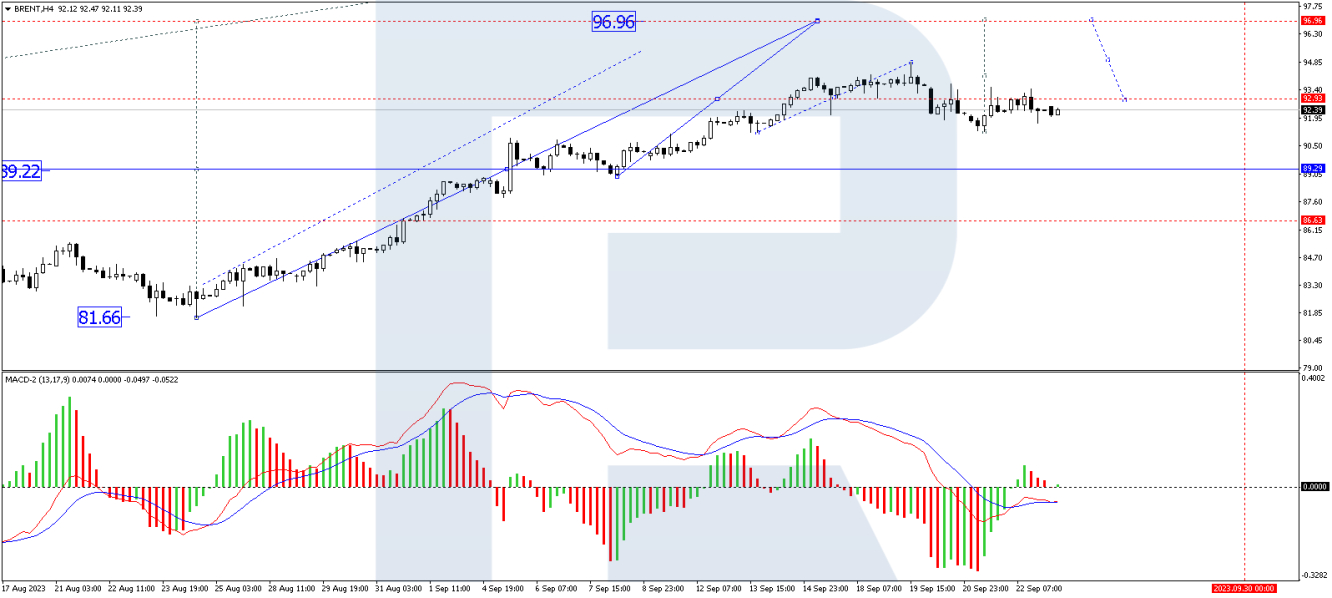

The H4 chart reveals that Brent has completed a growth wave at USD 94.47 and undergone a correction to USD 91.31. The market is currently shaping a growth structure towards USD 94.00. A successful upward breakout of this level could pave the way for a further rise to USD 96.96, and potentially even reaching USD 104.00. The MACD indicator supports this scenario, as its signal line, now below the zero mark after exiting the histogram area, hints at possible continued growth upon breaking out of the zero level.

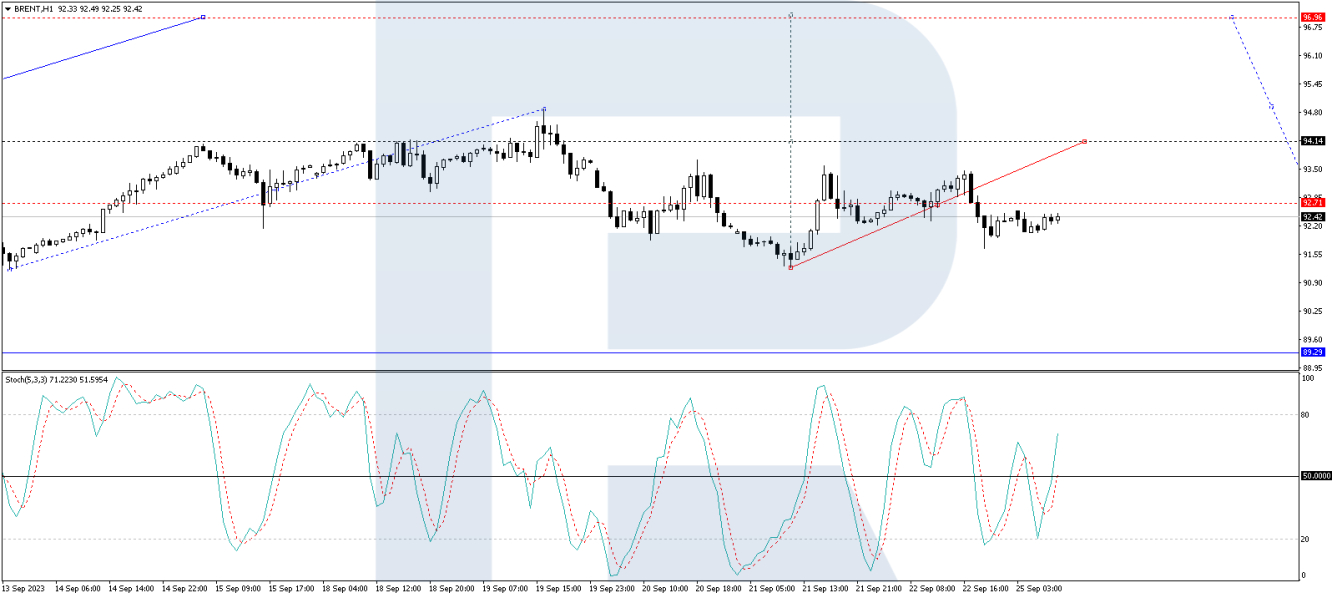

On the H1 chart, a consolidation range is observed around USD 92.80. The market is expected to experience a growth link to USD 94.14, which could subsequently be followed by a correction link back to USD 92.80, testing from above. The trajectory then suggests a rise towards USD 96.96. This outlook is technically confirmed by the Stochastic oscillator, as its signal line, having broken the 50 mark upwards, continues its upward trend towards 80.

In conclusion, while investors remain cautious, the technical analysis indicates potential growth for Brent oil prices. Market participants will closely monitor developments and adjust their strategies accordingly, as Brent continues its fluctuations in the coming days.

By RoboForex Analytical Department

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Brent Crude Oil Maintains Position, Investors Cautious

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.