Strong tanker market

The fortuitous timing of last year’s Braemar (L:BRMS) merger with ACM has been reinforced by the strong recovery in the oil tanker market, which has contributed materially to the virtual doubling of interim profits. Neither the discount rating nor the recent weakness of the share price reflects the underlying recent trading performance and medium-term potential of the group.

Interims ahead of expectations

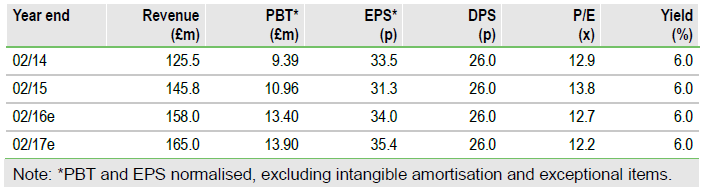

Braemar’s interims show underlying pre-tax profits comfortably ahead of our estimate, with underlying pre-tax profits virtually doubled from £3.53m to £6.96m. The key features were the full consolidation of ACM, with which the group merged its shipbroking division last year, and the strength of the oil tanker market, in which the group’s broking division is a major global player; EPS rose by 59%. We have decided not to adjust our full year profit estimates at this stage, but if current trends in the tanker market are sustained they could prove to be conservative.

Diversification continues to deliver

Braemar’s acquisition policy of the last few years continues to support the quantity and quality of earnings. Reliance on the shipping cycle has been reduced, with around half of estimated current year profits to be produced in cash-generative businesses where demand is related either to the less volatile volume of seaborne trade or the oil and gas sector, which have differing cycles. Moreover, the ACM deal appears to have revitalised the broking business. The tone of the trading statement points positively to the medium term.

To Read the Entire Report Please Click on the pdf File Below