By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

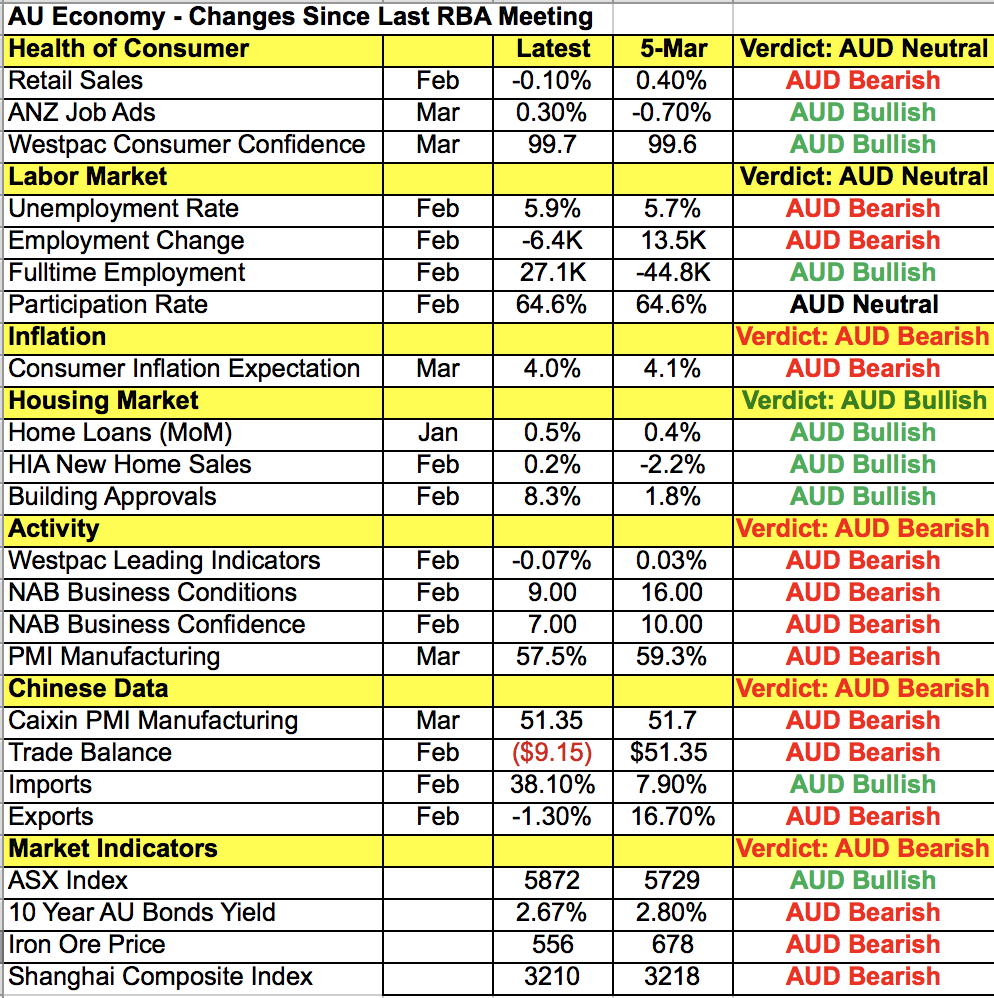

If you take a look at a recent chart of the Australian dollar, there’s no question that the currency is in the process of forming a top. Over the last 2 weeks, AUD/USD gradually descended from a high of 0.7750 to below 0.75 cents. Seventy eight cents has been rock-solid resistance for the Australian dollar since early 2016 and the currency pair continues to reject that level. Yet the decline in AUD/USD has been slow and AUD bears have been reluctant to call the recent move a top because of the Reserve Bank’s optimism. The Australian economy began showing pockets of weakness before the RBA met last month and while the central bank expressed continued concern about the complications of a strong currency, investors latched onto their brighter outlook for the global economy. But as the weeks have passed, it has neen getting harder for the Reserve Bank to put on a brave face with economic data continuing to weaken. Retail sales took an unexpected dip while manufacturing activity grew at a slower pace. We’ve compiled a table to show the extent of the changes in Australia’s economy since its last meeting in March and there’s been more deterioration than improvement. The RBA expressed specific concern about the labor market and unfortunately the latest numbers provide greater cause for concern than optimism with the unemployment rate rising to its highest level in more than a year. The case can be made for less hawkishness from the RBA and that’s what we believe AUD/USD traders are waiting for, as it would imply that further easing is still on the table. If we are right and the RBA is less optimistic, AUD/USD could extend its losses to 75 cents.

Meanwhile, one of Monday's worst-performing currencies was the Canadian dollar, whose losses took USD/CAD to 1.34. The move cannot be explained by data or oil as manufacturing activity accelerated according to Markit Economics and oil prices fell only slightly. Instead, it was a steep decline in Canadian bond yields that sent CAD tumbling. This is a busy week for the Canadian dollar and the action kicks off with Tuesday’s trade-balance report. After jumping unexpectedly in January, the country’s trade surplus is expected to come off slightly in February. In addition to the trade report, Canadian labor data and IVEY PMI are scheduled for release at the end of the week. Like AUD and CAD, the New Zealand dollar also dipped slightly versus the U.S. dollar. No New Zealand economic reports were released overnight but there is a dairy auction scheduled for Tuesday.

In the U.S., ten-year Treasury yields fell sharply, driving USD/JPY below 111 but the greenback’s weakness was restricted to the Japanese yen as risk aversion took the dollar higher against other major currencies. According to the ISM report, manufacturing activity slowed in March. While the deterioration was not material and offset by an uptick in prices and employment ,the data was also not strong enough to encourage investors to buy dollars ahead of a potentially soft nonfarm payrolls report. Without overwhelmingly positive data, the dollar could struggle to rally this week and we don’t think Tuesday’s trade balanec, factory orders or durable goods will be significant enough to trigger a big move in the dollar. Instead, traders should watch Fed speak. We heard from FOMC voter Harker on Monday who is one of the most hawkish members of the central bank. He said 3 rate hikes in 2017 would be appropriate and while the Fed doesn’t want to rush, it doesn't want to fall behind either. These words are consistent with a central bank still divided on a June-vs.-September hike. Fed President and FOMC voter Tarullo is scheduled to speak on Tuesday.

Euro traded in an exceedingly tight 39-pip range throughout the European and North American trading sessions. The moves in the single currency were limited by the equally large decline in 10-year German bund yields. Data from the Eurozone was mixed with producer price growth slowing but the unemployment rate improving. There were no revisions to the Eurozone and German manufacturing PMI reports. Although the Eurozone’s retail sales report is scheduled for release on Tuesday, the market may be more keenly focused on ECB President Draghi’s speech in Frankfurt. However considering that the event he will be speaking at is the launch of the new EUR50 banknote, the central-bank head may avoid talking about the economy and monetary policy. The first round of the French election will be a key focus in April and so far it appears that Emmanuel Macron holds a comfortable lead over Marine Le Pen. As April 23 nears, the euro’s sensitivity to the polls will increase significantly. In the meantime, 1.0650 continues to be an important support level for EUR/USD.

Finally, Monday's worst-performing currency was sterling, which declined on the back of softer data. The manufacturing PMI index dropped to 54.2 from 55.1 in March. As reported by our colleague Boris Schlossberg:

UK manufacturing growth remains positive but has clearly lost momentum as higher costs begin to weigh on consumer demand. According to Markit’s Rob Dobson, The domestic market remained the primary source of new-business wins for manufacturers. The boost to export demand from the historically weak sterling exchange rate also played a role, albeit to a lesser degree than in recent months. The impact of the exchange rate is still being keenly felt on the cost side. Although purchase price inflation moved further from January’s record high, it remained among the steepest recorded in the 25-year survey history.