The HSBC (LON:HSBA) share price has tanked over 5% as trading kicks off on Tuesday following the release of its full year results.

To say these figures were disappointing would be an understatement. They lay bare the scale of the turnaround required at the inefficient banking giant to put it back on track.

There was a lot to cause concern. A 33% fall in pre-tax profit, a $7.3 billion goodwill impairment charge in Europe, suspending its share buyback, a troubled outlook in Asia its most profitable region owning to coronavirus and a culling of 15% of its workforce. These numbers paint a picture of a very troubled bank.

Return on tangible equity which is considered a key profitability measure fell 0.2% in 2019. It is expected to be 10% -12% in 2022.

Restructuring

HSBC set out its restructuring plans which aims to overhaul a bank that has grown too big, too inefficient and too complex. HSBC plans to shed $100 billion in assets, shrink its investment bank and revamp its US and European business in a move that will see 35,000 jobs cut over 3 years

Whilst on paper the remodeling plan looks encouraging as it addresses many of the known concerns, it is a huge amount of work and it remains to be seen how it settles.

Outlook

The timing will add another layer of challenges as HSBC faces headwinds from low interest rate environment and disruptions from coronavirus which it says has significantly impacted operations. In the long run the impact of coronavirus could reduce revenue and result in bad loans rising amid disrupted supply chains.

The million-dollar CEO question remains unanswered a Noel Quinn continues to his very public audition for the permanent role, however there has been no update.

Levels to watch

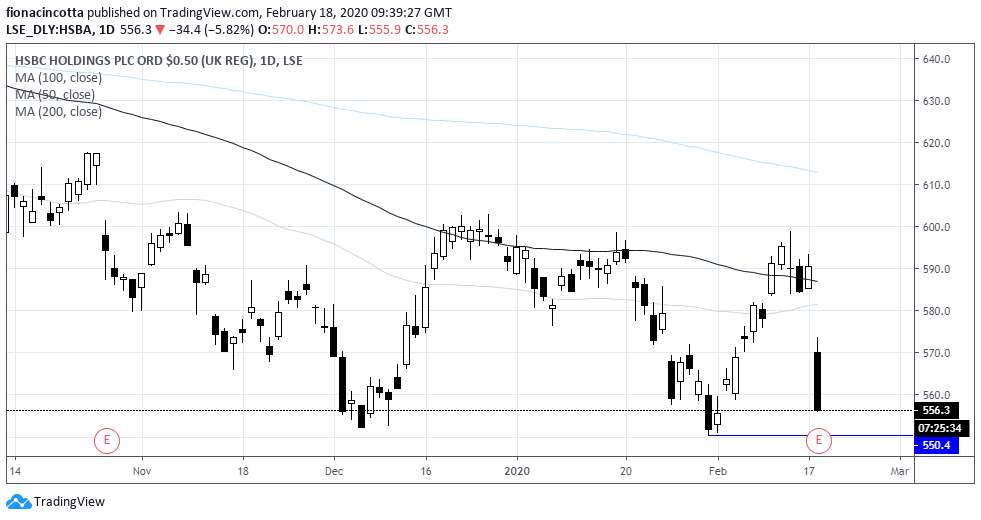

HSBC was trading below its 200 sma on the daily chart prior to its results. After dropping 5% in early trade on Tuesday HSBC dived through its 100 & 50 sma. Support can be seen at 550p, its low (31st Jan).

A move below here will confirm control is in the hands of the bears and could take HSBC back to levels not seen since 2016.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."