abrdn UK Smaller Companies Growth Trust (AUSC) is managed by Abby Glennie and Amanda Yeaman. The strategy of using the proprietary Matrix screening tool to search for stocks that fulfil strict quality, growth and momentum criteria has proved very successful over the long term but has been challenged since the start of 2022, as macroeconomic factors rather than company fundamentals have driven stock markets. Despite their frustrations, the managers are sticking with their tried-and-tested strategy and are highly confident that the trust will resume its record of outperformance when there is a change in the investment backdrop. This may already be underway as UK inflation is moderating, interest rates may be close to peaking and, in recent months, AUSC’s NAV performance versus the reference index looks to have stabilised.

Why consider AUSC?

AUSC has experienced a difficult period of performance in recent quarters, as macroeconomic events and value stocks have driven the stock market. However, considering its commendable long-term record, now may be a good time to consider the trust. The managers are not deviating from the tried-and-tested investment process, continuing to seek stocks with favourable quality, growth and momentum attributes that they can hold for the long term.

UK equities, particularly those of smaller companies, have been out of favour with investors in a difficult macroeconomic environment and the UK looks attractively valued versus other developed markets. An improvement in investor risk tolerance coupled with more robust corporate earnings could prove very supportive for the performance of UK smaller-cap stocks.

Despite the trust’s performance, the managers highlight that, at the fundamental level, AUSC’s prospects are bright. Its top 10 holdings are a diverse mix of businesses and, at 31 August 2023, seven companies had upwards earnings trends, while three were flat. The trust’s portfolio offers a broad exposure to both international growth (51% of total revenue) and domestic (49%), which includes dominant UK operators and global leaders, or those companies able to expand into adjacent businesses or geographies.

NOT INTENDED FOR PERSONS IN THE EEA

AUSC: Solid process drives long-term outperformance

Now could be a particularly opportune time to consider AUSC as it has faced significant headwinds since the beginning of 2022. The UK market has been out of favour and within this, small-cap stocks have been particularly unloved. An environment of rising inflation and interest rates has been detrimental to an investment process based on quality, growth and momentum. A change in the macroeconomic backdrop could see a significant reversal in fortune for the trust’s performance. It should be remembered that the strategy has been tried and tested and has proved to be successful over multiple business cycles.

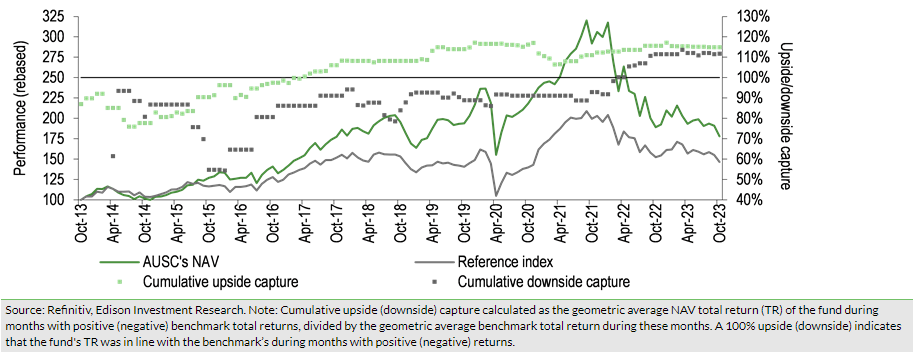

Upside/downside capture

AUSC’s upside/downside capture is shown below in Exhibit 1. Since 4 October 2013, its upside capture is 115%, suggesting that AUSC will outperform in months when UK small-cap shares are rising. The 112% downside capture implies that the trust will underperform in months when these shares decline but, to a lesser degree. Exhibit 1 shows that AUSC’s relative performance started to deteriorate at the beginning of 2022, which is illustrated by an increase in the downside capture from around 90%. As this figure is below 100%, it implies that, historically when small-cap stocks fell, the trust did not capture the full downside. At which time, investors got the best of both worlds, outperformance in both rising and falling markets. It should be noted that 2022 was unusual, as during market weakness, investors focused on value rather than quality stocks. This helps to explain the increase in AUSC’s downside capture rate.

Perspectives from AUSC’s managers

Glennie and Yeaman explain that they are sticking to the investment process, using the proprietary Matrix screening tool (employed since 1997), which reflects quality-, growth- and momentum-based factor analysis. Over time ‘quality’ has been effective in highlighting companies that have pricing power, resilient and visible earnings streams, and strong balance sheets, ‘growth’ identifies businesses that can grow over the long term through economic cycles, while ‘momentum’ signals those companies with an ability to meet or beat consensus expectations. The Matrix is also nimble in flagging changes at a company level that require further investigation and, as it is an objective quantitative tool, it removes any emotional bias. There has been little change in the investment process since 1997.

The managers invest with a three- to five-year horizon. They highlight how the investment strategy has outperformed over the long term by referencing the open-ended version of AUSC’s fund, which has a longer history going back to 1997. After significant pullbacks including during the 1999–2000 Asian crisis and the technology bubble, the 2008 global financial crisis, and the 2020 COVID-19-led bear market followed by the value stock rally, UK small-cap shares bounced back strongly. As timing the stock market is very difficult, Glennie and Yeaman’s approach is to remain invested during volatile periods.

Macroeconomic conditions have had a major impact on stock markets since the beginning of 2021, according to the managers; they comment that value stock leadership has been a major headwind to AUSC’s performance. In the UK, interest rates have risen sharply and there have been steady increases in inflation expectations as inflation in the UK has been more stubborn than in other developed markets. In this environment, value stocks have outperformed as growth stocks have derated in response to higher interest rates, which reduce the value of their long-term earnings streams. Glennie and Yeaman consider that we are at, or near, a peak in UK interest rates, inflation is coming down, inflation expectations are moderating and this change in backdrop should be positive for AUSC’s relative performance. They stress that tightening money policy, higher 10-year government yields and elevated inflation have made for a difficult environment for the trust. The managers believe that quality and growth factors should outperform when there is a change in the macroeconomic backdrop, while a higher focus on individual company fundamentals should also be beneficial for the trust’s relative performance.

Glennie and Yeaman contend that corporate earnings revisions are an important driver of stock markets. While there was a strong decline in estimates going into 2022, the environment is now improving, which they believe is positive for AUSC. Stock markets discount an inflexion in corporate earnings and the UK market bottomed in October 2022. The managers believe that, even if there is more downside risk to UK corporate earnings, this is already priced into UK stocks as, on a P/E basis, UK growth stocks are valued at one standard deviation below their long-term average, unlike in other developed markets where growth stocks are trading in line with their historical averages. AUSC’s portfolio also looks inexpensive as it is at a 4x forward P/E multiple premium to its reference index, which is at the low end of its broad 4x to 12x premium historical average.

Current portfolio positioning

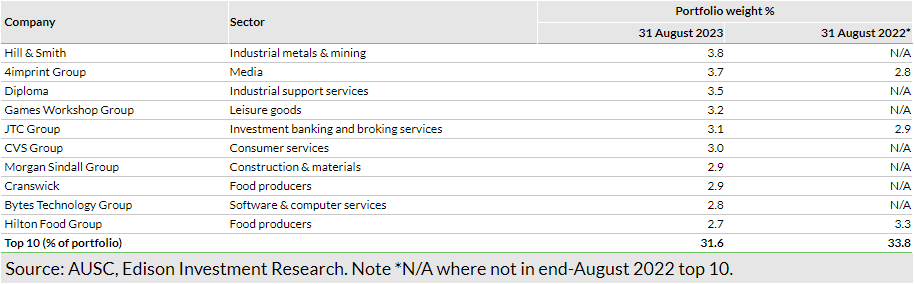

At end-August 2023, AUSC’s top 10 positions made up 31.6% of the fund, which was lower than 33.8% a year before; three names were common to both periods. The portfolio had 56 holdings, which was three less than 59 at end-August 2022.

Over the 12 months to end-August 2023, the trust’s active share decreased from 90.8% to 83.6%; this is a measure of how a fund differs from its reference index, with 0% representing full index replication and 100% no commonality. The reduction is borne out by a higher percentage of the fund represented by companies in the reference index (83.6% at end-August 2023 versus 68.5% at end-August 2022).

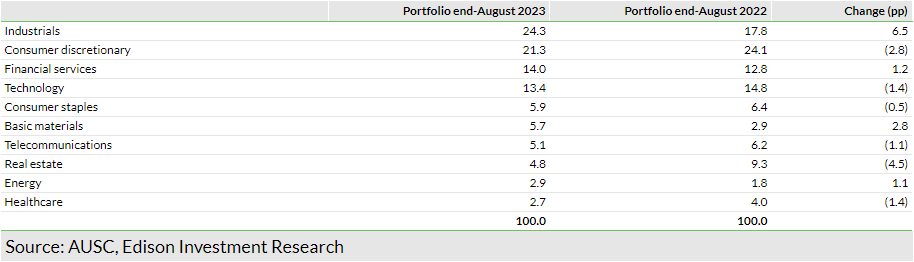

AUSC’s sector breakdown is shown below in Exhibit 3. There are 11 broad market sectors, of which 10 are represented in the trust’s portfolio. It does not contain any utility stocks as none of these companies fulfil the managers’ quality, growth and momentum criteria. Over the 12 months to end-August 2023, the notable changes were a 6.5pp increase in industrials and a 4.5pp lower weighting to real estate stocks.

Recent portfolio activity

The managers initiated a position in Ashtead (LON:AHT) Technology, an Aberdeen-based subsea equipment rental and solutions provider. Its business outlook is favourable due to a range of macro- and microeconomic factors, such as the changing geopolitical landscape, rising commodity prices and structural growth in the global offshore wind market. Ashtead is an industry leader, with opportunities to increase its market share, while it is benefiting from the trend of service companies renting rather than buying equipment.

Complete sales include Focusrite, which was the largest detractor to AUSC’s FY23 performance, GB Group and Watches of Switzerland, following Rolex’s announcement of the acquisition of Bucherer. Rolex is Watches of Switzerland’s largest supplier.

The trust also participated in the placing to fund YouGov’s purchase of the consumer panel business of GfK, the Germany-based market research company. This acquisition extends YouGov’s offering in the fast-moving consumer goods sector and complements its existing client base. It also provides access to more consumers and better data, while expanding YouGov’s US offering.

Performance: Negatively affected by market backdrop

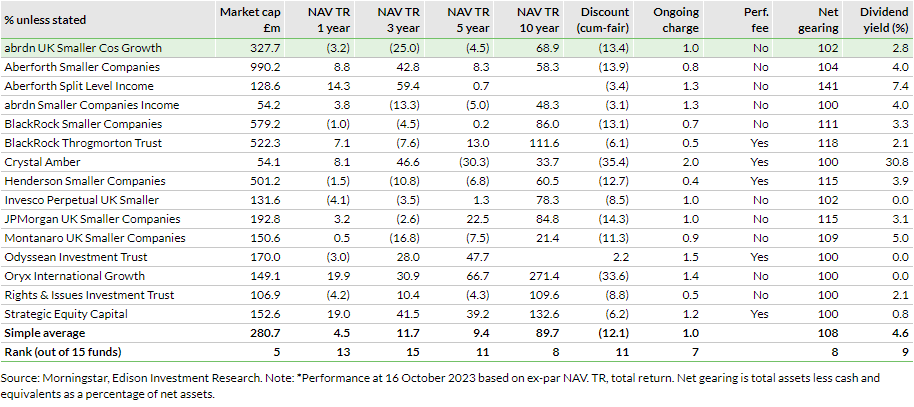

In Exhibit 4 we show the 15 largest funds in the 25-strong AIC UK Smaller Companies sector that have market caps above £50m; they follow a variety of different mandates. AUSC is unique in searching for stocks using the proprietary Matrix screening tool that fulfil the managers’ quality, growth and momentum criteria.

As highlighted elsewhere in the report, the macroeconomic backdrop has negatively affected the trust’s performance and its NAV total returns are below the averages in the selected peer group over the last one, three, five and 10 years, ranking 13th, 15th, 11th out of 15 funds and eighth out of 13 funds, respectively. The trust’s discount is modestly above average, and it has an average ongoing charge, although this is likely to come down (see Fees and charges section below). AUSC has a below-average level of net gearing and, befitting the focus on capital growth rather than income, its dividend yield is 1.8pp below the mean.

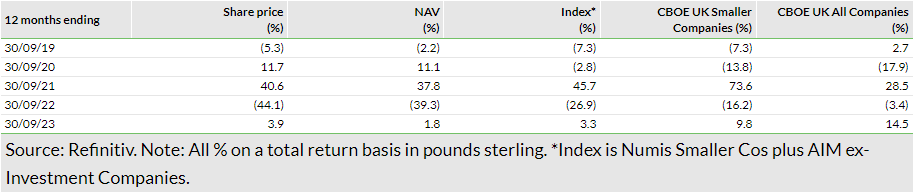

In FY23 (ending 30 June) AUSC’s NAV and share price total returns of -7.4% and -6.8%, respectively, trailed the reference index’s -2.8% total return. The board is very mindful of the trust’s continued underperformance and, as well as having detailed discussions with the managers, it has considered whether the investment thesis remains valid and whether the process is being implemented thoroughly. It has concluded that AUSC’s underperformance is primarily due to the macroeconomic environment of a weak UK economy, rising inflation and interest rates, and an uncertain political backdrop. This has meant that UK shares, particularly those of smaller companies, are out of favour with investors. De-rating of growth stocks and outperformance of value-based strategies have been particularly unhelpful for the trust’s relative performance given its focus on quality, growth and momentum factors.

The largest positive contributors to AUSC’s FY23 performance were 4imprint Group (+2.0pp, results exceeded consensus expectations, strong dividend growth and paid a special dividend); Games Workshop Group (+1.3pp, benefiting from investment in new product innovation and community engagement, dividend increases and a deal with Amazon (NASDAQ:AMZN) to turn its Warhammer franchise into a TV series); Diploma (LON:DPLM) (+1.0pp, robust growth both organically and from attractive bolt-on acquisitions); and Kainos (LON:KNOS) Group (+1.0pp, consistent growth in an uncertain economic environment and higher pricing has offset wage inflation).

On the other side of the ledger, the positions that detracted most from the trust’s performance were Focusrite (-1.3pp, seeing lower demand following the global COVID-19 pandemic); Hilton Food Group (-1.1pp, margin squeezed from an inability to fully pass on higher salmon prices); and Future (-1.1pp, lower advertising spend and CEO departure).

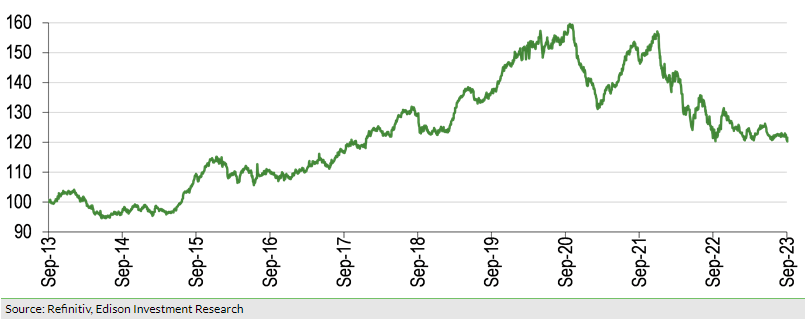

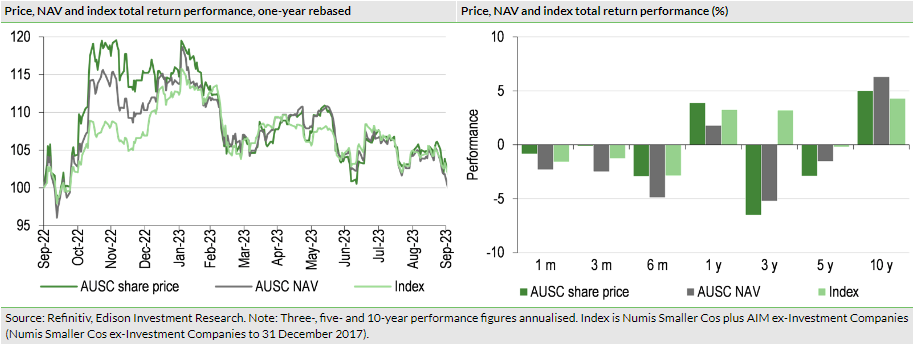

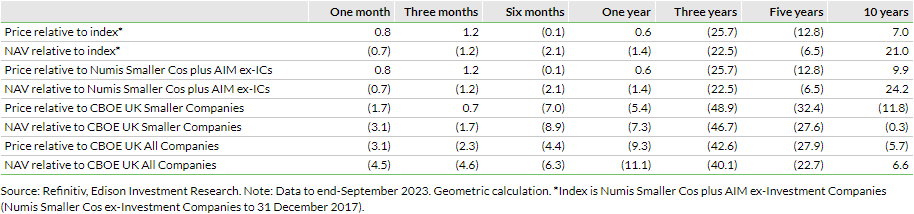

The tough macroeconomic backdrop has had a significant negative impact on AUSC’s relative performance, particularly over the last three years (Exhibit 6). Despite this, the trust remains ahead of its reference index over the last decade in both NAV and share price terms.

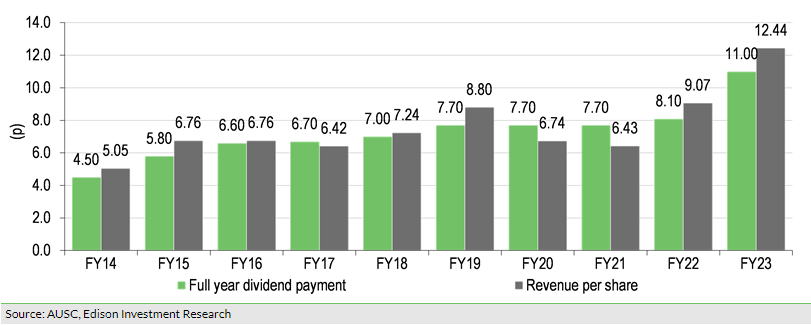

Dividends: Fully covered for a second year post COVID

AUSC pays semi-annual dividends in April and October. The board aims to pay out around a third of the total annual distribution as the interim dividend, with around two-thirds as the final dividend. In FY23, the trust’s revenue earnings were 12.44p per share, which was a healthy 37.2% increase versus 9.07p in FY22. This was due to both higher ordinary and special (7.2% of the total) dividends received, along with a material increase in interest income as cash balances delivered a meaningful return for the first time since 2008. Income was enhanced by 0.34p per share due to share repurchases. AUSC’s higher income has enabled the board to significantly increase the trust’s annual dividend by 35.8%, from 8.10p per share in FY22 to 11.00p per share in FY23 (over the last five years, the trust’s dividend has compounded at an annual rate of 9.5%). Following the payment of the trust’s final FY23 dividend, 2.0p per share was added to revenue reserves.

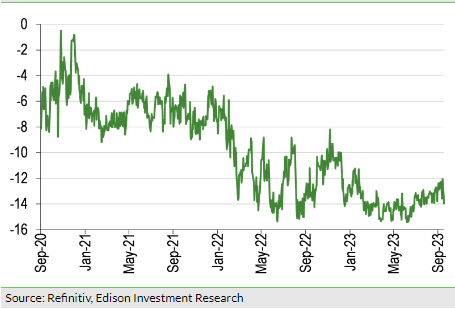

Discount: Plenty of scope for a higher valuation

AUSC’s 14.0% discount to cum-income NAV is wider than its historical averages of 13.1%, 9.8%, 8.5% and 6.8% over the last one, three, five and 10 years, respectively. This is not unusual as, in general, investment trust discounts have widened in an environment of above-average investor risk aversion, where small-cap shares in particular have been out of favour. Hence, there is plenty of scope for AUSC to be afforded a higher rating if investor sentiment improves. Importantly for the trust, its relative underperformance is likely to be weighing on its valuation, so a change in the macroeconomic background, which could favour the managers’ focus on quality, growth and momentum, could lead to a meaningfully narrower discount.

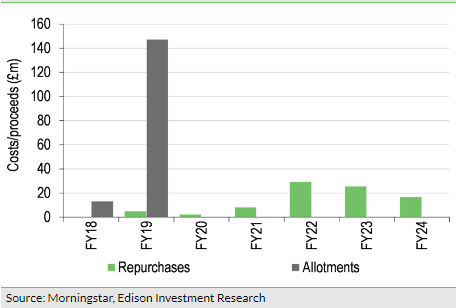

The board employs a discount control mechanism, targeting a maximum 8.0% share price discount to cum-income NAV in normal market conditions. Renewed annually, it has the authority to repurchase up to 14.99% of AUSC’s share capital. During FY23, c 5.7m shares (c 6.0% of the share base) were bought back at a cost of c £25.8m. The weighted average discount at which the shares were repurchased was 12.8% and the board calculates that this added 4.0p to the trust’s NAV. So far in FY24, a further 4.7% of the share base has been bought back; currently shares are being repurchased on most trading days.

AUSC also has a discretionary tender mechanism in place, although no tenders have taken place since June 2015, as share buybacks are the primary method to manage the trust’s discount. The large allotment of shares in FY19 was due to the October 2018 merger with Dunedin Smaller Companies Investment Trust.

Fund profile: High-conviction UK small-cap equities

Launched in August 1993, AUSC is quoted on the Main Market of the London Stock Exchange. Since 1 January 2023, the trust has been managed by Abby Glennie, who replaced long-standing lead manager Harry Nimmo; they had worked closely together since January 2016, and Glennie had been AUSC’s co-manager since 17 November 2020. Amanda Yeaman is the trust’s deputy manager; she joined abrdn in 2019. Glennie and Yeaman aim to generate long-term capital growth from a diversified portfolio of UK smaller companies.

AUSC’s portfolio is made up of 50–60 of the managers’ highest-conviction investment ideas. The trust’s performance is measured against the Numis Smaller Companies plus AIM ex-Investment Companies Index (the Numis Smaller Companies ex-Investment Companies Index before 1 January 2018). To mitigate risk, at the time of purchase, AUSC may hold no more than 5% of total assets in a single position, no more than 5% in companies with a market cap below £50m and the managers tend not to invest in ‘blue sky’ (not yet profitable) companies, although up to 5% is permitted. Up to 50% of the portfolio may be invested in companies that are constituents of the broad AIM index. The managers may vary the trust’s level of gearing between a net cash position of 5% and net gearing of 25% of NAV (at the time of drawdown). Over the last decade, the financial year-end position has ranged from 4.6% net cash to 5.7% net gearing.

AUSC started life as Edinburgh Smaller Companies in 1993, with Standard Life (LON:ABDN) Investments (now abrdn) assuming management in 2003. The trust merged with Gartmore Smaller Companies Trust in 2009 and with Dunedin Smaller Companies Investment Trust in October 2018. With effect from 25 October 2021, the trust’s name was changed, following shareholder approval, from Standard Life UK Smaller Companies Trust (ticker: SLS) to abrdn UK Smaller Companies Growth Trust. The board deemed that the addition of ‘growth’ better reflects what the trust is seeking to achieve.

Investment process: Using the proprietary Matrix

The managers follow seven principles for successful small-cap investing:

- Focus on quality to enhance return and reduce risk – factors include the strength of a company’s relationship with its customers, the existence of long-term contracts and an element of pricing power. Firms with high or unsustainable levels of debt are generally avoided.

- Look for sustainable growth – portfolio companies often provide niche products or services.

- Momentum – run your winners and cut losers.

- Concentrate your efforts – use of the proprietary screening tool known as the Matrix helps identify suitable candidates for inclusion in the portfolio and reduces the risk that time is spent on stocks that do not meet the required criteria.

- Invest for the long term – identify the great companies of tomorrow and hold them for the long term, which helps to maximise returns and reduce trading costs.

- Management quality – high ownership and involvement by founders and CEOs with long tenures are viewed positively.

- Valuation aware – this is a secondary consideration.

In their search for long-term capital growth, Glennie and Yeaman use the Matrix. This screening tool is based on a series of 12 quality, growth, momentum and valuation factors, including forecast earnings and dividend growth, earnings revisions, share price momentum, balance sheet strength and the level of directors’ dealing, to whittle down the investible universe of around 500 stocks to around 100 that are deemed worthy of further consideration. The most important factor, at c 40% of the Matrix weighting, is earnings revision momentum because back-testing shows this is the most predictive measure of future share price performance. Stocks are assigned a Matrix score between +40 and 40, with those between +10 and +40 deemed potential buy candidates and those between 10 and 40 potential sells. Companies considered for inclusion in AUSC’s portfolio are subject to further in-depth analysis and meeting company managements is an integral part of the research process. In keeping with other abrdn investment teams, the managers have a strong focus on a company’s ESG credentials.

Given the managers’ long-term perspective, the average holding period for AUSC’s investments is around seven years, implying an average annual portfolio turnover of around 15%; although some names have been in the fund for more than a decade. Positions may be trimmed or sold if there is a deterioration in the Matrix score, the original investment thesis no longer holds true, they have grown to more than 5% of the portfolio or there is a higher-conviction name identified. The disciplined investment process has been employed since abrdn took over management of the fund in 2003 and has delivered creditable performance through economic and market cycles.

AUSC’s approach to ESG

abrdn has more than 800 investment professionals, including c 50 ESG specialists around the world. It encourages companies in which it invests to adhere to best practice in the areas of ESG stewardship. abrdn believes this can be achieved by entering into a dialogue with company managements to encourage them, where necessary, to improve their corporate standards, transparency and accountability. By making ESG central to its investment capabilities, abrdn seeks to deliver robust outcomes as well as actively contributing to a fairer, more sustainable world. It considers ESG factors are financially material and affect corporate performance; companies that have higher standards tend to outperform those that do not.

The managers explain that for AUSC, ESG is really embedded at the core of the research process and is an important aspect of the focus on quality and the lower-risk approach. There is an ESG specialist on abrdn’s small-cap desk, and the managers also work closely with abrdn’s large and knowledgeable central ESG investment team. Glennie and Yeaman regularly engage with company management teams, including on ESG aspects. They say that it is important to highlight a couple of nuances for smaller companies. While external ESG data are used, it is not an ideal process because many of the companies are not covered at all, or are covered badly, providing a real opportunity for the managers to add value by conducting ESG fundamental research themselves. Also, smaller companies often have limited internal resources to focus on ESG, so many are keen to engage with the managers, who are able to help advise them and encourage them towards those ESG aspects required by shareholders.

Gearing

AUSC has a £40m revolving credit facility (RCF) with Royal Bank of Scotland (LON:NWG) International, which expires on 1 November 2025, and has a further £25m uncommitted accordion provision. Currently, £25m debt is drawn down at an interest rate of 6.231%. At 13 October 2023, AUSC had net gearing of 2.9%.

Fees and charges

The board has negotiated a new fee structure with abrdn to make AUSC more competitive with similar funds in the AIC UK Smaller Companies sector. From 1 July 2023, the tiered management fee is: 0.75% per year up to £175m (previously 0.85% up to £250m) of the trust’s NAV; 0.65% per year between £175m and £550m (previously 0.65% between £250m and £550m); and 0.55% per year above £550m (unchanged). Along with the investment management fee, abrdn also receives a fixed secretarial and administration fee of £75k per year plus VAT (which will no longer be charged from 1 January 2024) and a separate fee for the provision of promotional activities for AUSC (£301k plus VAT in FY23 compared with £246k plus VAT in FY22). On a pro-forma basis, based on the 30 June 2023 NAV, the reduction in annual management fees and the removal of the secretarial and administration fee represents an annual saving of c £415k, which is equivalent to c 12% of management fee costs.

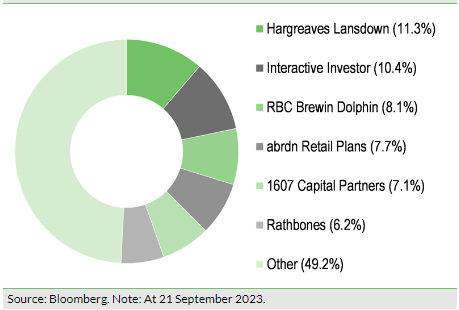

The FY23 ongoing charges ratio (OCR) of 0.95% is 13bp higher than 0.82% in FY22. AUSC’s board had highlighted that the OCR would rise in FY23 due to a fall in the NAV and the promotional fee, which is calculated annually, is based on a higher NAV. The board anticipates a lower OCR for FY24, which along with the fee reductions highlighted above, is partly due to abrdn discontinuing its share plan at the end of 2023; AUSC contributes to the marketing and administration of the plan, which represents around 7% of the trust’s shareholder base.

Capital structure

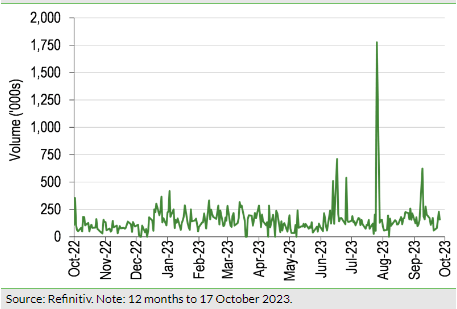

AUSC is a conventional investment trust with one class of share; there are c 84.2m ordinary shares in issue, with c 20.0m held in treasury. Its average daily trading volume over the last 12 months is c 155k shares.

The board

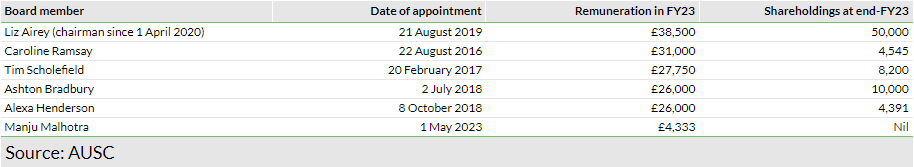

Caroline Ramsay will stand down at the 23 November 2023 AGM. Her replacement is chartered accountant Manju Malhotra, who joined the board on 1 May 2023. She was formerly the CEO of Harvey Nichols and is currently a non-executive director of Workspace (LON:WKP) Group.

---

General disclaimer and copyright

This report has been commissioned by abrdn UK Smaller Companies Growth Trust and prepared and issued by Edison, in consideration of a fee payable by abrdn UK Smaller Companies Growth Trust. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom