It’s been said that gridlock is a feature, not a bug, of the US Constitution, and we may be about to find that out. The election results have left some questions to be resolved, but a few things are coming clear: Democrat Joe Biden is the winner of the Presidential race, but down ballot, the Republicans appear to have made important gains. We’re looking at the prospect of divided government – a Biden Administration with a Republican Senate and a Democratic House with a stronger minority.

According to JPMorgan strategist Marko Kolanovic, this may be the best possible outcome.

“A GOP senate majority should ensure that Trump’s pro-business policies stay intact, and if Biden is confirmed we should be able to expect an easing of the trade war, which should boost global trade and corporate earnings growth,” Kolanovic noted.

With investor fears allayed – that the Democrats would roll back Trump-era tax policy or focus on aggressive bureaucratic regulation – Kolanovic believes the markets are primed for gains.

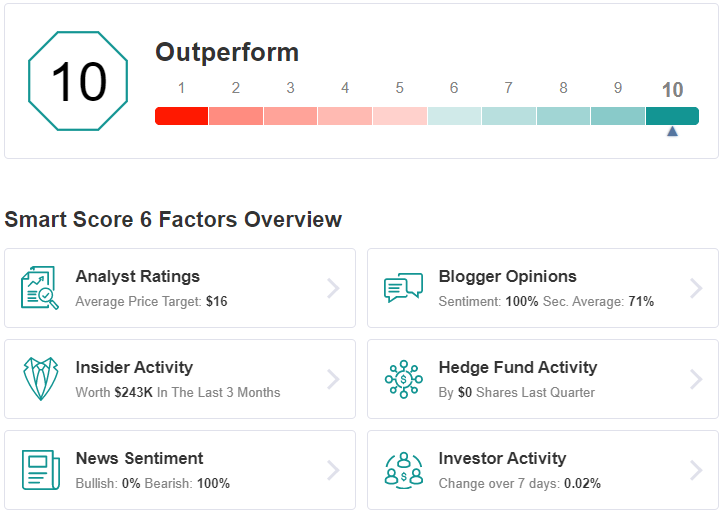

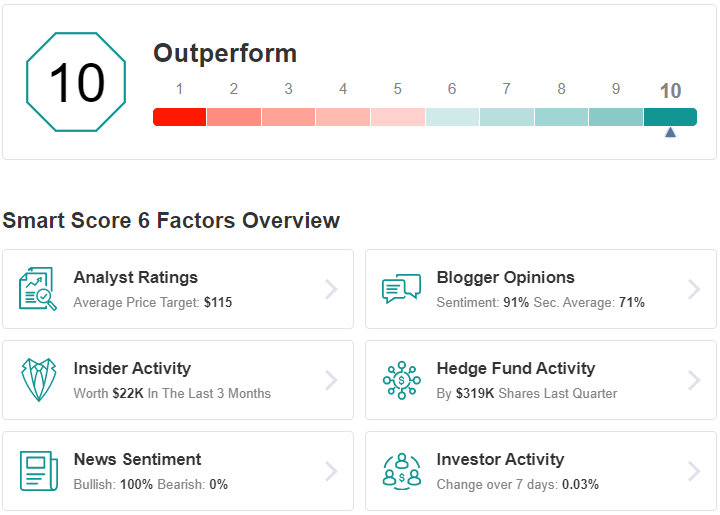

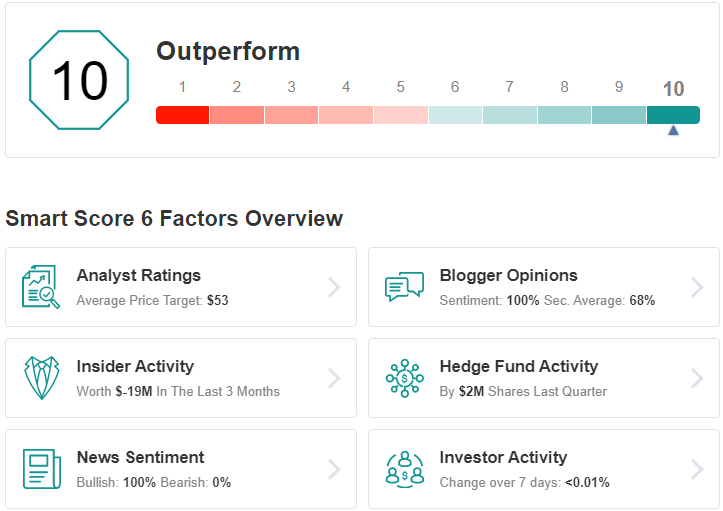

However, finding the right stock to buy is always a challenge, even in a bullish environment. Investing.com has the right tool for that job: The Smart Score, which analyzes 6 separate factors, all collected and measured by AI algorithms, and uses them to generate a simple, comprehensive score for the market’s most traded stocks. The Smart Score measures the traditional factors of stock analysis, and the result is an aggregate, a single number that points out the stock’s likely forward path.

With this in mind, we’ve used the tool to find three stocks with “perfect 10” Smart Scores. Let’s take a closer look.

We’ll start with a diversified company, with production lines in food products and animal feeds as well as industrial alcohols and renewable fuels. Pacific Ethanol (NASDAQ:PEIX) sells its products on the global market, and has seen major gains in 2Q20. Even with recent losses in account, the stock is up a whopping 795% this year.

The gains have come since July, as the company expanded production in response to demand for sanitizing alcohols. Sales of alcohol for hand sanitizers has been a major boost for the Pacific Ethanol in the wake of the coronavirus crisis. Taking new production and sales potential into account, the company has revised 2020 earnings estimates upward to the $66 million to $86 million range.

So far, the company is on track. Like many small-cap manufacturers, Pacific Ethanol was running earnings deficits prior to this year – but COVID-19 changed that. Earnings turned positive in Q2 and remained so in Q3. The sudden shift has investors bullish on the stock.

Amit Dayal, 5-star analyst with H.C. Wainwright, sees plenty of reason for an upbeat outlook here.

“Investors should note that management indicated that though the company has a firm visibility on pricing, specialty alcohol volumes delivered to customers could vary on a quarterly basis. Given that sanitizers are a key end-market for specialty alcohols, the stock has come under some pressure with positive COVID-19 vaccine related news. However, we believe demand for sanitizer products should remain elevated with increase in any economic activity in the near term. We believe the improved balance sheet and cash flow is allowing the company to make investments in areas of the business that have been previously overlooked, and may have been under-contributing as a result,” Dayal opined.

In-line with these comments, Dayal rates this stock a Buy along with a $16 price target. This figure suggests an impressive 174% upside potential in the coming year.

All three of the recent reviews on PEIX are positive, making the consensus rating a unanimous Strong Buy. PEIX shares are priced at $5.82 and have been growing fast in 2H20, but the Street expects to see more growth here; the average price target is $16.50, implying 183% growth ahead for Pacific Ethanol. (See PEIX stock analysis)

New York Times Company (NYT)

Our next stock is a storied name in the publishing world. The New York Times Company (NYSE:NYT) owns its eponymous newspaper, along with an array of other media assets and Times-related brands. The company boasts a $6.4 billion market cap and upwards of 30 business assets. Its core brands attract 150 million readers every month, and over 6.5 million paid subscriptions.

In a news environment as fast-paced and chaotic as 2020 has been, the NYT has reaped the benefit of people’s need to know. The stock is up 20% year-to-date, despite some slips in recent weeks.

Covering NYT for J.P. Morgan, analyst Alexia Quadrani writes, “NYT remains our favorite midcap stock, and we see the growth story for digital subs continuing and will very likely reach 10m well ahead of management’s 2025 target. ARPU and margin improvements over time will also make the stock look cheaper on earnings, which will negate the pushback on valuation. While shares could remain a bit more range bound near term until we get more visibility into trends in 2021, we view the sell-off today as creating an attractive entry point.”

Quadrani rates this stock an Overweight (i.e. Buy), and her $50 price target indicates a potential for 30% in the next 12 months.

The Strong Buy analyst consensus rating on NYT is unanimous, and based on 4 recent reviews. Shares have an average price target of $53, suggesting a 37% one-year upside from the current trading price of $38.53. (See NYT stock analysis)

Thor Industries (THO)

Last but not least is Thor Industries (NYSE:THO), a major manufacturer of recreational vehicles. RVs are a popular form of leisure, and have seen a modest gain during the ‘corona time,’ as there are compatible with social distancing requirements while still permitting households to vacation together. Thor owns seven brands, including well-known names like Airstream and Heartland. The company has a $4.8 billion market cap and upwards of $8 billion in annual revenues.

Quarterly revenues, which were reported for Q3 earlier this month, have recovered from a short dip earlier this year. The Q3 top line came in at $2.32 billion, the highest of the past four quarters. Earnings, which has been falling since Q3 of last year, showed a massive sequential spike, jumping from 43 cents per share to $2.14.

Leisure stocks have been seeing a resurgence recently, and BMO Capital analyst Gerrick Johnson has been reviewing the sector. Of Thor Industries, Johnson writes, “Stocks of leisure companies usually move higher or lower on retail sales results more so than revenues or EPS. We think investor focus will shift after this quarter. Retail has caught up with investor expectations… We think … Thor (THO) will have the longest legs in terms of consumer demand…”

Turning to sales numbers, Johnson adds, “Last quarter, management sounded very optimistic about FY2021 and expects the current robust retail and restocking cycle will last through at least the end of its fiscal year.”

To this end, Johnson rates THO an Outperform (i.e. Buy) and his $110 price target implies an upside of 26% from current levels.

Once again, we are looking at a stock with a unanimous Strong Buy analyst consensus rating; Thor has 4 recent Buy reviews. The stock also has a $115 average price target, which suggests a bullish 32% upside for the next 12 months. (See THO stock analysis)

To find more ideas for stocks trading at attractive valuations, visit Investing Insights.