- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

China to scrap ownership limits in financial sector in 2020, earlier than planned

By Kevin Yao

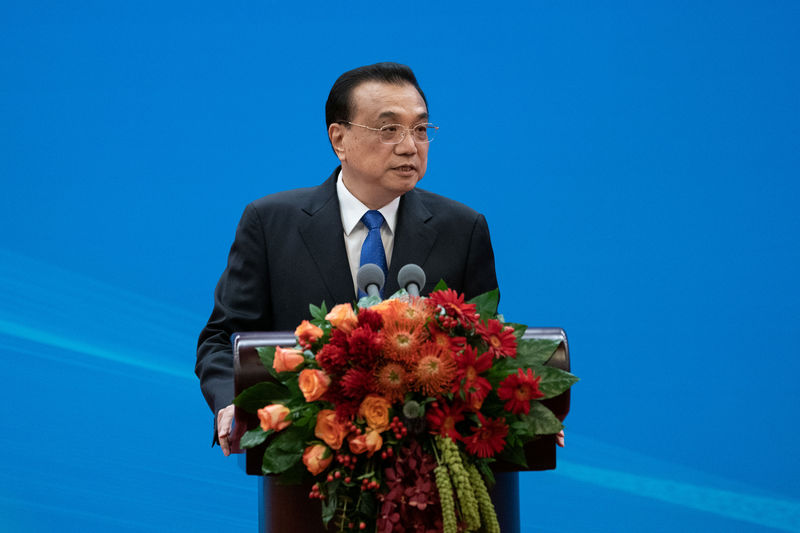

DALIAN, China (Reuters) - China will end ownership limits for foreign investors in its financial sector in 2020, a year earlier than scheduled, Premier Li Keqiang said on Tuesday.

China also will further open its manufacturing sector, including the auto industry, while reducing its negative investment list that restricts foreign investment in some areas, Li told the World Economic Forum in the northeastern Chinese port city of Dalian.

Beijing's signal that it is quickening the pace of opening up came after the presidents of China and the United States agreed over the weekend to restart trade talks in another attempt to strike a deal and end a bruising tariff war.

But analysts doubt the ceasefire will lead to a sustained easing of tensions, and warn lingering uncertainty could dampen corporate spending and global growth.

"We will achieve the goal of abolishing ownership limits in securities, futures, life insurance for foreign investors by 2020, a year earlier than the original schedule of 2021," Li said.

China is moving forward the schedule to show the world that it will not stop opening up its financial sector, Li said, adding the government will also reduce restrictions next year on market access for foreign investors in the value-added telecoms services and transport sectors.

On Sunday, China cut the number of sectors subject to foreign investment restrictions, a widely expected move, to 40 from 48 in the previous version, published in June last year.

On Saturday, leaders of the Group of 20 major economies warned of growing risks to the global economy but stopped short of denouncing protectionism, calling instead for a free and fair trade environment after talks some members described as difficult.

Echoing the sentiment, Li said protectionism is rising, but did not make references to specific economies.

"In the face of pressure from a slowing pressure global economy, I believe people are all in the same boat. We should promote the spirit of partnership, carry out equal consultations, seek common ground while reserving differences and manage and control disputes," Li said.

GLOBAL SLOWDOWN

The U.S-China trade war has hit business confidence worldwide, disrupted supply chains and shaken financial markets, adding to worries about a global economic slowdown.

Fallout from the dispute is spreading. Business surveys this week showed factory activity shrank in China and much of the rest of Asia in June, as well as in Europe, while manufacturing growth cooled in the United States, keeping pressure on policymakers to shore up growth.

Rising worries over global growth have compelled some central banks, such as those in Australia, New Zealand, India and Russia to cut interest rates.

"Currently, global economic risks are rising somewhat, international investment and trade growth is slowing, protectionism is rising and unstable and uncertain factors are increasing," Li said.

"We should actively cope with this. Some countries have taken measures including cutting interest rates, or sent clear signals on quantitative easing."

But China will not resort to competitive currency devaluation, Li said, and will keep the yuan exchange rate basically stable at a reasonable and balanced level.

China is likely to hit its economic growth target of 6%-6.5% this year provided the trade dispute with the United States does not worsen, and hence will not need "very big" stimulus measures to prop up growth, a central bank adviser said on Monday.

The People's Bank of China (PBOC) has already slashed the amount of cash banks must hold as reserve six times since early 2018 to help turn around soft credit growth, and more cuts are widely expected in coming months.

It has also injected large amounts of liquidity into the financial system and guided short-term interest rates lower, while ramping up infrastructure spending and cutting taxes.

Related Articles

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.