- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Russian investors report less losses than their British counterparts since start of Ukraine war, but how?

With Russia becoming a global pariah and getting hit with an unprecedented wave of British and international sanctions amid Moscow’s invasion of Ukraine, it stands to reason that Russian investors would be reeling at this moment. Conventional wisdom also holds that the plummeting value of Russia’s ruble currency should only exacerbate that situation.

Yet multiple surveys conducted by uk.Investing.com reveal that Russian investors are actually faring better than their British counterparts during the war in Ukraine.

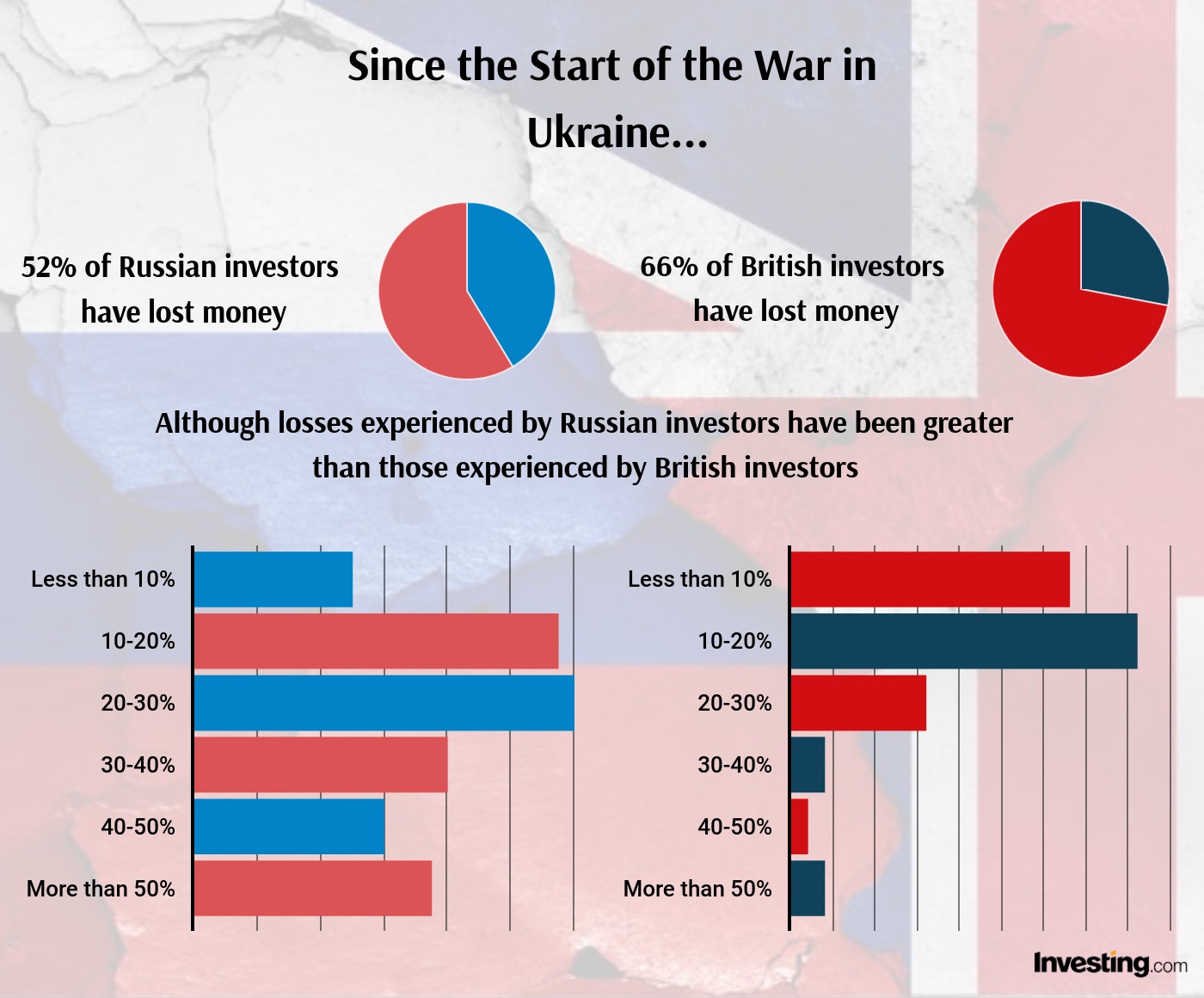

In a survey of about 1,204 British respondents, 66% reported that their investments have lost value since the start of the Russia-Ukraine war, with 41% of investors seeing a 10-20% drop in their portfolio and 33% experiencing a dip of less than 10%.

A separate survey of 1,478 Russian investors, however, found that only 52% have lost money following the crash of the Russian stock market in late February — and 56% have earned on the fall of the ruble. How is this possible with the Russian economy in free fall? For starters, 55% of Russian investors hold the majority of their assets in foreign stocks and currencies and 1 in 5 only invest in Western-based stocks. With that being said, losses experienced by Russian investors have been greater than those experienced by British investors, with 43% losing more than 30% of their portfolio as opposed to just 10% of British investors experiencing the same losses.

“While the Russian stock market plunged in value since the invasion began in late February, ironically, it is foreign investors who own the majority of shares that are available to trade on the Moscow Exchange, rather than Russian retail investors,” said Jesse Cohen, senior analyst at uk.Investing.com.

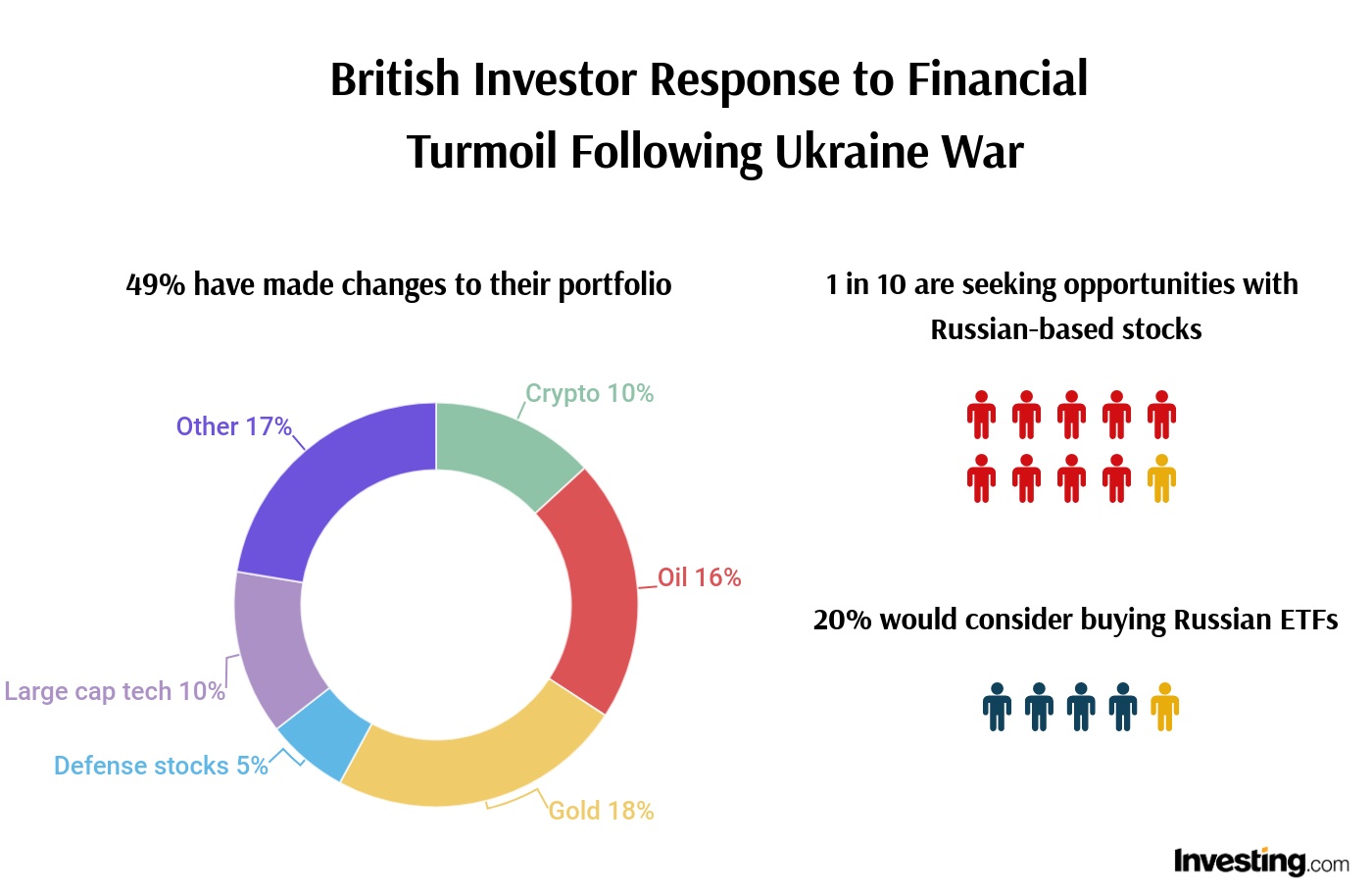

Almost half of British investors have made changes to the portfolio during the war, including 18% who added investments in gold and 16% who added investments in oil, according to the uk.Investing.com survey. About 1 in 10 investors are seeking opportunities with Russian-based stocks that are listed on UK indexes, and more than 20% would consider buying Russian ETFs at this time. In the survey of Russian respondents, nearly 50% of investors said they are looking out for opportunities to buy shares of Russian companies at low and attractive prices. These results also align with reports that many Russians are sensing an opportunity in the stock market due to the fall of the ruble. Outside of Russia, meanwhile, investors have tried jumping on currently distressed investments as a cheap entry point into the Russian market.

“Despite the negative impact of harsh Western sanctions on Russia’s economy, long-term buying opportunities are starting to emerge as a result of the historic collapse in stocks of leading Russian companies, most notably energy and commodity producers, such as Gazprom (MCX:GAZP), Lukoil, and Rusal,” Cohen continued.

On the other hand, Russian investors are maintaining a relatively pessimistic attitude about the stock market in their country, with 60% anticipating a complete decline as well as a long and slow recovery. Exactly how slow? Forty-five percent project a recovery for the Russian market within three to five years after the lifting of sanctions — and that is coming from investors who held a positive outlook in the previous question.

British investors are more optimistic about their stock indexes. Forty-one percent expect a decline followed by a long and slow recovery, 27% a rapid recovery followed by rapid growth, and only 2% a complete decline without a recovery within a decade.

In both the UK and Russia, the Ukraine war has only added to the perception of cryptocurrency as a risky investment. Among British investors, 58% believe cryptocurrency remains “very risky” and 9% consider it “riskier based on the conflict.” Sixty-one percent of Russian investors also feel that there are too many risks associated with cryptocurrency. That said, nearly 30% of UK investors said they could understand how cryptocurrencies might be an attractive alternative for investors in distressed markets.

“Essentially, there have always been worries that rogue states could use cryptocurrencies to evade sanctions and move billions of dollars around the world in secret,” said Cohen. “The Russia-Ukraine war has done little to change that perception.”

Ultimately, while the Russian economy will undoubtedly take a severe hit for the foreseeable future in a situation that will hurt the bottom line of the average Russian citizen, the Ukraine war has also revealed that Russian investors have thus far been better prepared than their British counterparts for disruptive markets and, thanks in large part to the diversification of their holdings, have been able to capitalize on the drop in value amid the war in Ukraine.

UK Survey Results:

This survey was conducted on March 21-23 based on polling 1,204 British adults from uk.Investing.com's user database.

1. Are you closely following the news about the Russia-Ukraine war?

2. Are you aware of the potential impact of the war on your investments?

3. Have your investments lost value since the Russia-Ukraine war?

4. How much has your portfolio dropped (for those who answered “Yes” in Q.3)?

5. What has happened to your portfolio since the war started (for those who answered “No” in Q.3)?

6. Have you made any additions to your portfolio in response to the crisis in Ukraine?

7. Do you own any Russia-based stocks listed on UK stock indices or otherwise?

8. Would you consider buying Russian ETFs right now?

9. Have your views on cryptocurrency’s risk level changed since the conflict?

10. Have you made any changes to your cryptocurrency allocation?

11. What are your expectations regarding the future of UK stock indices?

12. When do you believe the Russian market will recover?

13. Do you plan to invest in any of the following alternative investments instead of the stock market?

14. What do you think the biggest factor for the stock market is going forward?

Russian Survey Results:

This survey was conducted on March 16-18 based on polling 1,478 Russian adults from ru.Investing.com's user database.

- Have you lost money due to the crisis on the Russian stock market?

2. What percentage of your portfolio have you lost (for those who answered “Yes” in Q.1)?

3. Describe your situation (for those who answered “No” in Q.1)

4. What investment strategy are you following currently?

5. Have you earned or lost on the fall of the ruble?

6. What ratio of your assets are in Russian or foreign stocks / currencies?

7. Do you think that cryptocurrencies are now the most protected asset?

8. Are you planning to transfer some of your assets into cryptocurrencies?

9. How do you feel about the idea of buying foreign currency through a crypto wallet?

10. How do you feel about the restriction of trading on the Moscow stock Exchange?

11. What are your expectations regarding the future of the Russian stock market?

12. According to your forecasts, when will the Russian market recover (responses from investors who gave a positive outlook)?

13. What alternative instruments do you plan to invest in instead of the stock market?

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.