- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

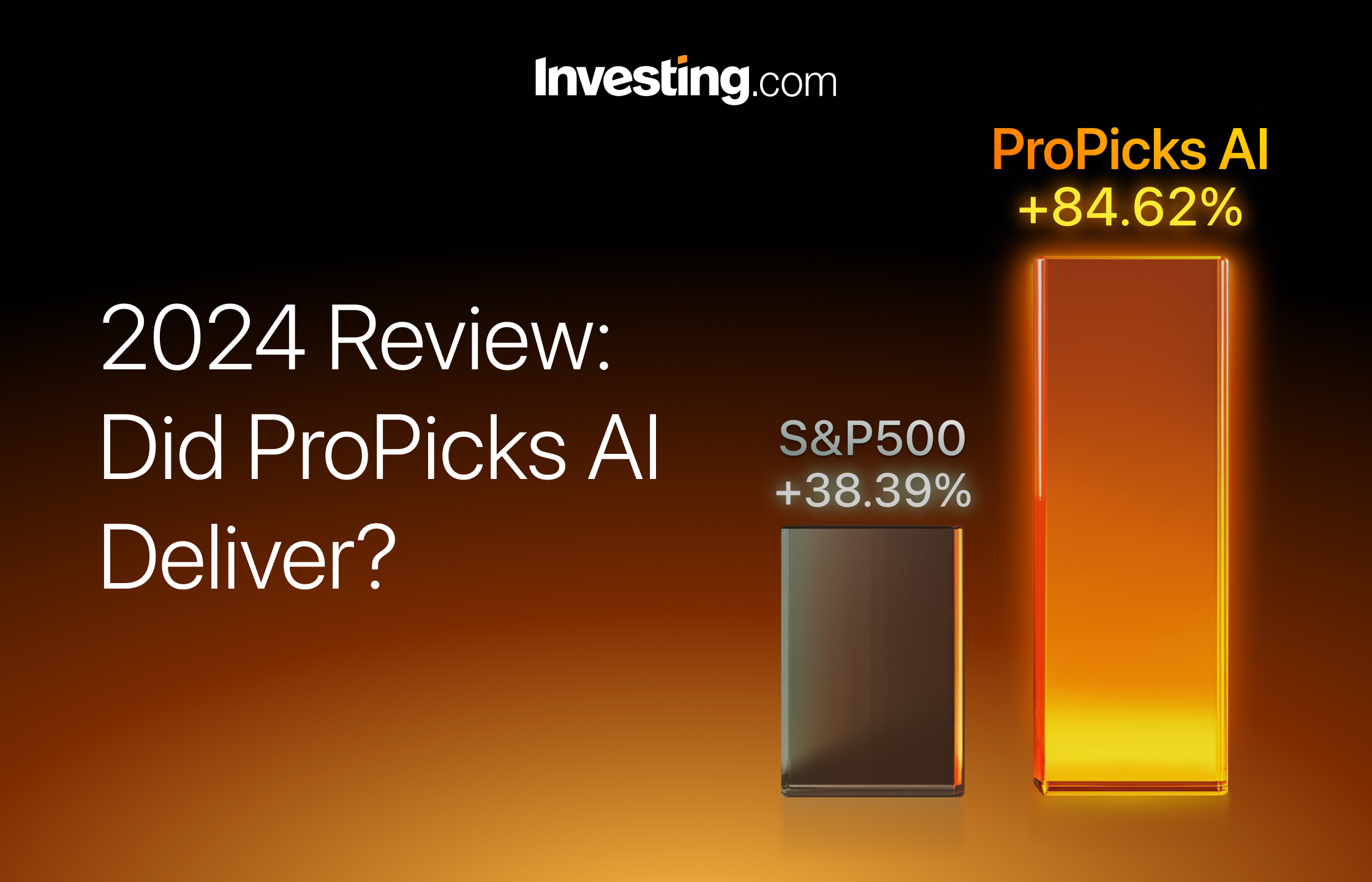

Money Time: Analyzing ProPicks AI Results in 2024

It’s been 12 months since the launch of our 6 AI-powered stock-picking strategies, designed to beat the S&P 500 and other benchmark indices. Here’s how they did.

Markets will be markets. There are no guarantees. So for your lower-risk, lower-yield investments, you know where to look: main indices’ ETFs, short-term government bonds – whatever lets you sleep well at night.

But when you’re looking to take calculated risks for higher returns:

ProPicks AI is your AI-powered stock picker that finds exciting investment opportunities every month to beat the market.

These kinds of opportunities are usually reserved for hedge funds, but thanks to our proprietary AI model they’re now available to over 150,000 subscribers at InvestingPro.

ProPicks AI analyzes over 25 years of historical financial data across thousands of companies and considers over 50 financial metrics to identify top stocks. That’s something the average retail investor could only dream of doing themselves.

How have we done so far?

It’s been a full year since the launch of our flagship service, so you can now check out the highlights and learnings based not only on 10 years of historical backtesting, but real-world performance.

Similar to what we saw in the markets, the tech sector fueled a strong rally that translated even better in our own tech-focused strategy. The results* have been pretty incredible:

- Tech Titans, our top strategy, outperformed the S&P 500 by +46.24%.

- 9 of our stock picks generated over 40% each in the past year.

- Out of the thousands of stocks the model had to consider, the top two YTD performers on S&P 500 - Vistra Energy and Nvidia - are in our top 10 performing stock picks.

- Our “least” successful strategy - Mid-Cap Movers - gained +20.33%.

Some of our strategies - while still gaining above 20% - are trailing behind their respective benchmark index. For the sake of comparison, these benchmark indices are rough heuristics and far from a perfect apple-to-apple view. Our strategies are equally weighted, contain 10-20 stocks, and rebalance on a monthly basis - which is not the same operating method for indices such as S&P Midcap 400, S&P 500 Pure Value and others.

Compare these different strategy results to your own portfolio performance, and consider whether or not you could have achieved more than ProPicks AI, with less effort.

Scorecard

Tech Titans

Discover 15 companies at the forefront of tech innovation, offering some of the most exciting opportunities in the sector. This list features both established industry giants with substantial market caps and fast-growing businesses with remarkable metrics and cutting-edge developments.

Maximum Holdings: 15

Annualized Return: +84.62%

Dominate the Dow

Renowned for their stability, market dominance, and significant growth potential, Dow Jones stocks are among the most dependable investments available. Each month, our cutting-edge AI models analyze the data to spotlight the top 10 performers. These "blue chip" stocks have truly earned their status as leading forces in the industry.

Maximum Holdings: 10

Annualized Return: +26.27%

Beat the S&P 500

With the 500 largest companies on the U.S. stock market, the S&P 500 is a go-to index for investors globally. Our AI evaluates each stock using key performance indicators like valuation ratios, momentum metrics, and overall company health, tracking them against real-time market shifts to ensure timely insights. This approach pinpoints the 20 top performers each month with the highest potential to excel.

Maximum Holdings: 20

Annualized Return: +31.02%

Mid-Cap Movers

Striking the perfect balance between size and stability, mid-cap companies are often top-tier in financial resilience. Known for their agility without excessive risk, leading mid-cap stocks frequently deliver exceptional overall returns. Each month our AI models identify the 20 stocks that are leading in their industries, each primed for significant mainstream success.

Maximum Holdings: 20

Annualized Return: +20.33%

Top Value Stocks

Every month, our AI models spotlight up to 20 undervalued U.S.-listed stocks with strong earnings and promising growth potential. These companies typically trade below their estimated intrinsic value, presenting a significant opportunity for investors seeking a bargain.

Maximum Holdings: 20

Annualized Return: +48.93%

Best of Buffett

Using cutting-edge AI, we've analyzed every stock in Buffett’s portfolio and selected the top 15 standouts from an already stellar group of companies. These stocks represent the best of Buffett’s investment philosophy, offering high potential for long-term growth. Quarterly evaluations of Buffett’s 13F filings ensures that our list is always up-to-date with the latest holdings.

Maximum Holdings: 15

Annualized Return: +32.92%

-

The year’s top 10 performing stock picks will be revealed in the coming days on Investing.com, culminating in the announcement of the past year’s #1 stock which will be made during a special live webinar. Hosted by Thomas Monteiro, Investing.com’s Global Analysis Lead, and Andy Pai, the visionary behind ProPicks AI and VP of Subscriptions at Investing.com, the webinar will also include a Q&A session with our experts.

Sign up to Investing.com for free to get your exclusive webinar invitation.

How to make the most of ProPicks AI

ProPicks AI offers various investment strategies, ranging from higher-risk to conservative. Each strategy provides a monthly updated shortlist of stocks to consider.

Our customer feedback revealed that some of you were unsure about the best way to utilize this tool. That’s understandable given that different investors have different approaches.

So let's break it down:

Step 1. Choose your AI-powered investment strategy

- Select the strategy (you can choose more than one) that matches your goals, risk preferences, and comfort level.

Step 2. Use it as an idea generator to source new monthly stock picks

- Focus on newly added stocks: Conduct in-depth analysis; Review fundamentals; Compare to peers; Consider the key stats that matter to you most — like dividend yield or revenue growth; Utilize premium data like Fair Value, ProTips, and Company Health Score.

- Make trades aligned with your strategy and risk preferences.

If you want to follow the AI-powered strategies one-to-one in order to match their performance, you’ll need to choose the entire monthly portfolio of 10-20 stocks and hold them equally weighted. Then check the monthly updates sent via email, and posted on our platform.

Note that it takes some effort to recalculate and rebalance the stocks equally. Also, buying and selling monthly may have tax implications for capital gains, as well as transaction fees depending on your location and broker.

We always recommend doing your own due diligence. Past performance doesn’t guarantee future returns.

What’s next for ProPicks AI?

It was a great first year, but we’re just getting warmed up! Expect exciting updates.

For example, many customers have been asking for ProPicks AI in local markets – and we listened. Over the next few months we’ll be introducing localized editions of ProPicks AI in different local stock markets around the world.

Stay tuned.

Visit the ProPicks AI page to unlock the full stock lists

*Data is for 01-11-2023 → 18-10-2024

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.