- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Adding insult to the injuries of Brexit and COVID-19, UK investors are looking abroad

Between the continued fallout from Brexit and the COVID-19 pandemic, it has certainly been a year to forget for the UK economy — and new research from uk.Investing.com reveals another disturbing layer to the crisis.

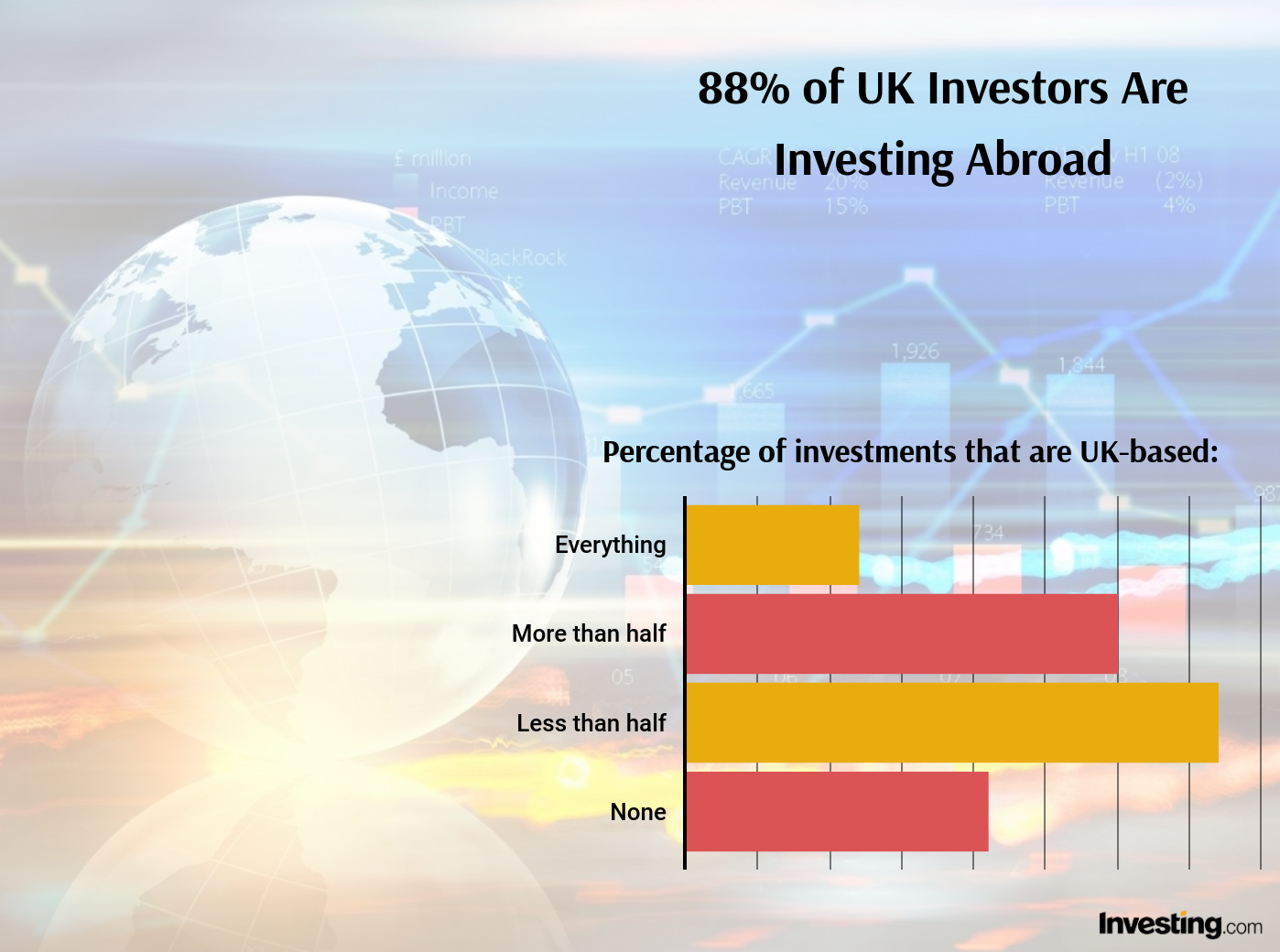

In a survey of more than 1,000 British investors, nearly 90 percent of investors reported that they are looking away from the UK for their investments, with more than 1 in 5 not currently investing in any UK stocks and domestic stocks comprising less than half of the investment portfolios for 60 percent of British investors. Fifty seven percent are currently invested in foreign stock exchanges and 54 percent invest in cryptocurrencies.

More than 75 percent of respondents see more potential in overseas investments over the coming year. Thirty percent have decreased UK-based equities during the past year, with 22 percent increasing such investments and 48 percent maintaining their position on domestic investments.

Sixty five percent of UK investors said that they have increased their positions in foreign investments or cryptocurrencies following the 2016 Brexit referendum, a trend that is only continuing to unfold amid COVID-19, with 62 percent increasing foreign and digital currency investing since the start of the pandemic in 2020.

"It’s unsurprising to see UK investors shunning the domestic market for better returns elsewhere,” said Samuel Indyk, senior analyst at uk.Investing.com. “The FTSE has consistently underperformed its counterparts in Europe since the Brexit vote and there’s no reason to suggest that won’t continue as the UK grapples with its new trading arrangements."

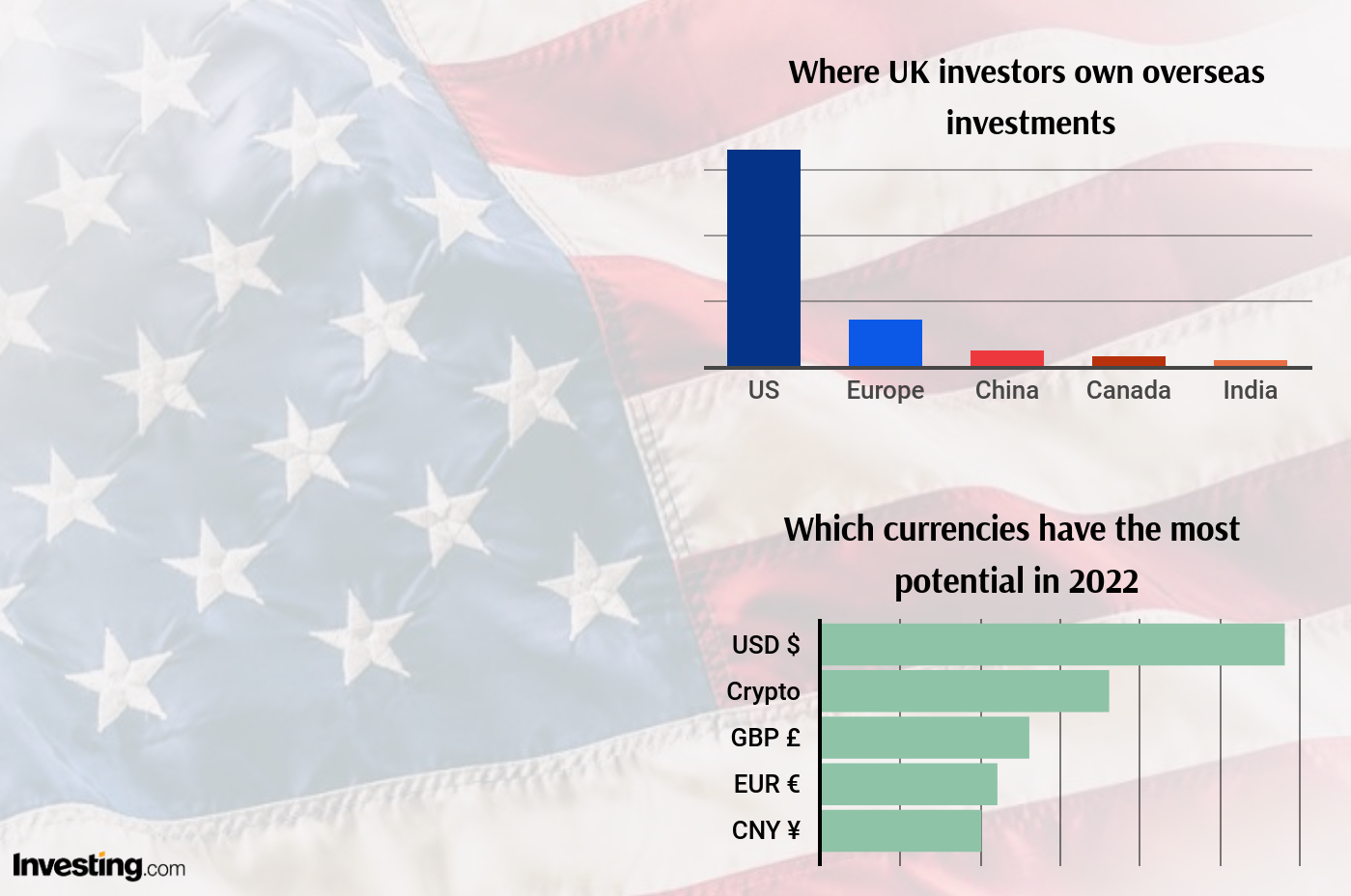

As to where UK investors are looking to invest their cash, the U.S. is where an overwhelming majority have hedged their bets. As many as 66% of UK investors own investments in the States, followed by Europe (14%), China (5%), Canada (3%) and India (2%). Furthermore, when asked which currency had the most potential over the coming year, the U.S. dollar was again a resounding winner, with 29% of investors backing the currency and 18% believing cryptocurrencies to be the next best alternative. The pound sterling (13%) was seen to have slightly more potential in 2022 than the Euro (11%), followed by the Chinese Yuan Renminbi (10%).

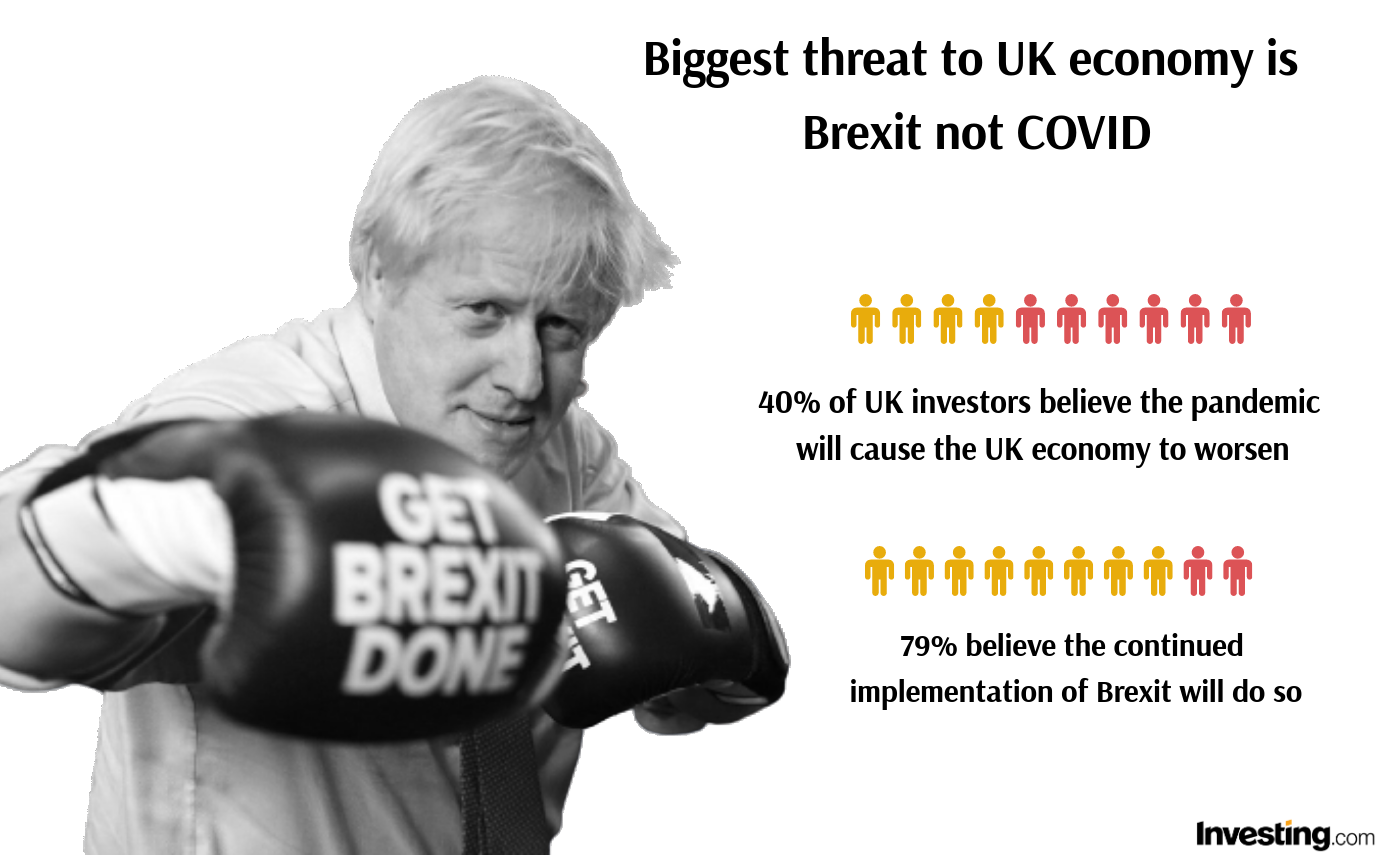

The survey also sought to gain insight into public opinion surrounding which seismic event is pummeling the UK economy harder. Since the start of 2020, a comparable number of investors blame Brexit (67 percent) and COVID-19 (76 percent) for the economic struggles, while the same exact proportion (57 percent) attribute rising employment gaps to Brexit and COVID-19, respectively. But from a forward-looking perspective, investors’ outlook is far more skewed, as 79 percent of investors who believe the economy will weaken in the coming year attributed their position to the continued implementation of Brexit, and only 40 percent cited the pandemic as an anticipated factor of future economic weakness — including 11 percent who believe the pandemic will worsen and 29 percent who believe the pandemic’s conditions will remain similar. Among those who believe the UK economy will strengthen in the next year, 36 percent cited Brexit, and 81 percent said the economy will grow stronger because the pandemic will subside.

"A shortage of workers in lower-paid jobs is having an impact on UK supply chains, with petrol stations running out of fuel and some supermarket shelves remain empty,” Indyk continued. “It’s unfair to blame this entirely on Brexit but the UK appears to be suffering more from these issues than its European neighbours. And with COVID cases and deaths relatively stable over recent months, there’s no reason to think the pandemic will be a greater threat to the economy than issues related to the UK’s withdrawal from the EU in the coming year."

Brits’ support for the EU is apparently rising during the pandemic, according to the survey. Forty two percent of respondents disclosed that they voted to remain a member of the European Union in 2016, but 52 percent asserted that if the Brexit referendum were held again today, they would opt to stay in the EU. This comes despite the UK-EU spat over vaccines and differs from previous research which found that the vaccine dispute had contributed to boosting support for Brexit.

Among those who reported decreased support for Brexit in the survey, 77 percent attributed their stance to economic issues and 27 percent citing pandemic-related issues, while 22 percent noted their growing support for the EU and its policies. Among those who reported increased support for Brexit, 69 percent expressed growing satisfaction with the EU, 33 percent cited the pandemic, and 29 percent cited the economy.

Ultimately, whether Brexit or COVID-19 (or a mixture of both) is to blame for its economic struggles, it’s clear that the UK will need to address the trend of investors increasingly looking abroad if the country wishes to remedy this ongoing malaise.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.