- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fed Preview: It’s A Credibility Issue For Yellen

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

On the eve of the Federal Reserve’s quarterly monetary policy announcement, no one is buying U.S. dollars. The greenback ended the day lower against the Japanese yen, sterling, Canadian and New Zealand dollars and was unchanged versus other major currencies. Even the strongest rise in annualized core producer price growth did not spark lasting demand as investors eye the rate decision with caution. The problem is that everyone expects the Federal Reserve to raise interest rates by 25bp on Wednesday so the rate change will be the least interesting part of Wednesday’s monetary policy decision. Instead, investors will be focused on the dot plot, changes to the central bank’s economic projections, the tone of Yellen’s speech and their plans to reduce the balance sheet. There’s significant debate on how the Fed approaches each of these issues so fireworks are expected. The dollar, which has been trading quietly versus the yen and euro ahead of the decision, will most likely break out of its 1.1165-1.1285 EUR/USD and 109.50-110.50 USD/JPY range.

3 Questions For The Fed

- Will the dot plot still show 1 more hike in 2017?

- Will the Fed provide details on how it plans to reduce its $4.5 trillion balance sheet?

- Will Janet Yellen stand firm on her view that stronger labor-market conditions will take inflation back to target

If the answer is 'YES' to all of these questions, the dollar will rise, otherwise, it’s a sell on rally.

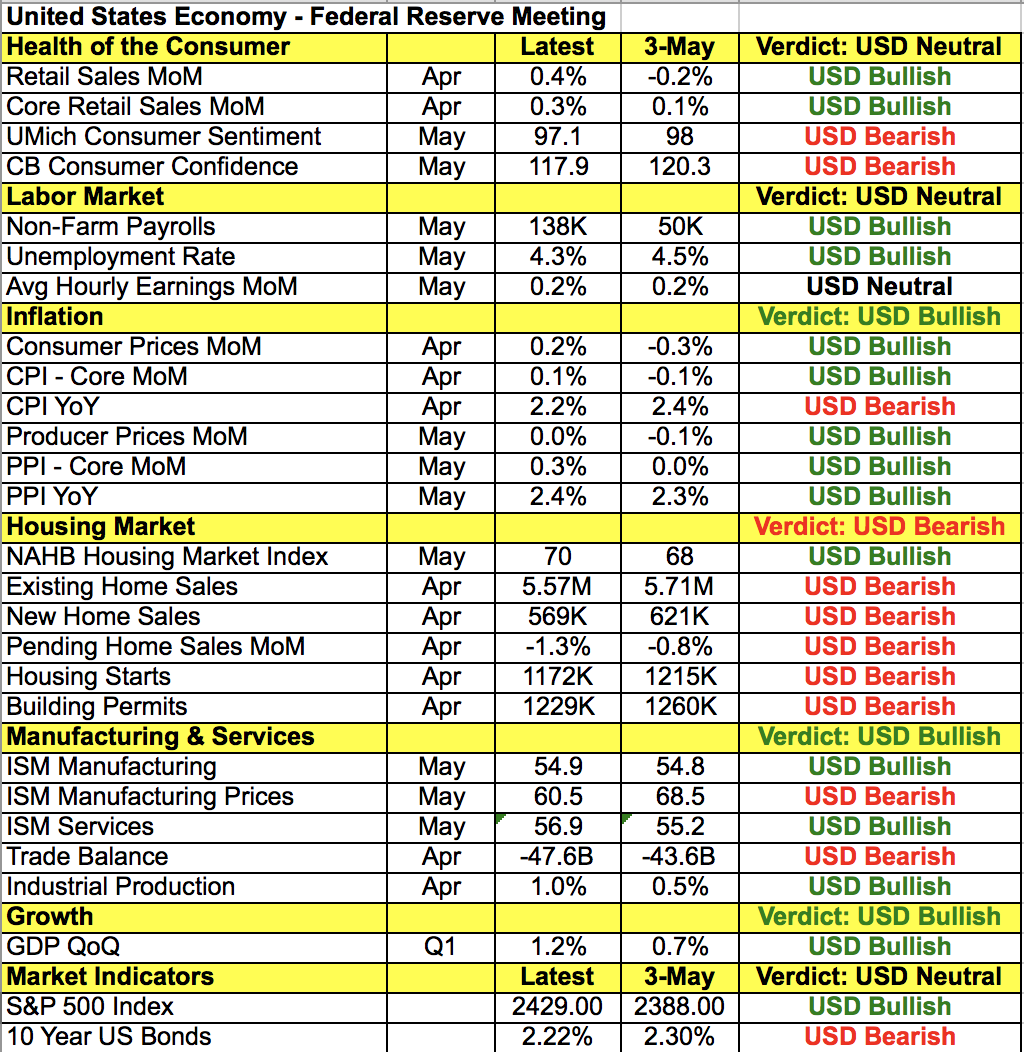

This month’s FOMC rate decision is about credibility. The following table shows more improvement than deterioration in the U.S. economy since the last meeting but none of us can forget the big disappointment in nonfarm payrolls this month. Economists were looking for 185K jobs and only 135K jobs were created. This follows a downward revision the previous month and a staggeringly weak 50K increase in March. The economy is not performing as well as the Fed has hoped and there’s no clear timeframe on tax cuts or fiscal stimulus. The political drama in Washington is stifling progress on economic stimulus. To forgo raising interest rates would be a major credibility issue for the Fed because U.S. policymakers have taken every opportunity to say that 1 to 2 more rate hikes are needed this year. Unfortunately, their credibility will remain in question if they tighten because weak data leaves the Fed stuck between a rock and a hard place. Thankfully, time is on their side with investors not looking for a follow up move until December.

With 6 months to go before the December meeting, we think it is too soon for policymakers to drop their call for one more hike in 2017. Their credibility would take a major hit if they shifted guidance and then changed shortly thereafter as data improves. So while we expect Yellen to recognize the down drift in inflation and softness in data, she will also provide details on reducing the balance sheet. If her tone was cautious back in March, it's only going to be more so in June and that’s why we believe that unless she is overwhelmingly hawkish, keeping the door open to another hike in September, the rally in the dollar should be sold.

Meanwhile, positive political and economic developments sent sterling higher against all of the major currencies. There’s talk of a coalition agreement between the DUP and Conservatives. Consumer prices grew at its strongest pace in 4 years with core consumer price growth hitting its highest level since 2012. This increase was a surprise and was powerful enough to driver short covering in sterling. We still think GBP is a sell on rallies with the latest recovery mimicking the move in 2010 when GBP/USD rebounded off its post-election lows only to break the low by 250 pips after a Coalition government was announced. With that in mind, U.K. labor data is scheduled for release on Wednesday and stronger job growth is expected as the manufacturing sector saw its greatest improvement in jobs in 3 years according to the PMIs. We like selling GBP/USD between 1.2790 and 1.2830 though EUR/GBP would be a better trade as there is no embedded USD–FOMC risk.

Tuesday's best-performing currency was the Canadian dollar, which extended its gains on the back of Bank of Governor Poloz’s comments. Although he was not as explicit as Wilkins, who questioned the bank’s easy monetary policy, Poloz said interest rates have been extraordinarily low and have done their job. Combined with the rise in oil prices, his comments took USD/CAD within 10 pips of 1.32. The break of the 50- and 100-week SMA means that further losses are likely with a possible drop down to 1.3050. The New Zealand dollar also pressed higher but lower business confidence prevented the Australian dollar from participating in the rally.

The euro also ended the day unchanged against the greenback. Although investors grew less optimistic about Germany’s economic outlook, they felt better about current conditions in the Eurozone’s largest economy and the outlook for the Eurozone in general. For this reason we continue to expect euro to outperform the GBP. EUR/USD will also be a good trade if the Fed disappoints.

Related Articles

In response to criticism of tariff 'confusion', President Trump stepped in emphatically yesterday to announce that tariffs would be going ahead on Canada, Mexico, and China next...

Trump said yesterday that tariffs on Mexico and Canada are still on the table ahead of next Monday’s deadline. Markets remain reluctant to price that in for now, and some soft US...

GBP/USD is making another attempt to push past the 1.25 level, buoyed by stronger-than-expected UK GDP data. The preliminary report suggests the UK economy grew by 1.5% in 2024, a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.