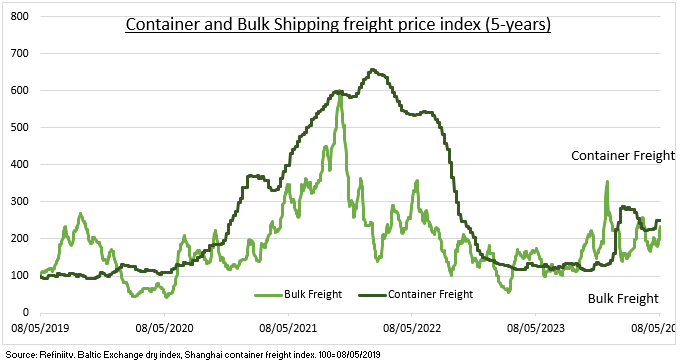

TRADE: Container and Bulk shipping rates are a fraction of pandemic shock levels but also well above their lows. The shipping industry moves 90% of global trade, making it a real-time barometer for the slow-burn global manufacturing and trade cycle recovery. This is being helped by US economic ‘exceptionalism’, China’s latest import and export recovery, and the outlook for Europe. Whilst Red Sea crisis impacts have proved less than feared and global supply chain disruptions are still low. But Red Sea impacts are proving longer lasting. This has all begun to turn the tide for container shippers, Maersk (MAERSKB.CO) to Hapag-Lloyd (HLAG.DE). Whilst the broadening stealth commodity rally helps the bulk shippers, from ZIM (ZIM) to Star (SBLK).

RED SEA: The number of ships transiting the Red Sea is down 50% year-over-year. Whilst those going the longer Cape route have tripled. This adds 6,000 km to journeys connecting Asia with Europe, and around two weeks to the journey time. The cost of shipping a standard 40ft container on the largest Shanghai to Rotterdam route is currently $3,100, down by a third from the end of January crisis peak. But still up a dramatic 150% in the past four months and seemingly stabilising at this level in a ‘new normal’ of higher container freight costs (see chart).

IMPACT: The continued simmering Red Sea disruption has been the latest vice of higher costs and delivery delays for consumer goods from the world’s Asia manufacturing hubs to consumers in Europe. Electronics, clothing, toys, furniture, and cars have been particularly hurt. Alongside time sensitive seasonal goods, like clothing, or just-in-time supply chains, like cars. This has thrown more sand-in-the-gears of a depressed global trade cycle. It further incentivizes the longer term trade trends. To costlier near-shored supply chains. And the expense of holding higher levels of inventories, to act as a buffer to what is just the latest supply chain shock.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Messages from rising freight rates

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.