Investors and Analysts Delve into Royal Mail's Outlook Amidst Market Flux

In the dynamic realm of the UK stock market, all eyes are on Royal Mail, operating under the banner of International Distributions Services PLC (LON:IDSI), as of 2024. With heightened interest from investors and analysts, the performance and future trajectory of this venerable postal service provider are under meticulous examination.

Company Profile

A cornerstone of International Distributions Services PLC, Royal Mail boasts a storied history as one of the world's oldest and most esteemed postal services. As reported by the Financial Times, the company has played an instrumental role in facilitating communication and commerce across the United Kingdom and beyond. From delivering parcels and letters to offering innovative logistics solutions, Royal Mail has adeptly adapted to the evolving demands of the contemporary era while upholding its hallmark values of reliability and efficiency.

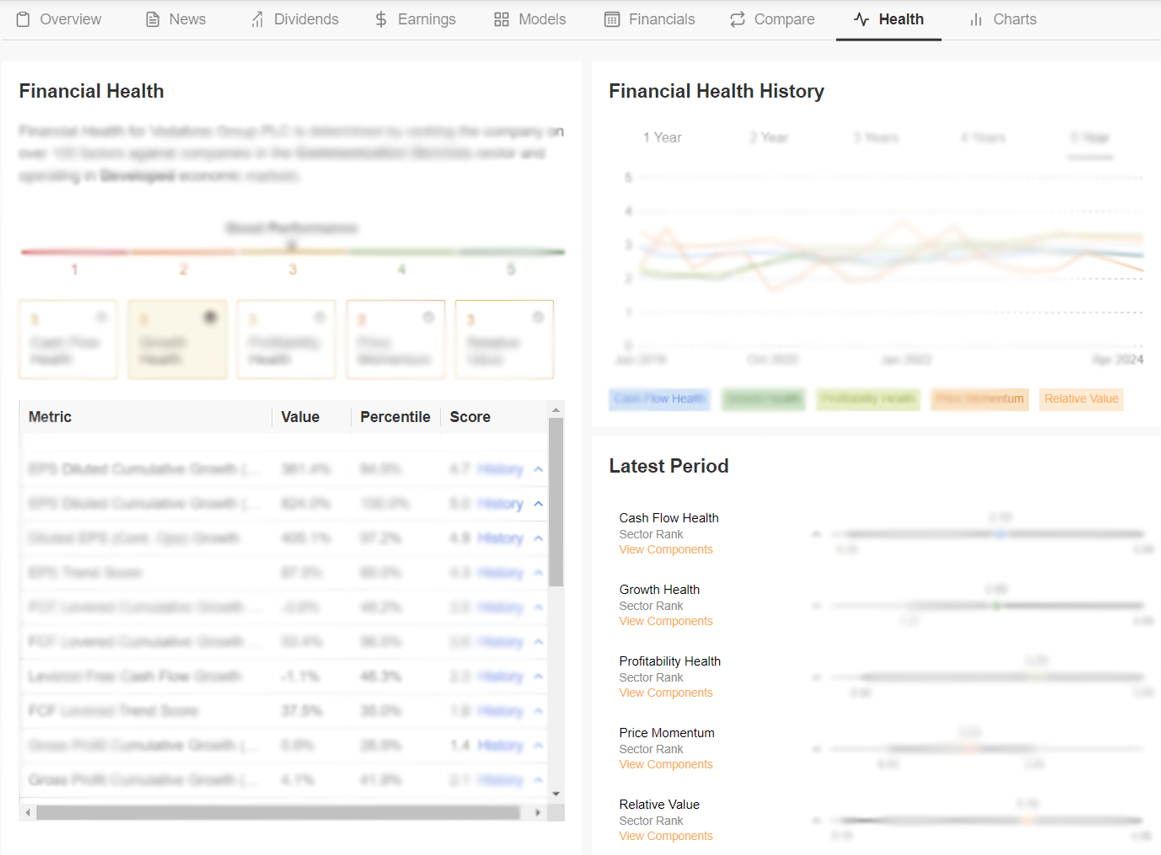

Financial Health

Despite encountering challenges such as dwindling letter volumes, heightened competition in the parcel delivery sphere, and regulatory constraints, Royal Mail has showcased resilience and adaptability. Leveraging its expansive network and technological advancements, the company has charted growth trajectories in its parcel delivery and logistics divisions. As noted in a Bloomberg report, Royal Mail has navigated these headwinds while maintaining robust financial standings, characterized by consistent revenue streams and unwavering commitments to cost optimization and operational efficacy.

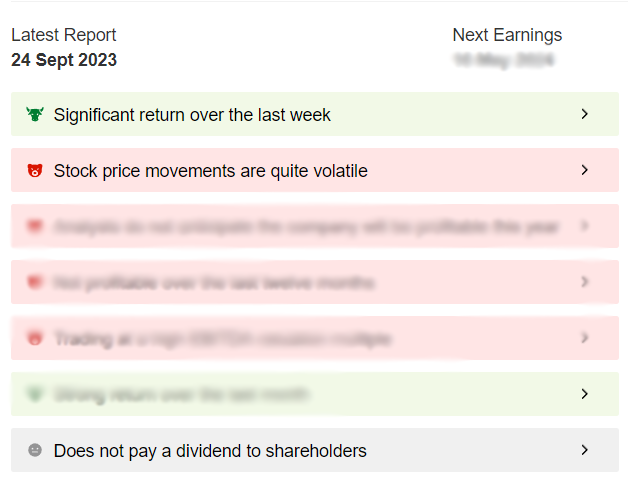

Investing Pro scorecard confirms the report, ProTips pointing out that IDSI has had significant returns over the last week, even if the stock's price movements are quite volatile.

Market Sentiment

The market's perspective on the valuation of IDSI stock, which encapsulates Royal Mail's fortunes, is multifaceted and contingent upon several factors:

- Parcel Delivery Expansion: Analysts express optimism regarding Royal Mail's parcel delivery prospects, buoyed by the burgeoning e-commerce landscape. With consumers increasingly turning to online shopping, Reuters suggests that Royal Mail is poised to capitalize on escalating parcel volumes and burgeoning delivery service demands.

- Cost Management Endeavors: Investors are closely monitoring Royal Mail's endeavors to streamline operations and enhance cost efficiency. Through strategic initiatives aimed at optimizing routes and investing in automation technologies, Royal Mail endeavors to bolster profitability and sustain its competitive edge in the market.

- Regulatory Dynamics: Royal Mail's operational and financial trajectory is subject to regulatory fluctuations and governmental policies. Investors are attuned to developments concerning postal regulations, pricing reforms, and competitive frameworks, weighing potential risks and opportunities for the company. This contributed to the volatile price actions over the last 12 months.

- Digital Transformation Drive: Embracing digital transformation is imperative for Royal Mail's sustained growth, per insights from The Guardian. Investments in digital platforms, tracking systems, and data analytics underscore the company's commitment to driving long-term sustainability amid an evolving postal landscape.

In conclusion, Royal Mail, epitomized by IDSI stock, remains a cornerstone player in the UK's postal and logistics arena, renowned for its legacy of reliability and innovation. Despite navigating challenges inherent in a rapidly evolving market milieu, Royal Mail continues to pivot and evolve, positioning itself for prospective growth avenues. The cautious optimism surrounding IDSI stock underscores investors' vigilance as they closely monitor the company's strategic endeavors and performance trajectories in the foreseeable future.

You can find more fundamental details about Royal Mail and many other stocks on Investing Pro. Subscribe today with the code UK10 and get a 10% discount on yearly or bi-yearly subscriptions to Investing Pro and Investing Pro+.

Subscribe here and unlock access to:

ProPicks: AI-selected stock winners with proven track record.

ProTips: Digestible, bite-sized insight to simplify complex financial data.

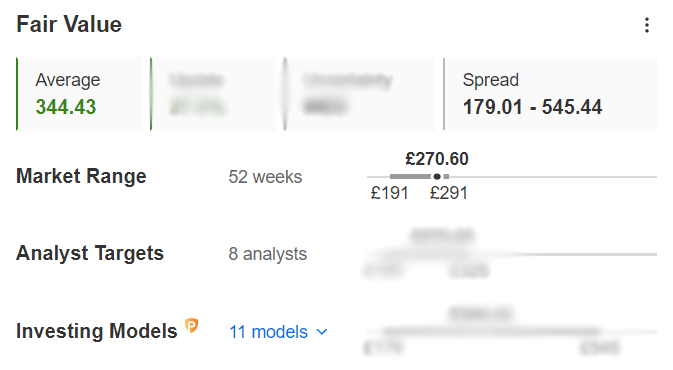

Fair Value: Gain deeper insights into the intrinsic value of stocks.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Disclaimer

This post was created with the help of AI.