- Amid growing interest in dividend-focused ETFs, investors seek stocks that offer both reliable dividends and growth potential.

- Today, we'll unveil a selection of such stocks meeting criteria like attractive dividends, stable earnings, and no sell ratings.

- With InvestingPro's tools, we've curated a compelling list of candidates poised for growth and increasing dividends

- If you want to invest while knowing how to avoid market risks, try InvestingPro. Sign up HERE for less than $10 per month and get an almost 40% discount for a limited time on your 1-year plan!

- Attractive Dividends: A healthy dividend yield to provide consistent income.

- Earnings Stability: Forecasted earnings that hold steady or grow throughout the year, ensuring dividend sustainability.

- Analyst Confidence: No "sell" ratings from analysts, indicating overall positive sentiment.

- Upside Potential: Market consensus pointing towards a future price increase.

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Dividend stocks are back in the spotlight, with investor demand and capital flowing into dividend-focused ETFs of late. But what if you could combine reliable dividends with explosive growth potential?

Today, we'll uncover a powerful selection of stocks that meet these criteria. We're looking for companies offering:

Finding stocks that tick all these boxes can be challenging. But with the help of InvestingPro's professional tools, we've identified a compelling list of candidates we'll explore in detail below.

1. Kinder Morgan

The company was formerly known as Kinder Morgan Holdco and changed its name to Kinder Morgan (NYSE:KMI) in February 2011. It was incorporated in 2006 and is headquartered in Houston, Texas.

It is one of the largest energy infrastructure companies in America, being specialized in oil and gas pipelines.

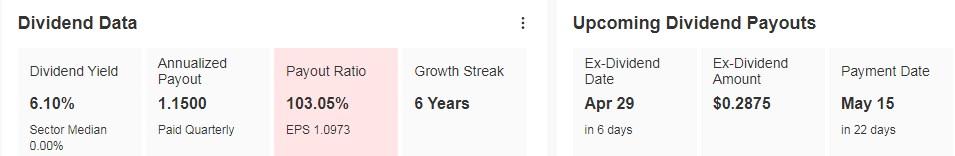

On May 15, it pays a dividend of $0.2875 per share, and in order to receive it, shares must be held before April 29. Its dividend yield is 6.10%.

Source: InvestingPro

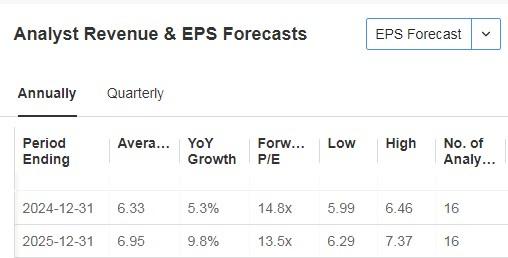

On July 17 it presents its results. Looking ahead to 2024, it expects EPS or earnings per share to increase by 14.1% and revenue by 12.9%.

Source: InvestingPro

The company has been a trusted role model when it comes to dividends, increasing them for 6 consecutive years and maintaining payouts for 14 consecutive years, reflecting Kinder Morgan's financial discipline and commitment to shareholder returns.

The first quarter results reinforce the company's confidence and the company's extensive pipeline network is expected to be instrumental in the shift to low-carbon energy sources.

In addition, Kinder Morgan shares are known for their low volatility, which may appeal to investors looking for stable stocks in the energy sector.

Over the past 12 months it is up 14.25% and has no sell ratings.

The potential the market gives it is around $20.41, although it will first have to overcome resistance at $19.33.

Source: InvestingPro

2. Philip Morris International

Philip Morris International (NYSE:PM) is a tobacco company that was incorporated in 1987 and is headquartered in Stamford, Connecticut.

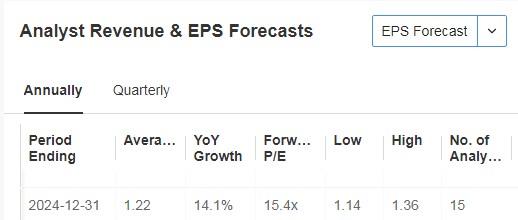

The dividend yield is 5.5%. The company has been increasing it for 17 consecutive years.

Source: InvestingPro

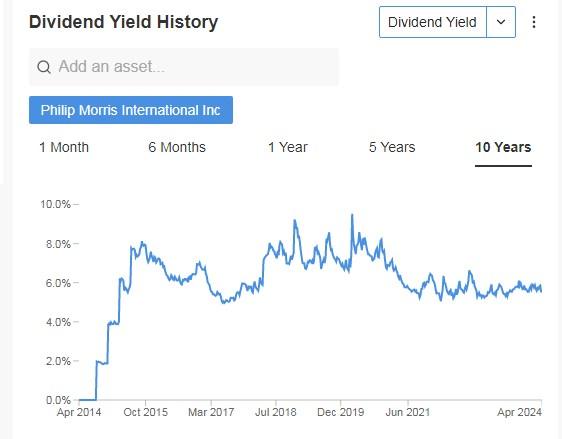

On April 23 it presents its accounts. For the current year the forecast is for an increase in EPS of 5.3% (9.8% by 2025) and revenue of 5.4%.

Source: InvestingPro

Philip Morris' gross profit margin is 63.39%, indicating strong operating efficiency and pricing power in the market.

It has invested $12.5 billion to develop innovative adult smoke-free products, which are already in 84 countries and used by 20.8 million people, accounting for 37% of the company's total net revenues in the full year 2023.

Its shares are up 0.80% over the past year. It has no sell ratings.

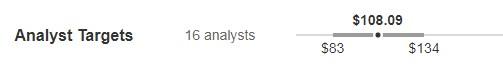

The market gives it a power at $108.09, although for example Citi is more bullish and puts it at $113.

Source: InvestingPro

3. Verizon Communications

Verizon Communications (NYSE:VZ)is engaged in the provision of communications, technology, information and entertainment products and services to consumers, businesses and government entities worldwide.

The company was formerly known as Bell Atlantic Corporation and changed its name to Verizon Communications in June 2000. It was incorporated in 1983 and is headquartered in New York.

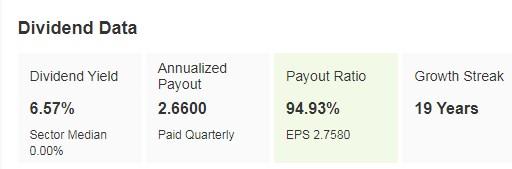

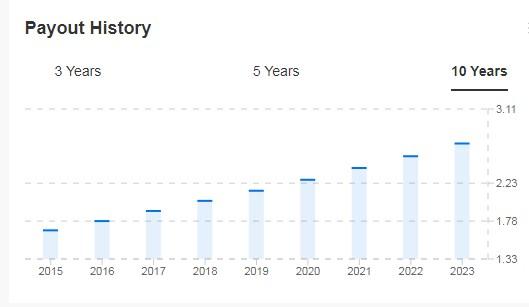

With a dividend yield of 6.57%, it ranks among the top performers in terms of dividends over the past seven years.

Source: InvestingPro

On April 22 we will know its quarterly results and this year it will meet its free cash flow (cash generation) target by touching $10 billion.

Source: InvestingPro

To its credit, Verizon gives customers access to exclusive, money-saving content offerings that they can't find at other providers, and it is leading the industry.

It is a defensive stock with solid cash generation and good dividend coverage.

Over the last 12 months its shares are up 17.17% and it has no sell ratings.

The potential assigned by the market is at $45.72.

Source: InvestingPro

4. Eversource Energy

Eversource Energy (NYSE:ES) is engaged in the energy supply business. The company was formerly known as Northeast Utilities (NYSE:ES) and changed its name to Eversource Energy in April 2015. It was incorporated in 1927 and is headquartered in Springfield, Massachusetts.

Its dividend yield is 4.80%. Its payout (percentage of profits it allocates to dividends) keeps increasing.

Source: InvestingPro

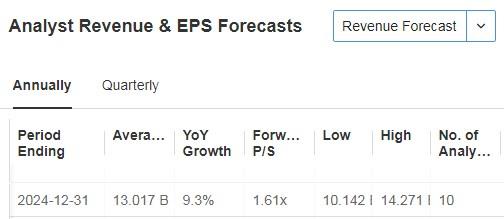

May 2 will be the time to know its accounts. By 2024, EPS is expected to increase by 5.3% and revenues by 9.3%.

Source: InvestingPro

Its shares have fallen by -21% in the last year, although in the last 3 months they have risen by 14.50%.

The market sees potential at $66.83.

Source: InvestingPro

***

Want to invest successfully? Take the opportunity HERE AND NOW to get InvestingPro's annual plan. Use the code INVESTINGPRO1 and get almost 40% off your 1-year subscription. With it, you'll get:

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.