(Reuters) - Britain's UDG Healthcare (L:UDG) posted a weaker-than-expected first-half performance at its second-largest business, Sharp, on Tuesday and lowered its outlook for the division, sending its shares down more than 6 percent.

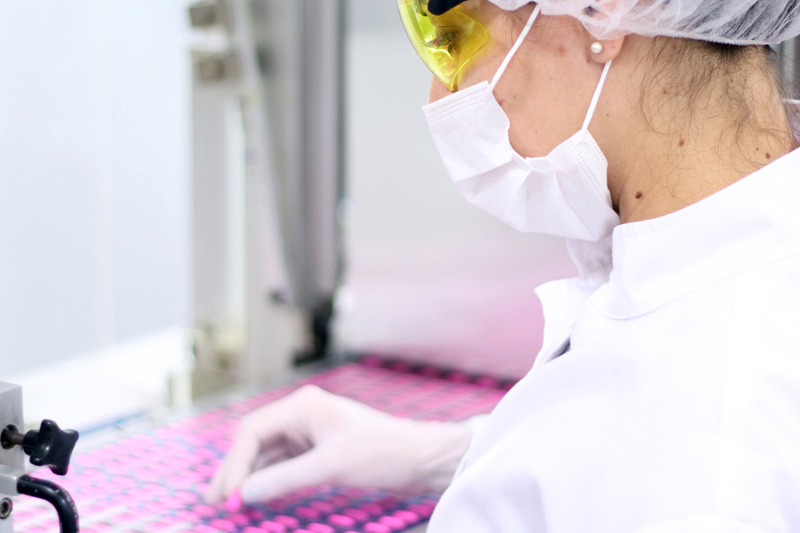

The company, which provides outsourced sales and marketing, drug distribution and packaging services to healthcare companies, said revenue at Sharp fell 4.4 percent to $118.6 million (88.4 million pounds) in the six months ended March 31.

Sharp, which specialises in contract packaging, also saw a 1.6 percent decline in operating profit, hurt by weaker demand for bottling at the division's U.S. business.

The company said Sharp is expected to deliver double-digit underlying operating profit growth in the second half of this year, but that will still only leave full year growth in the mid-single digits compared to its earlier guidance of low double digit growth.

Shares of the company were last down 5.3 percent at 882 pence, and were among the top losers in a FTSE midcap (FTMC) index that edged up overall on Tuesday.

"Given the lack of an upgrade to (overall) guidance and the short-term softness at Sharp, we would expect the shares to underperform today," Liberum analysts said in a client note. "That said, we do not believe the softness at Sharp will persist and expect a bounceback year in 2019."

The weakness at Sharp was offset by a 26 percent surge in revenue at UDG's biggest business, Ashfield, which benefited from the completion of a series of recent acquisitions.

The company reaffirmed its guidance for constant currency adjusted EPS growth of 18-21 percent and said total revenue rose 17 percent to $568.7 million.

"While this is below normal underlying growth rates, the improved pipeline of business in both the US and Europe leaves Sharp well positioned to generate strong underlying operating profit growth in FY19," the company said.