Benzinga - by Shanthi Rexaline, Benzinga Editor.

Tesla, Inc. (NASDAQ:TSLA), through its robotaxis, is striving to pivot to autonomous ride-hailing service, positioning itself in direct competition with Uber Technologies, Inc. (NYSE:UBER). As the two are likely facing off in the near future, here’s a look at how their shares have fared since the start of 2022.

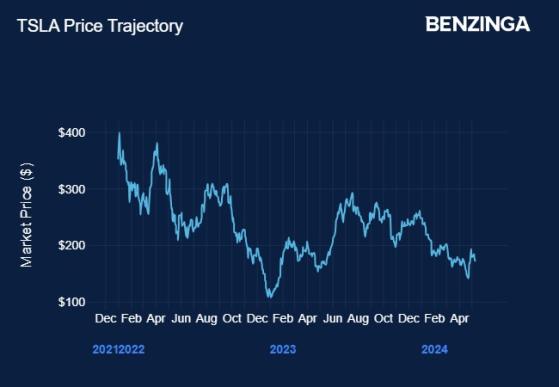

Tesla’s Tumultuous Journey: After showing surprising resilience during the pandemic years, Tesla’s fortunes took a turn for the worse at the start of 2022. Inflation, which began to rear its ugly head amid the COVID-19 stimulus measures during pandemic years, peaked in the summer of 2022. Rising inflation arm-twisted the U.S. Federal Reserve into announcing rate hikes.

The successive and aggressive rate hikes announced since March 2022 negatively impacted consumer sentiment and spending on discretionary items such as autos.

Demand for Tesla’s electric vehicles began to head southward amid the inclement economic environment. To make matters worse, the Elon Musk-led company’s strategy to reinvigorate sagging demand backfired. Given its scale of operation, Tesla thought it wouldn’t hurt to undercut prices with an eye on expanding market share. The competition followed suit, negating any impact from the Tesla price hikes.

The price reductions hurt Tesla’s core auto margins significantly. It was then, that Tesla bulls began to hope for a volume boost from the Cybertruck launch, particularly through the “halo effect.” After a protracted delay, the EV pickup truck was finally made available to customers in late 2023. But the expected benefit did not kick in.

The lean patch continued for much of 2023, culminating in the company missing both earnings and revenue expectations for three straight quarters.

The fundamental woes have weighed down on the stock and it has lost over 51% since 2022.

Source: Benzinga

Robotaxi Pivot: It was against the backdrop that Tesla stepped on the gas with respect to its full self-driving technology. The FSD graduated from beta testing to FSD (Supervised), and the management communicated clearly that its focus was on perfecting the tech to come in handy for its robotaxi service.

Musk confirmed that the company will hold a robotaxi event on Aug. 8.

Tesla bull Cathie Wood expects robotaxis to account for the bulk of the company’s valuation in the coming years. Ark Invest sees Tesla stock hitting $2,000 by 2027, with robotaxis accounting for 44% of revenue, 64% of EBITDA and 67% of enterprise value.

On a positive note, Tesla has reportedly received the nod to roll out its FSD in China, one of its key markets,

Uber’s Post-Pandemic Rise: On Wednesday, Uber reported better-than-expected revenue for the first quarter but gross bookings trailed expectations. The second-quarter guidance was also mixed. Following the post-earnings pullback, Wedbush analyst Scott Devitt said, “We think the underlying business remains healthy, and we would opportunistically buy any near-term pullbacks in shares.”

Uber, the analyst said, remains the “dominant global mobility and delivery platform with multiple drivers of long-term growth” including

- non-UberX mobility products

- ongoing share gains and improving category leadership across international markets

- rising frequency and adoption

- Ongoing Uber One membership growth

- growth in new verticals and advertising revenue

As the pandemic eased, the company invested in luring back its customers through offering discounts.

The results began to show up slowly and steadily. Uber turned profitable in the fourth quarter and its stock was added to the S&P 500 Index.

Tesla Threat For Uber? The specter of Tesla dipping its heel into the ride-hailing business through its robotaxis is viewed as a threat by some. Gary Black said in a post in late April following Tesla’s quarterly results that the minimal impact on Uber and Lyft, Inc. (NASDAQ:LYFT) shares indicated that investors may not perceive Tesla's unsupervised ride-hailing as a significant threat to these companies.

But he did not rule out narrative change on Aug. 8, when Tesla is scheduled to unveil robotaxis.

Tesla Vs. Uber: A Tesla-Uber matchup may not be an apples-to-apples comparison, given the diverse line of businesses each is operating in. Nevertheless, the two companies are set to cross paths in the not-to-distant future. Here’s how the returns from the stocks work out.

| No of Shares 1,000 investment fetched(2022 start) | Value of shares currently | Returns | |

| Tesla | 2.84 | $488.20 | -51.12% |

| Uber | 25.78 | $1,751.23 | +75.12% |

Source: Benzinga

Commenting on the performance, Future Fund’s Gary Black said, “Despite $TSLA ‘s intense focus on autonomy over the past two years, $UBER has been by far the better investment.”

In premarket trading, Tesla shares rose 0.83% to $173.40 and Uber gained 0.15% to $68.03, according to Benzinga Pro data.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next: Tesla Bulls Praise Musk’s Q1 Earnings Call, See EV Giant On Collision Course With Uber And Lyft — But Critic Says ‘Christmas Just Came Early’ For Bears

Photo by G.Tbov on shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga