(Reuters) - U.S. private equity firm Advent International Corp will buy Brammer Plc for 221.5 million pounds, the companies said on Wednesday, weeks after the British industrial parts distributor's profit warning halved its stock value.

Boston-based Advent's recommended cash offer of 165 pence per share represents a premium of 69.2 percent to Brammer stock's closing price on Tuesday.

Shares in Brammer, which urged its shareholders to accept the "fair and reasonable" offer, rose 68.9 percent to 164.93 pence by 0928 GMT on the London Stock Exchange.

Industrial parts suppliers and distributors, including Brammer, have been hurt by lower demand from commodity customers who have held back on making fresh investments and are taking longer to replace parts amid low oil prices.

Oil prices are still nearly 60 percent lower than prices seen in mid-2014. Brammer shares have lost 80 percent in value since hitting a 16-year high in June 2014.

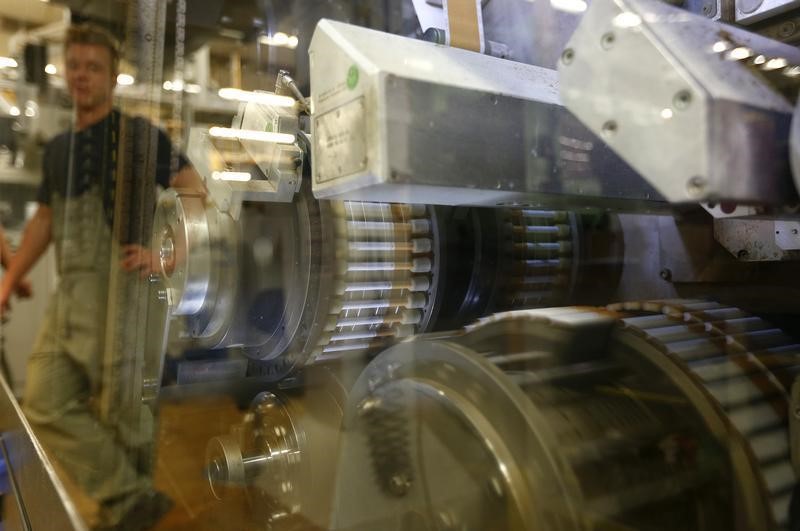

Founded in 1920 in Leeds, Brammer distributes bearings and equipment related to mechanical power transmission, pneumatics and hydraulics.

Brammer issued its second profit warning in six months on Oct. 7, saying it didn't expect a pretax profit for 2016, sending its shares tumbling 50 percent.

On Wednesday, Brammer said its recent strategic review had found that a turnaround would take at least three years to implement and result in significant reorganisation costs.

Advent's sector expertise and operational focus will help Brammer execute a turnaround strategy, said Jan Janshen, a Managing Partner of Advent.

An Advent spokesman declined to comment beyond the joint statement.

Advent had received undertakings from about 15.58 percent of Brammer shareholders, the companies said.