Proactive Investors - 7.05am: UK inflation eases by less than expected

UK inflation eased in March but not by as much as City commentators had hoped and remains stubbornly in double digits, official figures stated.

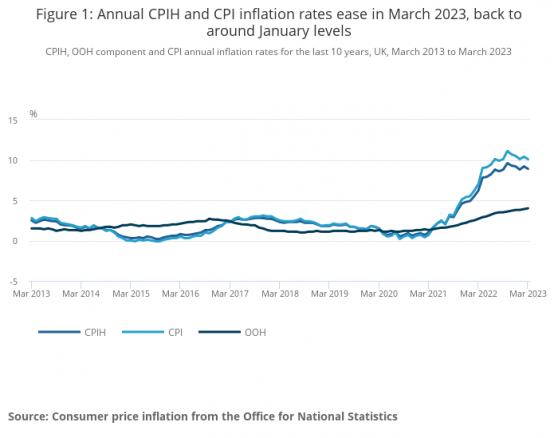

The Consumer Prices Index rose by 10.1% in the 12 months to March 2023, down from 10.4% in February, according to the Office for National Statistics.

On a monthly basis, CPI rose by 0.8% in March 2023, compared with a rise of 1.1% in March 2022.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 8.9% in the 12 months to March, down from 9.2% in February.

On a monthly basis, CPIH rose by 0.7% in March 2023, compared with a rise of 0.9% in March 2022.

The fall in prices mainly reflected changes in the transport division, particularly for motor fuels.

There were also downward effects from housing and household services, furniture and household goods, clothing and footwear, and restaurants and hotels.

These were partially offset by upward effects coming from food and non-alcoholic beverages, and recreation and culture.

The slowing in the headline rate was partially offset by an upward effect from food and non-alcoholic beverages, where prices rose by 19.2% in the year to March, up from 18.2% in February.

FTSE seen little changed ahead of Inflation print

FTSE 100 is seen flat ahead of inflation readings in the UK and the EU.

Spread betting companies are calling London’s lead index down by around 1 point.

UK inflation is expected to fall into single digits for the first time since August with City economists expecting a decline to 9.8% last month after a surprise bounce in February to 10.4%.

A sharp fall in energy costs compared to March 2022, when the Ukraine war drove up prices, is likely to be behind any decrease.

The figures are a key print for the Bank of England as it mulls its latest monetary policy move with a 25 basis point rise in interest rates currently expected at the next meeting of the Monetary Policy Committee.

In the US, stocks closed little changed as lacklustre earnings from Goldman Sachs (NYSE:GS) dented sentiment.

On Wall Street, the Dow Jones Industrial Average closed down 10.55 points at 33,976.63. The S&P 500 gained 3.55 points, or 0.1%, to 4,154.87, while the Nasdaq Composite ended flat at 12,153.41.

After the US close Netflix (NASDAQ:NFLX) posted its first quarter numbers. Shares dipped in after-hours trading after the streaming platform failed to attract as many new subscribers as expected during the first quarter.

The company added 1.75mln new subscribers during the period, far below the 2.3mln expected.

Back in London and aside from the inflation print the early focus will be trading statements from Just Eat, Antofagasta (LON:ANTO) and Hunting (LON:HTG).

Read more on Proactive Investors UK