Proactive Investors -

- Lead index down 15 points to 7,624.

- Gold hits an all-time high.

- Retail sales underwhelm.

China sets targets to reignite flagging economy

China’s premier Li Qiang has unveiled an ambitious 5% gross domestic product (GDP) growth target for the upcoming year, as the country looks to reignite its economy.

Speaking at the National People's Congress on Tuesday, he emphasised the need to boost consumer spending, after growth since the pandemic has been muted.

Qiang unveiled a range of measures aimed at stimulating the economy, including targets to add 12 million jobs in rural areas, new schemes to reverse China’s property crisis, funding for research in the likes of artificial intelligence and further regulation of financial markets.

Some 1 trillion yuan (or £110 billion) in “ultralong special treasury bonds” will also be issued in 2024 and beyond, he said.

Defence spending, which is closely watched internationally given China’s tensions with Taiwan, will be increased by 7.2% over the year, meanwhile.

“We should communicate policies to the public in a well-targeted way to create a stable, transparent and predictable policy environment,” Qiang added.

Ashtead leads fallers after outlook caution

Ashtead PLC (LON:AHT) led the FTSE 100 lower in early trading after warning slow third-quarter trading meant revenue growth would be at the bottom end of expectations for the year.

Rental revenue growth in North America was constrained by longer-than-expected strikes by actors and writers, the industrial equipment rental firm said in an update, alongside lower emergency response activity to natural disasters.

As a result, full-year rental revenue growth will likely sit at the lower end of the 11% to 13% guided range.

Revenue for the three months to January climbed by 9% to US$2.7 billion meanwhile, Ashtead added, though operating profit slipped 3% to US$591 million.

Shares slipped 7.7% to 5.286p.

The morning so far

The FTSE 100 started the day in the red this Tuesday, after retail sales fell well short of expectations.

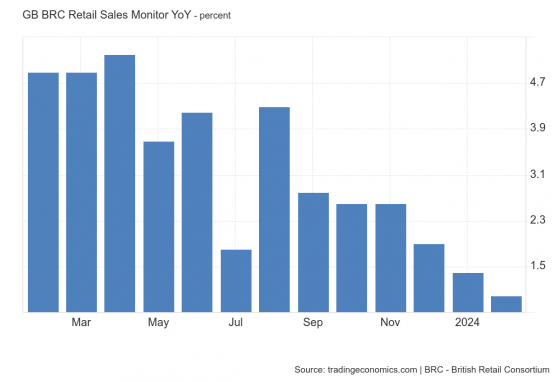

Per the BRS Retail Sales Monitor, sales rose a flat 1% year on year in February, widely missing the 1.5% mark expected by the market.

Bad weather and persistent cost-of-living pressures weighed, while the Valentine’s Grinch meant a Feb 14 sales bump failed to materialise.

It was an up-and-down morning on the company news front.

On the one hand, sausage roll stalwart Greggs (LON:GRG) dished out a special dividend while doubling down on its expansion plans after reporting a 27% jump in pre-tax profit to £188.3 million.

Merchant Travis Perkins (LON:TPK), however, slashed its full-year dividend to 18p from 39p in 2022, with worrying macroeconomic factors and mounting debt feeding into the decision.

Travis Perkins also said it will be lowering capital expenditure to £80 million compared to medium-term guidance of £125 million in order to tackle spiralling debt- currently at 2.6 times ratio to underlying earnings.

Fresnillo PLC (LON:FRES) shares were sent over 3% higher after the Mexican mining group espoused a “sound operating performance” in financial 2023.

Meanwhile, gold of the digital and physical variety was rallying. Bitcoin moved within a whisker of its all-time high, while gold did hit an all-time high US$2,118, with April futures pointing to further gains as traders eye up interest rate cuts.

The blue-chip index was seen 27 points lower at 7,613 as of 8.55am.

IWG shares dip as yearly losses surge

IWG (LON:IWG) PLC shares were sent 6% lower after the FTSE 250-listed services offices firm published its preliminary results for 2023.

The group delivered its best year of revenues on record, though operation profit declined 2% to £145 million.

Losses for the year totalled £216 million compared to £72 million in 2022 due to high financial costs and overheads.

Management declared that it is resuming its progressive dividend policy on the back of decent cash flows.

Shares were last seen swapping for 173.7p

Bitcoin and gold chasing all-time highs

Bitcoin (BTC) came within US$300 of its all-time high on Monday when the BTC/USD pair touched US$68,700.

It has been a marvellous year for the world’s largest cryptocurrency, thanks in part to the sweeping approval of spot-bitcoin exchange-traded funds in the US.

Tuesday trades were less lively, with bitcoin falling 2.6% to US$66,450 as of 8.25am, UK time.

Year to date, bitcoin is up more than 57% against the US dollar.

Gold, meanwhile, has reached a new record high of US$2,118, with April futures pointing to further gains as traders eye up interest rate cuts.