Proactive Investors -

- FTSE 100 down 22 points

- Mixed picture for retailers

- Broker notes provide some support

2.26pm: Fed has to take unpopular measures to bring down inflation - Powell

The US central bank has to take measures which are unpopular to bring down high inflation, Federal Reserve chair Jerome Powell has said.

In a speech to a Stockholm conference on central bank independence, he said: "Restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy. The absence of direct political control over our decisions allows us to take these necessary measures without considering short-term political factors."

And he said the Fed should stick to its goal of getting inflation to its 2% target and not take on board other considerations, such as climate change.

He sadi: "It is essential that we stick to our statutory goals and authorities, and that we resist the temptation to broaden our scope to address other important social issues of the day. Taking on new goals, however worthy, without a clear statutory mandate would undermine the case for our independence...

"Today, some analysts ask whether incorporating into bank supervision the perceived risks associated with climate change is appropriate, wise, and consistent with our existing mandates.

"Addressing climate change seems likely to require policies that would have significant distributional and other effects on companies, industries, regions, and nations. Decisions about policies to directly address climate change should be made by the elected branches of government and thus reflect the public's will as expressed through elections."

But he added: "At the same time, in my view, the Fed does have narrow, but important, responsibilities regarding climate-related financial risks. These responsibilities are tightly linked to our responsibilities for bank supervision. The public reasonably expects supervisors to require that banks understand, and appropriately manage, their material risks, including the financial risks of climate change.

"But without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals. We are not, and will not be, a 'climate policymaker.'"

1.02pm: Anglo American (LON:AAL) and Next among the fallers

Leading shares continue to drift lower as investors focus on interest rate rises again, and ahead of a speech by US Federal Reserve chair Jerome Powell.

The FTSE 100 - which has been in the red all day so far - is currently down 22.09 points or 0.29% at 7702.85.

The two biggest fallers in the blue chip indx have been hit by broker downgrades, with Anglo American PLC (LSE:AAL) down 3.21% and Next PLC (LSE:NXT) 2.85% lower.

12.25pm: Terry Smith's fund underperforms

Fund manager Terry Smith's thirteenth annual statement for his Fundsmith fund is unlucky for shareholders.

The fund fell 13.8% last year, partly hit by poor performances from technology investments such as Meta Platforms and PayPal (NASDAQ:PYPL).

Smith also attacks companies who do not engage with long term investors such as himself, and cites Unilever (LON:ULVR) as an example with activist investor Nelson Peltz being invited to the consumer giant's board.

He said: "What I find questionable is that companies mouth platitudes about wanting to attract long-term shareholders yet based on our experience, we tend to get ignored, whereas an activist who has held shares for fewer months than we have held in years gets invited to board meetings."

Laith Khalaf, head of investment analysis at AJ Bell said: “Terry Smith’s latest shareholder letter is characteristically combative and engaging, despite a rare year of underperformance from his Fundsmith Equity fund. This year Smith takes aim at a familiarly favourite target, Unilever, while also challenging the more arcane practice of removing share-based executive compensation payments from certain profit measures.

“Smith also rails against the flaccid response he has received to attempts to engage with companies as a large and long term investor, especially when compared to the elevated status often quickly conferred on activist investors. He may well have a point here, as activist investors are likely to be viewed as a potentially noisy and disruptive threat to management, whereas large, long-term shareholders don’t generally want to rock the boat in public, and are perhaps consequently taken for granted.

“2022 was by far the worst calendar year of performance the Fundsmith Equity fund has endured since launch in 2010, both in absolute terms and relative to the global stock market. Higher inflation and rising interest rates have prompted the market to turn against the growth stocks favoured by Smith and other fund managers with a similar investment philosophy. All active managers will endure such periods of underperformance and particularly those like Smith, who have a distinctive style bias expressed through a concentrated portfolio.

"The big question is how long the current anti-growth coalition in the market will last, and act as a headwind to the performance of Fundsmith and peers. If selected judiciously, a high quality growth portfolio should do relatively well in terms of business performance in a recessionary environment, but there is still a risk from a deflation in valuations, especially with more interest rate rises in the post...

"Fundsmith investors may need to exercise more patience than they have needed to up to this point. Given the high regard in which Terry Smith is held by shareholders, that forbearance will almost certainly be forthcoming. All fund investors should seek some diversity in the approaches of the managers in their portfolio however, because as the recent value rally has demonstrated, even style trends which are deeply entrenched can be disrupted in dramatic fashion.”

11.55am: US markets set for lower start

Wall Street is expected to open down as traders await more comments from US Federal Reserve Chair Jerome Powell after hawkish rhetoric from Fed officials removed some of the shine from equities in yesterday’s session.

Futures for the Dow Jones Industrial Average fell 0.3% in Tuesday pre-market trading, while those for the broader S&P 500 index shed 0.2% and contracts for the Nasdaq-100 declined 0.1%.

Powell is scheduled to speak at a banking conference in Stockholm before US markets open. His speech comes after Atlanta Fed president Raphael Bostic and San Francisco Fed president Mary Daly both said interest rates would go to at least 5%, with Bostic adding that they would remain there for a long time. The Federal Reserve Bank of New York's Center for Macroeconomic Data's Survey of Consumer Expectations showed inflation expectations continue to decline in the short term and were unchanged over the medium term.

At Monday’s close the DJIA was down 0.3% at 33,518, the S&P 500 fell 0.1% to 3,892 but the Nasdaq Composite jumped 0.6% to 10,636.

“After yesterday’s mixed session on Wall Street, futures are suggesting more modest losses at the opening bell on Tuesday,” commented James Hughes, chief market analyst at Scope Markets. “Those Consumer Inflation expectations yesterday fell short of expectations, hinting that the Fed might have a little more wiggle room than had previously been thought, so Fed Chair Powell’s speech shortly before the opening bell today will be under close scrutiny for any further clues over policy.”

Powell’s comments come ahead of Thursday's US inflation data, which is expected to show CPI easing to an annualised increase of around 6.5% in December from 7.1% in November.

“The onset of the reporting season in the US this week will add further colour to the performance of the economy on the ground,” said Richard Hunter, head of markets at interactive investor. “With the banks kicking off the season in earnest, there will inevitably be focus on any worsening of demand, particularly in the housing sector, alongside any increase in bad debts as the consumer comes under additional economic pressure.”

Back in the UK, the FTSE 100 is down 13.77 points or 0.18% at 7711.17.

11.32am: Crude price moves higher

Oil prices are edging higher but there is still a large amount of uncertainty about what happens next.

Brent crude is up 0.26% at US$79.86 a barrel while West Texas Intermediate, the US benchmark, is 0.44% better at US$74.96.

Craig Erlam at Oanda said: "It's been a choppy session in the oil market, where Brent is hovering around $80 and WTI $75. We've now seen three sessions on the bounce in which oil prices have rallied before ending the day well off the highs. Not a particularly bullish signal.

"There's a lot to consider in oil markets at the moment and the near-term risks probably are more tilted to the downside. The start of the year could see countries fall into recession as the cost-of-living crisis bites, interest rates are hitting a level that could significantly hurt economic activity and China is likely to experience the worst of the Covid surge after relaxing its approach.

"Beyond that, things could start to look up for a number of reasons. China could bounce back strongly, especially if backed by monetary and fiscal stimulus, central banks may discover they have room to cut rates if inflation falls substantially and economies are in recession and Russian output could be squeezed as sanctions take their toll. A lot of if's and but's, of course, but that is the uncertain world we now live in."

10.44am: Anglo down after price target cut

In the mining sector, Anglo American PLC has fallen back after a price target downgrade.

Analysts at Deutsche Bank (ETR:DBKGn), in a mildly positive note on the sector, have nevertheless cut their target for Anglo from 3500p to 3400p with a hold recommentation.

Its shares are down 2.42% at 3495p, making it the biggest faller in the leading index.

Overall the FTSE 100 has recovered some ground but remains in the red, down 12.18 points or 0.16% at 7712.76.

10.15am: Amazon to shut three UK warehouses

Amazon.com Inc (NASDAQ:AMZN) has announced it is shutting three UK warehouses affecting 1,200 workers, including one in Gourock in Scotland with the loss of 300 jobs. The other planned closures are in Hemel Hempstead and Doncaster.

#Breaking Amazon has said it plans to shut three UK warehouses in a move which will impact 1,200 jobs pic.twitter.com/EaWv0QGlDM— PA Media (@PA) January 10, 2023

Amazon said: "We're always evaluation our network to make sure it fits our business needs.. As part of that effort, we may close older sites, enhance existing facilities, or open new sites, and we've launched a consultation on the proposed closure of three fulfilment centres in 2023..

"We're also planning to open two new fulfilment centres creating 2,500 new jobs over the next three years.

"All employees affecte by site closure consultations will be offered the opportunity to transfer to other company facilities."

9.35am: Retailers face a tough year

The FTSE 100 remains in the doldrums although it has managed to stay above the 7700 level.

The leading index is currently down 21.56 points or 0.28% at 7703.38.

Among the fallers is Scottish Mortgage Investment Trust PLC (LSE:SMT). The US technology investor is down 1.41% on concerns about higher interest rates hitting the sector.

Next PLC is 0.9% lower as Investec cut its rating from buy to hold despite last week's upbeat Christmas trading statement from the retailer.

On Friday Credit Suisse (SIX:CSGN) moved from neutral to underperform.

Retails face a tough time in 2023 with rising rates and the cost of living crisis.

According to the British Retail Consortium, total sales rose by 6.9% in December year on year, up from 4.2% in November.

But although there was a boost from World Cup and Christmas spending, much of the rise was due to higher prices, with sales volumes actually weaker.

Victoria Scholar, head of investment at interactive investor said: "Double-digit UK inflation is still sharply outpacing the level of retail spending, highlighting the rising cost burden businesses are having to, at least in part, pass on to consumers. With a looming recession, a softening consumer and ongoing inflationary pressures, the start of 2023 looks set to be challenging for the retail sector after the Christmas cheer fades and the reality of the cost-of-living crisis sets in.”

9.03am: French industrial improvement

Some positive news from the eurozone.

In France, industrial production for November has come in better than expected.

French Industrial Production (M/M) Nov: 2.0% (exp 0.8%; R prev -2.5%)-Industrial Production (Y/Y) Nov: 0.7% (exp -1.0%; prev -2.7%)

— LiveSquawk (@LiveSquawk) January 10, 2023

Meanwhile Goldman Sachs (NYSE:GS) is reportedly no longer forecasting a eurozone recession.

8.48am: Brokers help limit market fall

There are some bright spots among the general downbeat mood, helped by some broker recommendations.

Insurer Admiral Group Plc (LON:ADML) is leading the way in the blue chip index, up 1.36% after Deutsche Bank moved from hold to buy.

And British Gas owner Centrica PLC (LON:CNA) has climbed 1.35% after Exane BNP issued an outperform recommendation.

Trading updates have received a mixed reception.

Card Factory is up 5.62% after it brought forward its statement and reported strong Christmas trading despite the postal strikes. It now expects full year earnings to reach at least £106mln.

Electrical retailer AO World PLC also issued unscheduled report, saying annual earnings would be ahead of expectations at between £30mln and £40mln. Previously it had forecast meeting the top end of a £20mln to £30mln range.

Its shares are 5.6% better.

But recruitent group Robert Walters PLC has disappointed the market, pushing its shares 8.15% lower. Rival PageGroup PLC (LSE:PAGE) has fallen 5.91% in sympathy.

Victoria Scholar, head of investment at interactive investor said: “Robert Walters issued a profit warning forecasting full-year earnings to come in slightly below expectations. However annual profit is still expected to hit a record high. Its quarterly net fee income in China slumped by 24% weighed down by the authorities’ covid lockdown restrictions, which have been hampering activity in the world’s second largest economy. Overall headcount peaked in November and declined in December while it forecasts more muted growth across all regions and all forms of recruitment.

"Shares in Robert Walters are extending losses today with shares now down by nearly 40% over a one-year period. On the one hand, the recruitment firm has benefited from labour shortages which have prompted businesses to seek sourcing potential hire and filling key roles. On the other hand, the recruitment firm which in part specialises in technology has suffered amid the slew of job cuts in the sector. Plus the broader global slowdown when combined with China’s covid lockdowns has muted hiring activity as businesses batten down the hatches, putting recruitment plans on hold amid cost inflation pressures and a softening consumer outlook.”

And Games Workshop Group PLC (LON:GAW) is down 5.64% with pretax profit pre-tax slightly lower at £83.6mln.

8.09am: Market heads lower as investors focus on interest rates

Leading shares are on the slide after a bright start to the year, as investors focus again on the prospects for interest rates.

The FTSE 100, which hit its highest levels for more than three years yesterday, is down 23.82 points or 0.31% at 7701.12 in early trading.

Richard Hunter, head of markets at interactive investor, said; "For the first time this year, the index eased from a generally positive direction of travel, although remaining ahead by 3% so far in 2023. Declines were largely driven by weakness in the mining sector, alongside downgrades to the likes of Entain (LON:ENT) and Next which dampened sentiment."

All eyes will be on US Federal Reserve chair Jerome Powell when he speaks later, although it it unclear how much new information will emerge.

Jim Reid at Deutsche Bank said: "[Powell will] be speaking at an event on central bank independence at 14:00 London time. It’s uncertain whether the topic in question will lead to an in-depth policy discussion, but if we do get any, a key question will be whether he entertains the prospect of a further downshift in the pace of rate hikes to 25bps. That’s currently the base case in markets, but clearly the consumer price index release on Thursday will be an influence on this and to future FOMC meetings too."

Powell's speech in Stockholm follows fairly hawkish comments from Fed members yesterday.

Michael Hewson, chief market analyst at CMC Markets UK, said markets expected the Fed to slow the pace of its rate hikes from 50 basis points in December to 25 next month.

But he added: "This reasoning comes despite further comments from Fed officials yesterday, this time from Atlanta Fed President Raphael Bostic who said he still sees a terminal rate of between 5% and 5.25% before pausing and keeping them there for a long time. This reasoning was also echoed by San Francisco Fed President Mary Daly yesterday, although neither of them has a vote this year."

Also today comes the latest outlook for the global economy from the World Bank.

7.55am: USD remains a seller’s market, EUR gains against GBP

There’s a slight disconnect forming in the currency markets between investors and the US Federal Reserve.

On the one hand, traders seem to be factoring in a cheaper US dollar in the wake of last’s week’s non-farm payroll data, which showed an easing up of wage growth; ostensibly a sign of easing inflationary pressures that could herald a more dovish approach to interest rates.

On the other hand, the US Federal Reserve has made few overtures to a lower terminal rate. Rather, Fed minutes released yesterday saw several members warning against loosening monetary policy given their historical experience.

Perhaps Thursday’s US inflation reading will give more clarity to the macro situation.

Against this backdrop, the US Dollar Index (DXY) closed at a seven-month low of 102.79, though it has since seen a small rebound to 102.94 this morning.

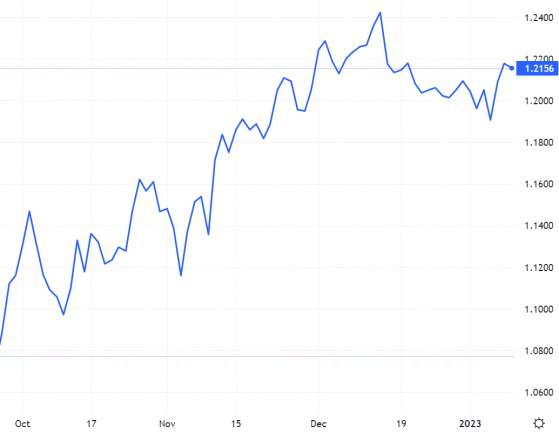

Cable added 60 pips to close the Monday session at 1.218.

GBP/USD cuts back after strong Monday gains – Source: dailyfx.com

Cable but has since shed a third of those pips this morning, bringing the pair back to 1.215, though the pair still remains comfortably above the 20-day moving average.

EUR/USD closed at seven-month highs of 1.073, where it has so far remained this morning.

The euro is also seeing its third straight session of gains against the pound after rebounding off the 20-day moving average on Sunday.

While it was a pretty volatile session, EUR/GBP closed higher at 88.08p and has climbed another 0.2% higher to 88.24p this morning.

6.59am: Markets set for lower start

The FTSE 100 is set to break its winning streak today and head lower at the open following a mixed showing in the US and ahead of a speech by Federal Reserve chairman, Jerome Powell, at a banking conference in Stockholm.

Spread betting companies are calling the lead index down by around 40 points.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank noted “US equity futures are in the negative this morning, as the King of market disappointment, the Fed chair Jerome Powell, will be speaking at an event in Stockholm today, and he will probably not pop the champagne just because the wages grew less than expected last month, especially when you think that the US economy added a near record 4.5 million jobs last year, and that the unemployment rate fell to 3.5%.”

At the close on Monday in the US, the Dow Jones Industrial Average was down 113 points, or 0.33%, to 33,518, the S&P 500 fell 3 points, or 0.08%, to 3,892 but the Nasdaq Composite jumped 66 points, or 0.63%, to 10,636.

Back in London and there was also a warning on UK inflation. The Bank of England's chief economist on Monday said that a "distinctive context" within the UK creates the potential for rampant prices to prove "persistent".

Today, shoe retailer Shoe Zone PLC (LON:SHOE) and wargame miniatrures manufacturer Games Workshop Group PLC are set to report results whilst a trading update is due from recruiter, Robert Walters PLC.

Read more on Proactive Investors UK