Benzinga - by Zacks, Benzinga Contributor.

FMC Corporation (NYSE: FMC) recently entered into a research partnership with AgroSpheres, a biotechnology firm dedicated to sustainable crop protection and health. This collaboration is geared toward expediting the discovery and advancement of groundbreaking bioinsecticides, aligning with FMC's strategic goals.

The agreement is aimed at solidifying FMC's leadership position in insecticide solutions while also expediting AgroSpheres' introduction of its ribonucleic acid portfolio to the market. By leveraging AgroSpheres' expertise in production and formulation alongside FMC's robust testing, evaluation and market deployment capabilities, both parties aim to achieve significant strides in their shared objectives.

FMC's investment in AgroSpheres, which is developing its biodegradable micro-encapsulation technology designed to enhance the efficacy of biological crop protection products using RNA interference (RNAi) technology, paved the way for this collaboration.

FMC underscored the collaboration's importance in driving sustainable agriculture through innovation. It hailed RNAi as a promising tool for crop protection and commended AgroSpheres' platform for its efficient discovery and manufacturing of these technologies.

AgroSpheres' patented AgriCell manufacturing technology enables the consistent expression of various RNA molecules, effectively tackling challenges encountered in commercial biological development. Their encapsulated RNA biomolecules promise improved stability, performance and targeted uptake in pests.

AgroSpheres expressed admiration for FMC's proactive stance in investing in next-generation agricultural technologies to address global challenges. The company looks forward to collaborating with FMC to drive comprehensive product development, leveraging their collective expertise to meet market demands effectively.

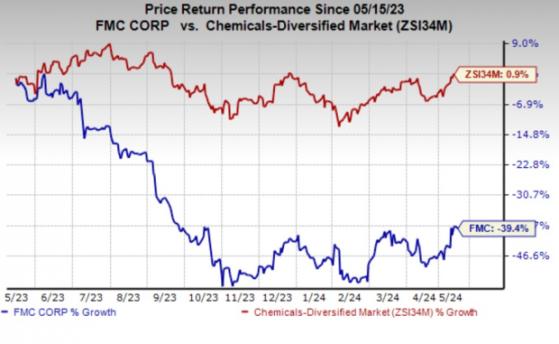

FMC's shares have plunged 39.4% in the past year against a 0.9% rise of the industry.

Image Source: Zacks Investment Research

FMC sees full-year 2024 revenues between $4.50 billion and $4.70 billion, indicating a 2.5% increase at the midpoint from 2023 levels. Adjusted EBITDA is expected to be between $900 million to $1.05 billion, flat at the midpoint compared with the prior year's levels. Adjusted earnings are forecast in the range of $3.23 to $4.41 per share, up 1% year over year at the midpoint.

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Zacks Rank & Key Picks FMC currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are ATI Inc. (NYSE: ATI) and Carpenter Technology Corporation (NYSE: CRS), each sporting a Zacks Rank #1 (Strong Buy), and Ecolab Inc. (NYSE: ECL), carrying a Zacks Rank #2 (Buy).

ATI's earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.34%. The company's shares have soared 64.7% in the past year.

CRS' earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company's shares have soared 106%% in the past year.

The Zacks Consensus Estimate for Ecolab's current year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. The Zacks Consensus Estimate for ECL's current-year earnings has been going up in the past 30 days. ECL beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The stock has rallied nearly 33.4% in the past year.

To read this article on Zacks.com click here.

Read the original article on Benzinga