(Bloomberg) -- Why are official warnings of the threat that rising interest rates pose to Hong Kong’s red-hot housing market falling on deaf ears?

The Hong Kong Monetary Authority and the International Monetary Fund have both highlighted the risks. But three Federal Reserve rate increases forecast for this year won’t stop prices from climbing, according to analysts at firms including JPMorgan Chase & Co (NYSE:JPM). and Union Bancaire Privee. Prices already jumped 22 percent as the Fed raised rates five times from December 2015.

On the face of it, the warnings make sense.

Household debt-to-gross domestic product is higher now than in 1997, just before a housing crash that lasted six years. As HKMA chief Norman Chan points out, not only is the ratio elevated, it’s recently rallied from its historical trend. Mortgage payments amounted to 68 percent of median monthly income in the third quarter, compared with an average of 45 percent between 1997 and 2016. Deteriorating affordability and record low rental yields increase the housing market’s vulnerability in the event of a big shock.

Last month, Chan urged vigilance on the risk of faster-than-expected rate increases and talked of “abnormally low” mortgage rates. Financial Secretary Paul Chan warned last year of a “dangerous situation” in property.

Yet, many factors suggest that, despite Hong Kong’s link to U.S. monetary policy via a pegged exchange rate, rising rates alone won’t kill off the property boom any time soon. Here are some of them.

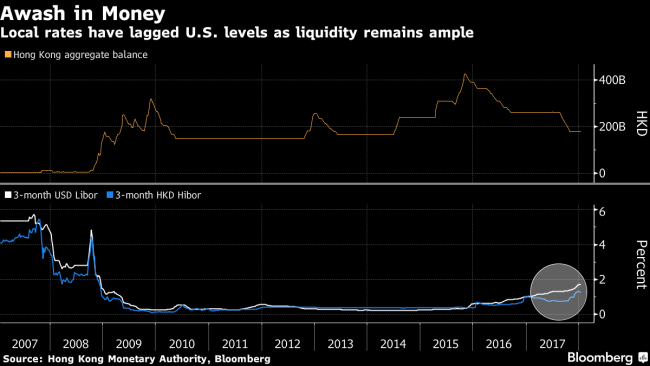

Lots of Liquidity

Even as the Fed raises borrowing costs, an abundance of liquidity flowing into Hong Kong has enabled banks to keep a lid on local rates. A booming stock market is attracting ever larger amounts of Chinese money through the stock connect, and mainland home buyers account for as much as a fifth of property demand, according to Mark McFarland, chief economist for Asia at Union Bancaire Privee.

“Hong Kong’s property market appears to be in a similar state of mind to the period immediately before the handover in 1997 where optimism, equity market gains and inflows pushed property prices up in a feedback loop,” said McFarland, referring to the year the city returned to Chinese control. Now, like then, it would take an external shock to derail the market, he said.

Low-Impact Increases

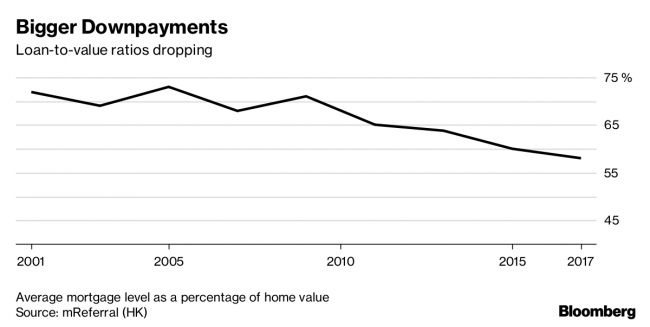

David Ji, head of research and consultancy for Greater China at Knight Frank LLP, says for every 25 basis-point increase in rates, monthly payments will climb by only about HK$124 ($16) for a HK$1 million mortgage with a 25-year term. “This is not a huge dent,” Ji said. Thanks to the HKMA’s curbs on banks, mortgages as a percentage of home values have dropped to 58 percent, the lowest level in 16 years. At the same time, the average duration of home loans increased to more than 26 years in 2017, from just over 18 years in 2001, according to data from mortgage broker mReferral.

Inflation’s Role

Persistently low yields on bank deposits are encouraging investors to look for higher returns to offset inflation, according to JPMorgan’s Cusson Leung, head of property research for Greater China. “If consumers feel that bank savings deposits are losing their purchasing power on the back of rising inflation, they may well deploy that money to buy a hedge: property,” Leung wrote in a January report. Gains in Hong Kong’s consumer prices are forecast to accelerate in 2018 and 2019 from last year’s levels, according to a Bloomberg survey of analysts.

Bargain Hunting (LON:HTG)

Hong Kong’s 14-year bull market for property means any decline in prices is seen by many as an opportunity to buy, leading to shorter and shallower corrections, said Deutsche Bank (DE:DBKGn) AG’s Michael Spencer.

“It comes down to having people accustomed to the idea that Hong Kong is a very expensive market and a 10 to 15 percent correction looks like a bargain even with interest rate hikes," said Spencer, the bank’s Asia chief economist.