By Maria Martinez

BERLIN (Reuters) -Germany's central bank chief and its finance minister renewed Berlin's calls on Tuesday for greater progress towards an EU capital markets union as a required next step for European integration.

Bundesbank President Joachim Nagel said such union should be one of the main goals of the European Union's new executive, which will take over after EU Parliament elections in June.

"We will really achieve this now, this capital markets union, and I could also imagine something similar for the banking union," Nagel said at an event for the Foreign Press Association in Berlin.

While all EU leaders expressed support for the union at a meeting last week, the key elements of which finance ministers foresee by 2029, divisions remain over some aspects and how quickly the bloc should move towards it.

France and Germany are pushing hard for a union that would include joint financial supervision, on which several smaller states such as Luxembourg, Malta and Ireland are not keen.

Nagel said Europe's funding needs called for progress in securitisation - the pooling of assets so that they can be repackaged and sold to investors.

"The commission estimates that 750 billion euros ($802.35 billion) per year are needed in Europe for the economic transformation," Nagel said. "A large part of this money has to be financed by the private sector."

Finance Minister Lindner also stressed the importance of securitisation for business financing possibilities.

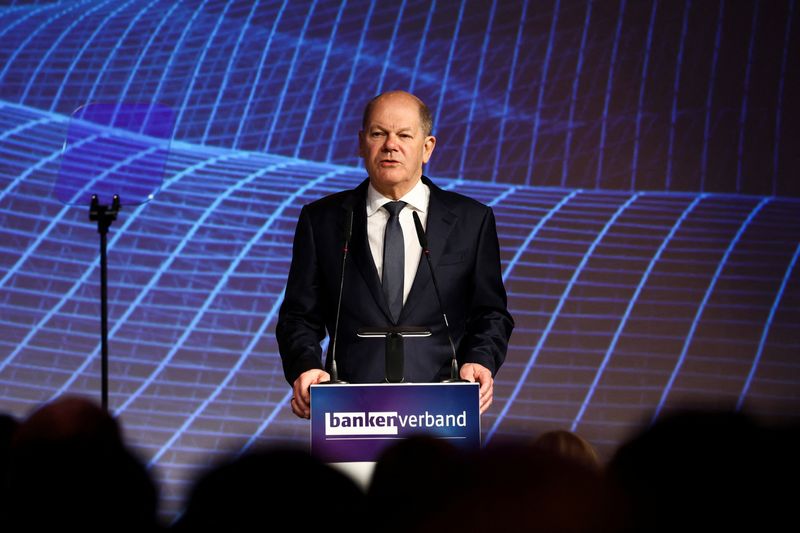

"Securitisation is much less in our everyday economic life than is actually possible and necessary," Lindner said at a banking event.

German Chancellor Olaf Scholz separately urged the completion of a European banking union, and calling for more uniformity in financial markets across the region.

Designed after the financial crisis, the banking union aims to centralise supervision of big lenders at the European Central Bank. It is a key element of a broader capital markets union, as a resilient European banking system would provide the liquidity required for the further integration of European markets.

A central element of the plan, however, a joint deposit protection scheme, has not been agreed in the face of German opposition.

($1 = 0.9348 euros)

(Reporting John O'Donnell and Maria Martinez, editing by Tom Sims, Miranda Murray and Tomasz Janowski)