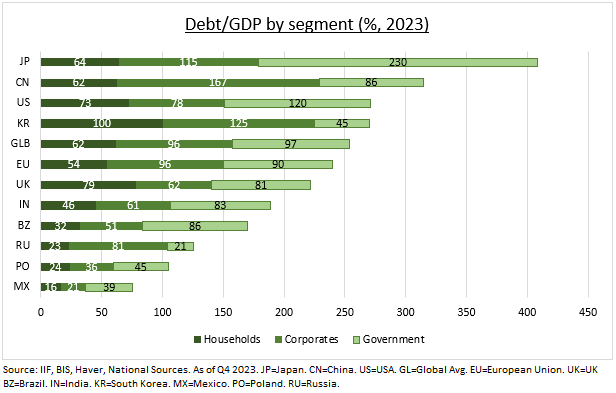

DEBT: The world’s rising debt mountain is a worry, but comes with silver-linings. The bad news is that the mountain grew to over $300 trillion last year. Equal to $39,000/person on the planet. As government debt rose, with fiscal deficits stuck above pre-pandemic levels and election timetable heavy. More positively, the global debt-to-GDP ratio fell for a 3rd year. As inflation driven nominal economic growth more than offset this government debt build. And companies and households deleveraged. Reflected in resilient consumption and narrowed corporate credit spreads. The wide differences in global debt levels tell us a lot about the policy stakes ahead.

ASIA & EM: Japan has by far the world’s highest government debt (see chart) level. This is one reason its policy interest rates have been negative for over 15 years and authorities pursued a yield curve control (YCC) policy. This will restrain how far the BoJ can go in now raising interest rates. China has by far the world’s most indebted corporates. A driver of the authorities’ property market deleveraging crackdown. And its caution on an over-stimulating policy response to the current growth malaise. Emerging markets are mostly lowly leveraged, given their more limited financial options. But this also explains their resilience to the interest rates and US dollar surge.

US & EUROPE: The US enjoys the unique exorbitant privilege of the dollar, and is the world’s largest economy. But it’s high and rising government debt levels are an increasing worry. With recent rating agency downgrades below AAA, large fiscal deficits despite the strong economy, and seemingly little political willingness on either side of the aisle to address. This raises the risk of an unpredictable future ‘bond vigilante’ event. Europe’s consumers are some of the world’s least indebted. Part explaining the continents continued resilience through this economic downturn. Whilst its companies are deleveraging from high levels, helping credit spreads ease to a two-year low.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Peaks and valleys of the global debt mountain

Published 17/03/2024, 07:29

Peaks and valleys of the global debt mountain

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.