- Inditex (BME:ITX) looks set to continue its hot streak

- Another weak performance expected from Currys (LON:CURY)

- Bunzl (LON:BNZL)battles softening organic demand

Inditex – Q3 Results, Wednesday 13 December

Aarin Chiekrie, equity analyst, Hargreaves Lansdown

“Zara’s parent company, Inditex, has been on a hot streak this year – with the valuation climbing more than 45%. The group owns fashion favourites like Bershka, Pull&Bear and Stradivarius.

The group’s expected to report another set of solid numbers in next week’s results. Ignoring currency impacts, markets expect third-quarter sales to grow at double-digit rates. That’s impressive given the company’s been wrestling against unfavourable weather conditions and a tough comparative period. Significant wage increases to its workers in Spain earlier this year is likely to nudge operating costs higher. Investors will be keen to hear just how much of an impact this has had on margins, and what actions are being taken to help offset it.”

Currys – Half Year Results, Thursday 14 December

Aarin Chiekrie, equity analyst, Hargreaves Lansdown

“Currys has found a new home for its Greek electronics retailer, Kotsovolos. The proceeds from this sale will provide a welcome boost to the group’s balance sheet, as well as allowing management to sharpen its focus on the remaining regions.

But there’s no magic wand here, consumers are struggling to justify as much discretionary spending on TVs and gadgets amidst a cost-of-living crisis. Markets are expecting another weak performance in next week’s results. Like-for-like sales in the UK & Ireland look set to drop around 3.5% in the first half, causing underlying operating profits to roughly half to £13mn. Analysts will also be keeping an eye out for any early signs of improvement in the struggling Nordics region, which will be key to a recovery in sentiment and profitability.”

Bunzl – Trading Statement, Thursday 14 December

Matt Britzman, equity analyst, Hargreaves Lansdown

“Bunzl’s December trading update is usually a short one but should provide details on revenue growth for the year, alongside commentary on expectations for 2024. Following a disappointing third quarter, analysts are expecting full-year revenue to come in slightly below 2022 levels. Covid-related sales continue to normalise, and the inflation tailwinds seen early in the year that helped elevate prices are fading away.

But despite revenue weakness, it’s been good to see operating margin guidance remain intact and it’s important this trend continues next week or there could be more weakness for the shares over the near term. Longer term, Bunzl has a resilient portfolio and a highly-cash generative model that enables it to pursue a strong acquisition pipeline.’’

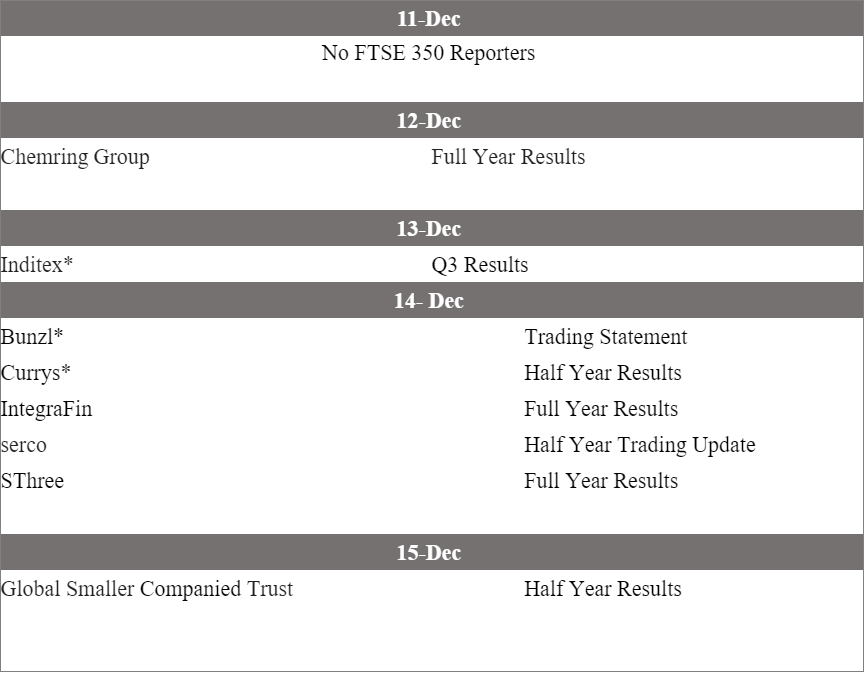

Among those currently scheduled to release results next week: