Partnership with SpaceX fuels growth

On 24 April, Filtronic (LON:FTC) entered into a strategic partnership and commercial agreement with SpaceX. The strategic partnership includes the supply of E-band solid state power amplifiers (SSPAs) as well as the development and supply of similar products at other frequency bands within SpaceX’s Starlink platform. As part of the partnership agreement, Filtronic has issued 21.7m warrants to SpaceX across two tranches to enable SpaceX to subscribe for up to 10% of the company’s existing share capital at an exercise price of 33p (closing price on 23 April). If fully exercised, this would generate proceeds of £7.16m. The vesting of the warrants is dependent on a regular flow of orders from SpaceX over a five-year period.

Material upgrade to forecasts

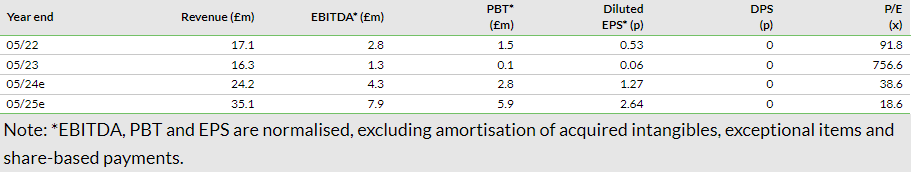

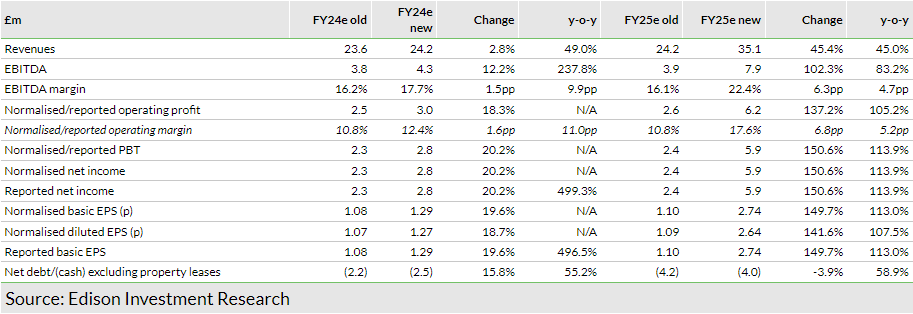

Filtronic now expects FY24 revenue marginally ahead of market estimates and EBITDA significantly ahead. The £15.8m order is scheduled for delivery in FY25 and management now believes FY25 revenue and EBITDA will be significantly ahead of current market expectations. We raise our revenue forecasts by 3% in FY24 and 45% in FY25 resulting in EPS upgrades of 19% and 142%, respectively.

Valuation: Contract drives step change in valuation

After the share price gained 48% on the announcement, Filtronic is trading on a P/E of 37.0x FY24e and 17.8x FY25e. Using a reverse discounted cash flow with a WACC of 8%, the current share price is arrived at using revenue growth of 6% per annum for FY26–28, growth thereafter of 3% and EBITDA margins growing to 23.7% from the 22.4% forecast in FY27. In our view, the relationship with SpaceX provides potential for higher growth than this, considering ongoing E-band production orders, the existing satellite payload development agreement and the new agreement to develop SSPAs at frequencies other than E-band.

Development of SpaceX relationship

Filtronic made its first announcement of a $2.8m order for E-band SSPAs for use in trials in LEO satellite ground stations in January 2023 with an unnamed customer. At that time, SpaceX’s Starlink project was the leading LEO satellite service provider and had announced that it would add E-band backhaul functionality to its v2.0 mini satellites, which it started launching in February 2023.

Further orders were received from the same customer in September 2023 ($4.25m), December 2023 ($6.0m) and February 2023 ($9.9m) when it also agreed to develop a prototype E-band module that would form part of the satellite payload and provide downlink connectivity to E-band ground stations.

Yesterday’s agreement names this customer and puts the company’s relationship on a more structured footing. As part of the agreement, SpaceX has placed a $19.7m/£15.8m order for E-band SSPA modules scheduled for delivery in FY25. Filtronic will also work with SpaceX to develop similar products at other frequencies.

The Starlink network is the most advanced LEO satellite network, with more than 5,700 satellites in orbit compared to the next largest network, Eutelsat OneWeb, with 648 satellites. With volume orders already underway for Starlink’s ground stations, development work underway for satellite payload and potential to supply additional frequencies for both, this relationship has scope to provide material and repeating revenues for at least the next five years.

Warrants could generate proceeds of £7.16m

As part of the strategic partnership, Filtronic has issued 21,712,109 warrants to SpaceX, across two tranches, which would enable SpaceX to subscribe for up to 10% of the company’s existing share capital. The warrants will vest on a variable basis, dependent on the volume and timing of orders placed by SpaceX and have an exercise price of 33p (closing price on 23 April). The warrants will vest in full once c $60m/£48m of orders have been placed. The warrants expire five years from the date of signing the strategic partnership contract (ie 24 April 2029). Vested warrants can be exercised in full or in minimum amounts of 500,000 at any time prior to expiry.

The details of the two tranches are as follows:

- Tranche 1: warrants for up to 10,856,055 shares (up to 5% of existing share capital). Warrants will vest on the receipt of purchase orders against a staged vesting profile for E-band SSPAs. All warrants will vest once $37m/£30m of irrevocable purchase orders have been placed. We estimate that 53% of tranche 1 warrants will have vested on receipt of the order described above.

- Tranche 2: warrants for up to 10,856,055 shares (up to 5% of existing share capital). Warrants will vest on the receipt of purchase orders against a staged vesting profile for SSPAs modules at other frequency bands. All warrants will vest once $23m/£18m of irrevocable purchase orders have been placed.

A further condition is that SpaceX must place a minimum order value of $10m in each subsequent 12-month period from the contract date to be delivered within 12 months. The timing between purchase orders must not exceed 12 months. If the order flow is not maintained in accordance with these conditions within the five-year warrant period, the warrants will expire six months from that date.

21,512,000 of the warrants are being issued using existing shareholder authorities granted at last year’s AGM. The remaining 200,109 warrants are subject to approval at this year’s AGM.

Changes to forecasts

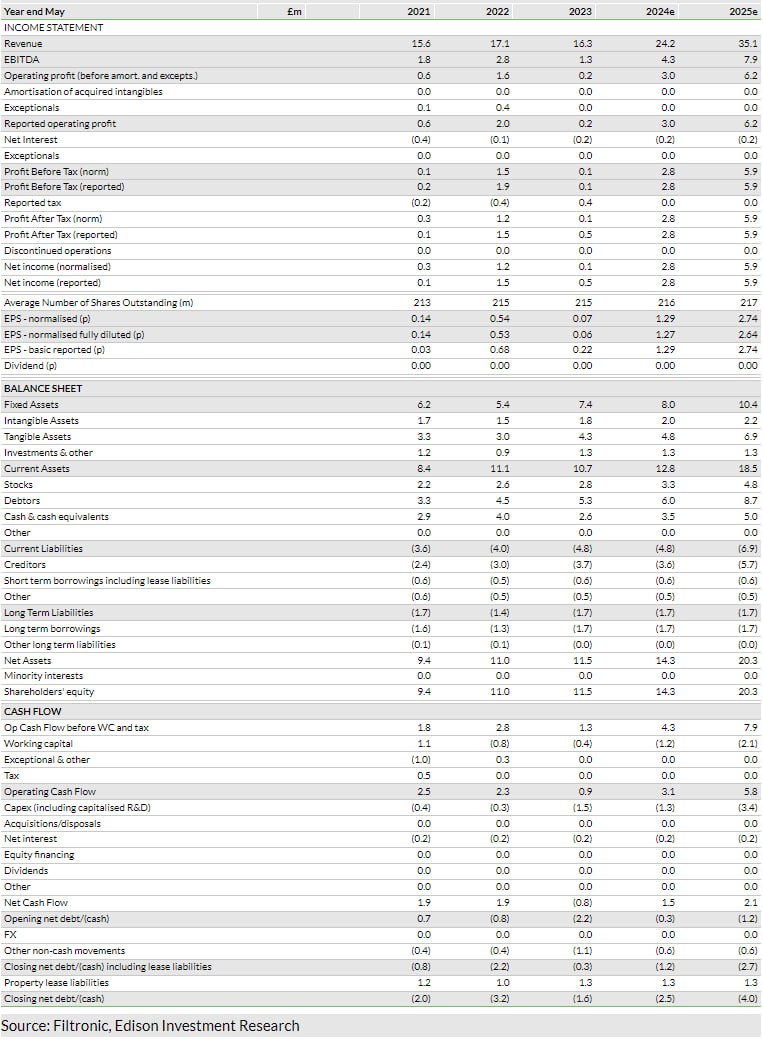

We have increased our FY24 revenue forecast by 3% to £24.2m. This results in a 12% increase in EBITDA to £4.3m and an increase in diluted normalised EPS of 19% to 1.27p.

For FY25, the £15.8m order drives a 45% increase in revenue to £35.1m. We assume that Filtronic will make further investment in manufacturing facilities and product development (both equipment and staff) to ensure product delivery to schedule, increasing opex by £2.7m and capex by £2.5m. Excluding any warrant proceeds, we forecast net cash (including lease liabilities of £1.0m) of £4.0m by the end of FY25. We estimate that around half of the tranche 1 warrants have vested so we include these in our diluted EPS calculation for FY25, which increases by 142% to 2.64p.

Valuation

On our revised forecasts and after the share price gained 48% after the announcement, Filtronic is trading on a P/E of 38.6x FY24e and 18.6x FY25e.

Using a reverse discounted cash flow with a WACC of 8%, the current share price is arrived at using revenue growth of 5.9% per annum for FY26–28, growth thereafter of 3% and EBITDA margins growing to 23.7% from the 22.4% forecast in FY27. In our view, the relationship with SpaceX provides potential for higher growth than this, considering the ongoing E-band production orders, existing satellite payload development agreement and the more recent agreement to develop SSPAs at frequencies other than E-band.

________________________________________________

General disclaimer and copyright

This report has been commissioned by Filtronic and prepared and issued by Edison, in consideration of a fee payable by Filtronic. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS