By Philip Blenkinsop

BRUSSELS (Reuters) - The euro zone economy rebounded in the first quarter from a mild recession as Germany returned to growth and expansion accelerated elsewhere, while inflation steadied to reinforce the case for the European Central Bank to cut interest rates.

Gross domestic product in the 20-country bloc increased by 0.3% quarter-on-quarter in January-March for a 0.5% year-on-year rise, official data showed on Tuesday, compared with market expectations that both would expand by 0.2%.

The fourth quarter GDP figure was also revised down to a negative 0.1% from a previous 0.0%, meaning that the euro zone was in a technical recession in the second half of 2023. GDP shrank by 0.1% in the third quarter.

The figures reflect general expectations of a slow recovery in the euro zone. The IMF forecast earlier this month that the bloc's GDP would rise by 0.8% this year, double the rate of 2023, and by a healthier 1.5% in 2025

Euro zone inflation steadied at 2.4% in April, data showed. However, a crucial indicator of underlying price pressures slowed, solidifying the case for the European Central Bank to cut interest rates at its meeting on June 6, just as the EU public starts voting in the European Parliament election.

Bank of France governor and ECB policymaker Francois Villeroy de Galhau said the data boosted confidence that inflation would return to the ECB's 2% target by next year and so the bank should be able to start cutting rates in June.

"The speed of cuts should afterwards be set pragmatically depending on the inflation outlook beyond the month-to-month results, which could show a certain volatility," he said on social network Linkedin.

Figures from EU statistics agency Eurostat showed growth in all 10 countries from which it compiles data for a flash estimate for the bloc. Growth rates were at least equal to those of the fourth quarter.

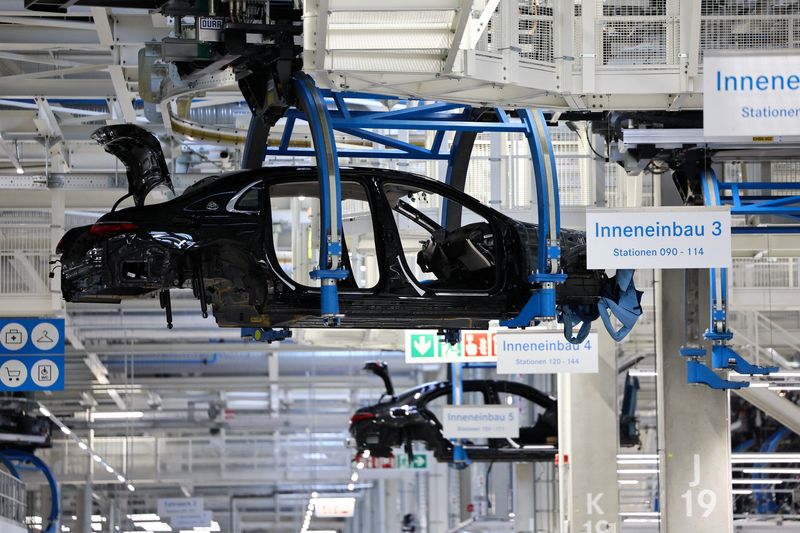

Germany, the euro zone's largest economy, returned to growth in the first quarter with a bigger than expected 0.2% expansion from the previous quarter due to exports and construction investment, which were boosted by unusually mild winter weather. However, fourth quarter numbers were revised to show a deeper dip at the end of 2023.

"The worst is finally behind us," was UniCredit (LON:0RLS)'s assessment, saying rising trade and lower inflation would likely lead to moderate German growth in the coming quarters.

Spain's economy grew by 0.7% quarter on quarter, beating analysts' forecasts for 0.4% growth, due to a boost in investment and private consumption. Investment growth had been weak in previous quarters despite the deployment of European recovery funds. Industry and construction expanded in the quarter.

The French economy also gained momentum in January-March, growing slightly faster than expected thanks to a pick-up in consumer spending and business investment.

The growth is good news for the French government which drew fierce opposition criticism for its handling of the economy after it revised down its 2024 growth forecast in February.

"To all of those who were wanting to think our economy has stalled out, the facts are stubborn, French growth is improving," Finance Minister Bruno Le Maire said.