Benzinga - by Anusuya Lahiri, Benzinga Editor.

Nvidia Corp (NASDAQ:NVDA) saw the most significant increase in market value among stocks held by hedge funds in the first quarter, despite these funds’ overall net sales of shares.

As hedge funds continued to adjust their portfolios amidst rising interest in artificial intelligence, they also increased their holdings in other leading AI companies such as Amazon.Com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and Microsoft Corp (NASDAQ:MSFT), while reducing positions in each.

The total holdings increased to $1.887 trillion from $1.728 trillion the previous quarter, with technology stocks constituting the most significant sector at 28% of portfolios, Bloomberg analyses 13F filings from 1,124 hedge funds.

During this period, notable shifts included Tiger Global Management boosting its stake in Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL), while Renaissance Technologies shifted from Exxon Mobil Corp (NYSE:XOM) to Chevron Corp (NYSE:CVX) and increased its focus on financial stocks.

Two Sigma Advisers expanded in health care and reduced technology holdings, including exiting positions in Advanced Micro Devices Inc (NASDAQ:AMD).

Meanwhile, Berkshire Hathaway Inc (NYSE:BRK) (NYSE:BRK) reduced its substantial stake in Apple Inc (NASDAQ:AAPL), which still remains its largest holding.

Overall, Microsoft experienced the most reductions, while Amazon saw the most increases in hedge fund portfolios.

Analysts expect continued upside from Nvidia, driven by the supply recovery of H100 GPUs and the ramp of H200 GPUs, coupled with GB200 and Blackwell. According to analysts, Nvidia’s transition to new GPU models will likely generate over $200 billion in data center revenue by 2025.

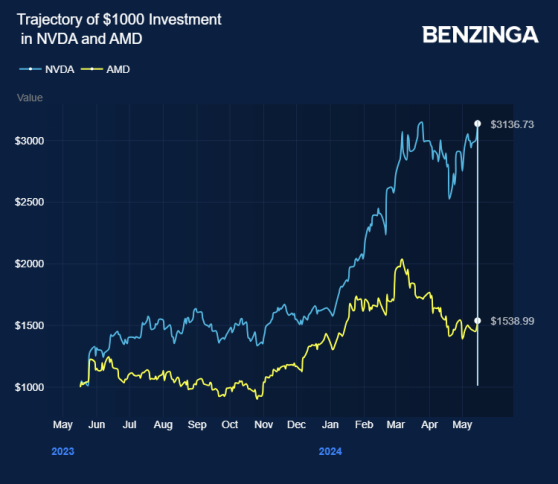

Nvidia's stock gained 224%, fueled by its AI chips and GPU market moats.

Investors can gain exposure to Nvidia via EA Series Trust Strive U.S. Semiconductor ETF (NYSE:SHOC) and VanEck Semiconductor ETF (NASDAQ:SMH).

Price Action: NVDA shares closed higher by 3.58% at $946.30 at Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga