Benzinga - by Zacks, Benzinga Contributor.

Merck (NYSE: MRK) announced that it is discontinuing a cohort of the phase III study evaluating a co-formulation of its blockbuster PD-L1 inhibitor, Keytruda plus vibostolimab, its investigational anti-TIGIT antibody, as adjuvant treatment for patients with resected high-risk melanoma.

Data from a pre-planned analysis of the study called KeyVibe-010 showed that the primary endpoint of recurrence-free survival (RFS) met the pre-specified futility criteria. A higher rate of patients discontinued all adjuvant therapy in the coformulation arm versus the Keytruda-only arm primarily due to immune-mediated adverse experiences. Due to this, it seemed unlikely that the study could achieve a statistically significant improvement in RFS.

Accordingly, an independent Data Monitoring Committee (DMC) recommended unblinding the study and guided Merck to offer patients receiving the Keytruda+vibostolimab coformulation to be treated with Keytruda monotherapy. Merck continues to analyze data from the study and will share the data with the scientific community and regulatory agencies at a later date.

At present, Keytruda is approved for two indications in melanoma. Phase III studies are ongoing evaluating Keytruda+vibostolimab coformulation in lung cancer.

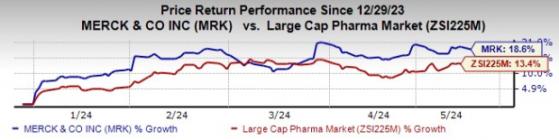

Merck's stock has risen 18.6% so far this year compared with an increase of 13.4% for the industry.

Image Source: Zacks Investment Research

This is the second Keytruda study to have failed in less than two weeks.

Last week, a phase III first-line endometrial cancer study on Keytruda failed to meet its primary endpoint of disease-free survival at an interim analysis conducted by an independent DMC. The study called KEYNOTE-B21 evaluated Keytruda in combination with chemotherapy as an adjuvant treatment, with or without radiotherapy, for the treatment of patients with newly diagnosed, high-risk endometrial cancer after surgery with curative intent. As the study failed to reach superiority for the DFS endpoint, its other primary endpoint of overall survival was not formally tested.

Keytruda, approved for several types of cancer, alone accounts for around 45% of Merck's total pharmaceutical sales. Keytruda sales are gaining from continued strong momentum in metastatic indications and rapid uptake across earlier-stage launches. Keytruda is continuously growing and expanding into new indications and markets globally. Numerous recent approvals and the expected launch of many additional indications, including in earlier lines of therapy, can further boost sales.

The Keytruda development program is also progressing well. The drug is being studied for more than 30 types of cancer, including both monotherapy and combination studies. Merck is also working on different strategies to drive the long-term growth of Keytruda. These include innovative immuno-oncology combinations, including Keytruda with TIGIT, LAG3 and CTLA-4 inhibitors. In partnership with Moderna MRNA, Merck is developing a personalized mRNA therapeutic cancer vaccine (V940/mRNA-4157) in combination with Keytruda for the treatment of adjuvant melanoma. Moderna and Merck initiated a pivotal phase III study in adjuvant melanoma in July 2023, while a phase III study in earlier stage non-small cell lung cancer (NSCLC) began in December 2023.

With Merck's growth largely depending on Keytruda, the recent pipeline setbacks do not bode well for the company.

Zacks Rank Merck has a Zacks Rank #3 (Hold) currently.

Merck & Co., Inc. Price and Consensus

Merck & Co., Inc. price-consensus-chart | Merck & Co., Inc. Quote

Some top-ranked stocks in the drug/biotech sector are ANI Pharmaceuticals (NASDAQ: ANIP) and Ligand Pharmaceuticals (NASDAQ: LGND). While Ligand has a Zacks Rank of 1, ANI Pharmaceuticals carries a Zacks Rank #2 (Buy).

In the past 60 days, the Zacks Consensus Estimate for Ligand Pharmaceuticals has improved from $4.42 per share to $4.56 per share for 2024. For 2025, earnings estimates have improved from $5.11 per share to $5.27 per share in the past 60 days. So far this year, shares of LGND have risen 17.7%.

Earnings of Ligand Pharmaceuticals beat estimates in each of the last four quarters. LGND delivered a four-quarter average earnings surprise of 56.02%.

In the past 60 days, the Zacks Consensus Estimate for ANI Pharmaceuticals has improved from $4.40 per share to $4.44 per share for 2024. For 2025, earnings estimates have improved from $5.01 per share to $5.04 per share in the past 60 days. So far this year, shares of ANIP have risen 22.2%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering a four-quarter average earnings surprise of 53.90 %.

To read this article on Zacks.com click here.

Read the original article on Benzinga