By Jonathan Cable

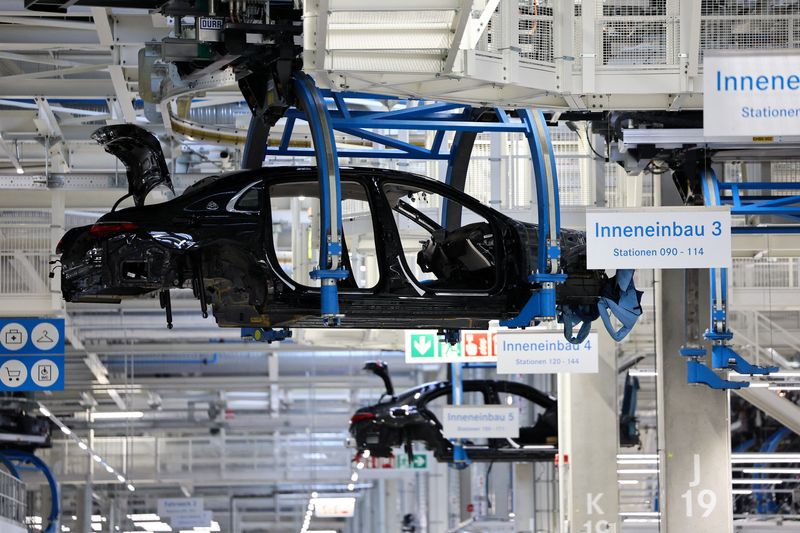

LONDON (Reuters) -The downturn in manufacturing activity across the euro zone deepened in April due to crumbling demand despite factories cutting prices, pushing firms to reduce headcount again, a survey showed on Thursday.

But it was something of a patchwork decline in the region with the situation deteriorating in France and Italy while in Germany the sector moved closer to expanding. Spain was an outlier, activity there expanded at its fastest pace in almost two years thanks to an uplift in demand.

HCOB's final euro zone manufacturing Purchasing Managers' Index (PMI), compiled by S&P Global, fell to 45.7 in April from March's 46.1, below the 50 mark denoting growth in activity for a 22nd month. However, it was just ahead of a 45.6 preliminary estimate.

An index measuring output, which feeds into a composite PMI due on Monday and is seen as a good gauge of economic health, nudged up from March's 47.1 to 47.3, matching the flash estimate.

"The euro zone continues to post a mixed bag of economic indicators. Traditional manufacturing powerhouse Germany is continuing to see contraction," said Boudewijn Driedonks, partner at consultancy McKinsey & Company.

"On the upside, Spain is emerging as a hub of manufacturing activity. Recent government investments...are helping Spain be seen as a destination for international investment in manufacturing and technology."

Italian manufacturing activity returned to contraction last month amid renewed decline in output and new orders, while weaker production and demand meant the French headline PMI declined. Germany's PMI nudged closer to break-even although a longstanding decline in purchases picked up pace.

Spain's strong April survey came after the country's statistics department said earlier this week the overall Spanish economy expanded a bigger-than-expected 0.7% last quarter.

Further afield, central Europe's manufacturers suffered in April, with a decline in factory activity deepening in Poland and the Czech Republic and Hungary's outlook softening.

WEAKER DEMAND

Suggesting no immediate turnaround for euro zone manufacturers the new orders index, below 50 since May 2022, fell to a four-month low of 44.1 from 46.0.

Factories depleted stockpiles of both purchased and final goods and reduced the size of their workforce for an eleventh month.

Last quarter, the euro zone economy recovered from a mild recession and expanded 0.3% quarter-on-quarter in January-March, official data showed on Tuesday.

The manufacturing malaise continued despite manufacturers reducing prices charged again, adding to evidence the European Central Bank will reduce borrowing costs in June in a widely expected move as inflation broadly eases.

Euro zone inflation held steady at 2.4% as predicted in April but a crucial indicator on underlying price pressures slowed, data showed on Tuesday.

On Wednesday, the U.S. Federal Reserve held interest rates steady and signalled it was still leaning towards eventual reductions in borrowing costs but put a red flag on recent disappointing inflation readings that could make those rate cuts a while in coming.