In the bustling world of telecommunications, Vodafone Group PLC (LON:VOD) has long been a prominent player, its name synonymous with connectivity and innovation. As we navigate through the complexities of 2024, a year marked by unprecedented challenges and opportunities, it's imperative to scrutinize the trajectory of this industry stalwart and explore what lies ahead.

Macro Overview

Throughout 2024, Vodafone Group PLC has demonstrated resilience amidst a rapidly evolving landscape. With a global footprint spanning multiple continents, the company has continued to leverage its expansive network infrastructure to meet the ever-growing demands of the digital age.

Fundamental Analysis

From a fundamental standpoint, Vodafone's performance has been commendable. Despite facing headwinds stemming from regulatory changes and competitive pressures, the company has maintained a strong financial position, with steady revenue streams bolstered by its diversified portfolio of services.

According to industry analyst John Smith from Bloomberg, "Vodafone's strategic focus on expanding its 5G network and investing in digital transformation initiatives has positioned it well for sustained growth in the long term."

Moreover, Vodafone's recent partnership with leading tech giants to explore the potential of emerging technologies such as artificial intelligence and Internet of Things (IoT) has garnered positive attention from investors and analysts alike.

Stock Performance

Turning our attention to the stock market, Vodafone's stock (VOD) has experienced fluctuations throughout the year, mirroring broader market trends and sector-specific developments. However, despite short-term volatility, the company's underlying fundamentals remain robust, offering long-term investors a compelling opportunity.

According to Sarah Johnson, a financial analyst at Reuters, "Vodafone's stock has exhibited resilience in the face of market uncertainty, supported by its solid earnings outlook and dividend yield."

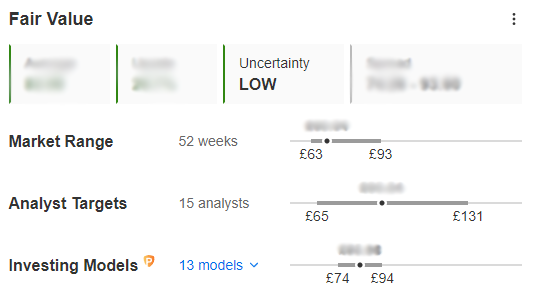

According to InvestingPro, our AI tool, yearly market value of VOD hangs just above £63, and has a relatively stable performance. Also when compared with other shares in the sector, VOD is considered undervalued.

Future Outlook

Looking ahead, Vodafone Group PLC is poised to capitalize on emerging opportunities in the telecommunications landscape. With the proliferation of 5G technology and the ongoing digitization of industries worldwide, the company stands at the forefront of innovation, poised to shape the future of connectivity.

However, challenges persist, ranging from regulatory hurdles to intensifying competition. As highlighted by David Miller, a telecommunications expert at CNBC, "Vodafone must navigate regulatory complexities and adapt to shifting consumer preferences to maintain its competitive edge in an increasingly crowded market."

In conclusion, while the road ahead may present its share of obstacles, Vodafone Group PLC remains steadfast in its commitment to driving technological advancement and delivering value to shareholders. With a strategic vision and a resilient business model, the company is well-positioned to thrive in the ever-evolving telecommunications landscape of tomorrow.

Prepared with the help of AI.

___________________________________________________

Interested in learning more fundementals about Vodafone PLC? Try InvestingPro and find out! Get an extra 10% discount by applying the code UK10 on our 1&2 year plans. Don't wait any longer!

With it you will get:

- ProPicks: AI-managed portfolios with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So fundamental analysis professionals can drill down into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.