OUTLOOK: US banks kick off Q1 earnings season. That’s a shame, as they’ll be weak. With focus on management guidance to support their double-digit rally this year. The 2nd biggest US sector is a classic value play with P/E near half broad S&P 500 and earnings outlook improving as capital markets activity recovers and margin pressure troughs. Yet Europe’s banks remain possibly the bigger opportunity. It’s the biggest European stock market sector. And source for 80% of the continent’s financing, which is the opposite of the US. Their growth and profitability is uniquely above US peers whilst valuations a third cheaper.

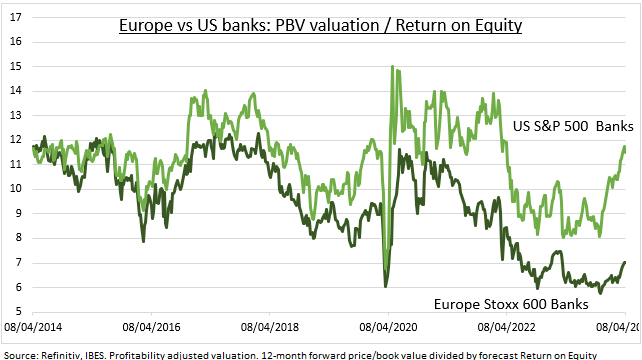

Q1 RESULTS: Big US banks kick off global Q1 earnings season. That’s unfortunate. With bank earnings estimated down 20%, led by regionals. With the combination of weak capital markets activity, margin squeeze as deposit rates catch up with lending rates, and higher precautionary loan provisions. The overall financial sector (XLF) earnings fall is being cushioned by strong 40% insurance industry profits growth. But markets are already looking ahead to a turnaround in net interest margins and better capital markets activity, with bank stocks outperforming this year. US banks trade on a 1.1x price/book value (P/BV) with a forecast 10% return on equity (RoE).

EUROPE: Financials is the largest sector in the region’s markets and valuations rerated after a decade in the wilderness. As interest rates rose and capital return policies were friendly. European bank (SX7PEX.DE) valuations nearly doubled off their lows, from 0.4x book value. Versus a 50% rerating from 0.8x in the US. Europe gets around 80% of its corporate financing from its banks, rather than its capital markets. Uniquely, European banks now have a higher earnings growth and RoE than US peers. This has only widened the relative valuation gulf (see chart) between them. Europe’s banks trade on 0.7x price/book value with a 10.6% RoE outlook.