By Casey Hall

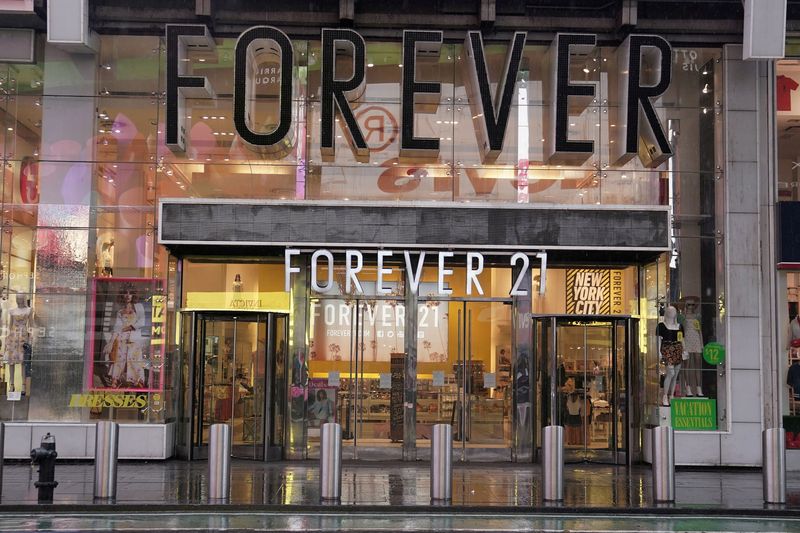

SHANGHAI (Reuters) - American fast fashion retailer Forever 21 is making its third tilt at the China market, with plans to open a physical store in the country later this month.

The brand said on social media platform WeChat that it would open a store "in June" at Jingjiang Impression City shopping centre in Taizhou, a third-tier city in the eastern province of Jiangsu, which neighbours Shanghai.

Chinese online mapping apps show that a Forever 21 store is under construction at the shopping centre.

Forever 21 did not immediately respond to a request from Reuters for more information about the opening.

The youth-focused, fast fashion retailer quietly re-entered the Chinese market last August, at first selling exclusively online via platforms such as Vipshop and Pinduoduo and later opening a store on Alibaba (NYSE:BABA)'s Tmall marketplace.

More recently, Forever 21 began making more noise on social media, with an online campaign to advertise its offerings in the "618" festival, China's major mid-year e-commerce sales event.

The brand first entered the China market in 2008, before leaving a year later.

Its second run at China's growing fashion market began in 2011. Forever 21 had a network of 11 physical stores around the country - including flagship outlets in Shanghai and Beijing - which lasted till 2019, a year in which it left multiple markets including China and filed for bankruptcy.

Forever 21 was acquired by Authentic Brands Group (ABG) in 2020. ABG signed a licensing agreement with Hong Kong's Lasonic Electric Xusheng Co. Ltd. and its subsidiary, Xusheng Electrical (Shenzhen) Co. Ltd., to manage Forever 21's China operations.

This third attempt at the Chinese market comes at a time when the country's fashion market has grown to become one of the world's largest.

Gaining and retaining market share, however, remains a tough task for mass market foreign fashion brands in China. Some, including H&M, have been plagued by controversy while others, including major sportswear companies Nike (NYSE:NKE) and Adidas (ETR:ADSGN) have lost ground to local brands Li Ning and Anta in recent years.

"It's clear within the fast fashion space there has been somewhat of a shift towards nimble domestic fashion brands, so if anything it is harder now for international fast fashion to compete here than in the past," said China Market Research Group managing director Ben Cavender.

"It will be difficult to claw away market share as most Chinese consumers either haven't heard of the brand or don't really know what it stands for."