By David Lawder

WASHINGTON (Reuters) - The International Monetary Fund called on Thursday for G20 leaders to take much stronger action to boost demand, revive flagging trade, make long-delayed structural reforms to their economies and share growth more broadly.

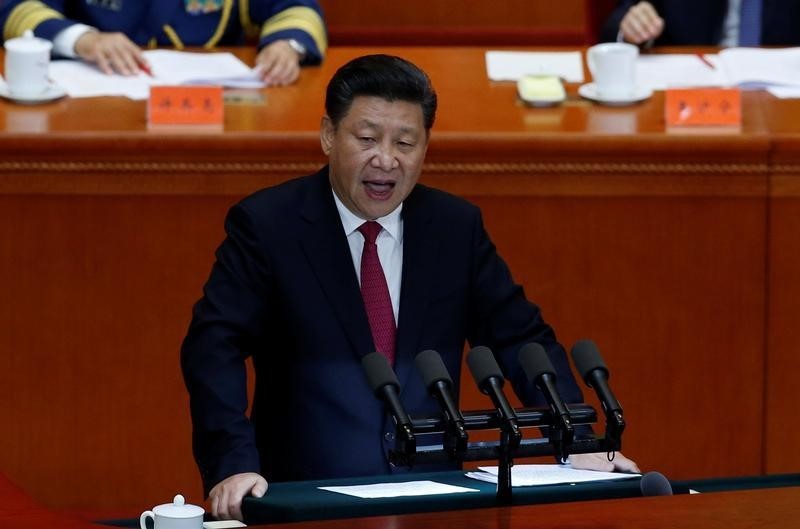

In a briefing note to heads of state of the G20 group of leading economies ahead of their summit in Hangzhou, China, on Sunday and Monday, the IMF said they had fallen far behind in their 2014 goals to boost collective growth by two percentage points within five years.

The IMF said its own research showed the growth of goods and services trade volumes had slowed in most countries since 2012 to a rate half of the pace in the two decades to 2007.

"While three-fourths of this drop can be traced to weaker economic activity, notably weak investment, the waning pace of trade liberalisation and a recent uptick in protectionist measures have added to the downward momentum," the IMF said. "Such reductions in global trade can feed back to lower GDP growth."

The IMF urged the leaders to "make the positive case for globalisation" and portray trade as "a tool to improve lives." It said they should adopt policies that foster innovation and new industries and improve labour mobility.

"It is easy to blame trade for all the ills afflicting a country, but curbing free trade would be stalling an engine that has brought unprecedented welfare gains around the world over many decades," IMF Managing Director Christine Lagarde said in a blog posting accompanying the note.

"However, to make trade work for all, policymakers should help those who are adversely affected through re-training, skill building, and assisting occupational and geographic mobility," Lagarde said.

She told Reuters in an interview that the IMF is nonetheless likely to downgrade its economic growth forecasts further.

The IMF also repeated its view that monetary policy be kept accommodative to fight low inflation and said countries with the fiscal space should pursue needed public investments in infrastructure and support growth by avoiding direct tax increases on consumers. Some countries should also use public funds to help rebuild financial sector balance sheets, the IMF said.