By Sarah McBride

SAN FRANCISCO (Reuters) - San Francisco-based startup Planet Labs, a company that aims to blanket the skies with low-cost satellites, has raised nearly $140 million from investors that include Russian billionaire Yuri Milner and SpaceX backer Draper Fisher Jurvetson. Now, the company has raised an additional $20 million from an unlikely contender: the venture arm of the International Finance Corporation, a multilateral lending organization that's part of the World Bank.

The IFC describes its mission as "alleviating poverty and creating opportunity." Generally, that has meant investing in emerging markets, not the Silicon Valley.

But lately, the Washington, D.C.-based IFC has taken a broader view of its role, including funding startups it thinks might eventually benefit poverty-stricken countries, even if the companies are U.S.-based and have other funding sources.

The Planet Labs investment comes on the heels of the IFC's $4.5 million investment last year in cloud-connectivity company Ayla and a $5 million investment in 2013 in online-education company Coursera, both based in California. Its first Silicon Valley tech investment was NeoPhotonics, a now publicly traded networking company the IFC backed in 2006.

"We seek to invest in companies and help them grow into markets we're interested in," said Nikunj Jinsi, the global head of IFC's venture team. "It's not like we invest all day long in Silicon Valley companies." Any profits from the team's investments are used to fund other IFC projects, a spokeswoman said.

This fiscal year, the venture group expects to invest more than $100 million, most of it in the developing world. But to critics, any investment by the team in Silicon Valley startups is troubling.

"They should be spending more time and effort finding investments in developing countries," said Luiz Vieira, coordinator at the Bretton Woods Project, a nonprofit that monitors the World Bank. "It's not like capital is challenging to get in California."

The IFC launched its venture capital work about 10 years ago, and the team's annual investments have grown rapidly since then, doubling since 2013. Still, the venture operation represents only a tiny portion of the IFC's overall investments in development.

Last year, the IFC invested $17.3 billion of its own capital, including equity financing and loans, to fund infrastructure and other development projects in emerging markets. In addition, it coordinated about $5 billion in co-investments from other organizations.

But Jinsi argues that companies don't have to be based in emerging markets to help meet urgent needs there.

"We're getting more aggressive in looking at core technology markets that have relevance to our underlying markets," he said. Data provided quickly and cheaply by Planet Labs' satellites will help address a range of challenges in the developing world, from crop management to fire risk, he said, creating cascading benefits to businesses in poorer countries.

The IFC declined to disclose how big an ownership stake it holds in Planet Labs, and it would not say whether it will require the company - or other U.S. startups it has invested in - to meet specific goals that would benefit developing countries. Planet Labs is already working on initiatives targeting the developing world, including a partnership with the Rockefeller Foundation that uses Planet Labs' images to try to improve ecosystems and crisis response.

Planet Labs' chief executive Will Marshall, a former NASA scientist, said the IFC investment would help the four-year-old company find more partners in emerging economies, as well as give it more credibility.

"They validate us," he said.

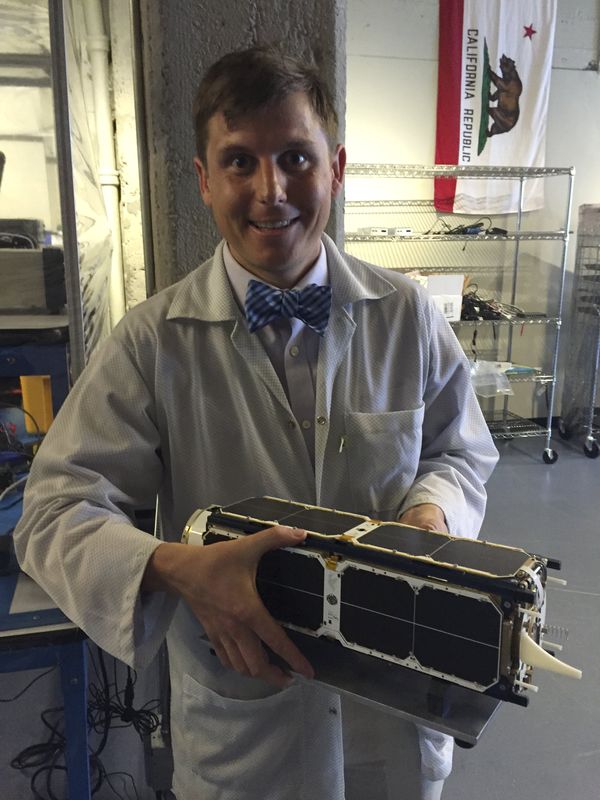

Planet Labs is one of several startups aiming to harness technology that will lead to smaller, less expensive satellites and allow the deployment large networks of satellites at less risk and lower cost. The satellites now being launched by the company are a bit smaller than two cinder blocks.

Planet Labs has successfully launched 73 satellites, with 14 more scheduled to launch today.

Customers use data they acquire from Planet Labs as a platform on which to build related apps, such as tools to monitor oil levels, for example, or crop development. Existing customers include Woolpert, an Ohio-based engineering and design company, and Geoplex, a Melbourne, Australia-based mapping company.

In October, Planet Labs lost 26 satellites due for deployment via Orbital Sciences Corp.'s Antares rocket, which exploded into a fireball just after launch in Virginia.