Benzinga - by Shanthi Rexaline, Benzinga Editor.

Tesla, Inc.'s (NASDAQ:TSLA) string of price cuts have alienated investors and fans, as they fear a further hit to profitability and see the move as a signal of waning demand.

SPAC king and venture capitalist Chamath Palihapitiya weighed in on the electric vehicle company's under-cutting, aggressive pricing strategy.

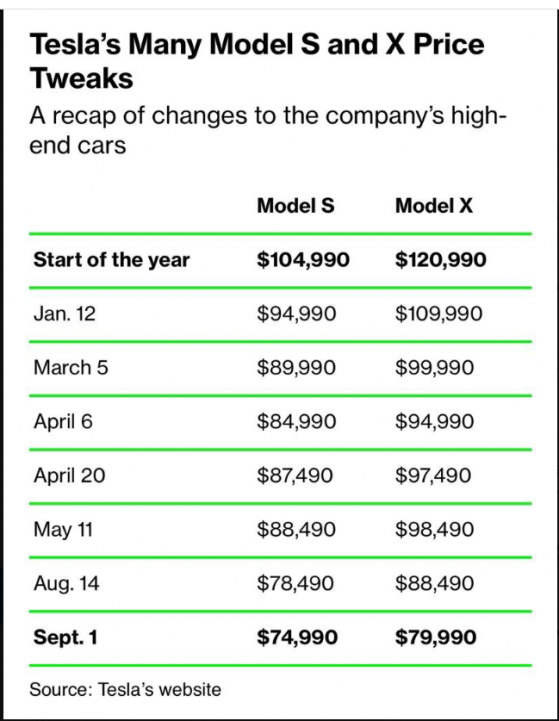

What Happened: Sharing a screenshot of Tesla's Model S/X price cuts since the start of the year, Palihapitiya said, “I was shocked when I saw this chart.”

“The speed and aggressiveness with which $TSLA is cutting prices is the way to beat the End Boss,” he said. The businessman sees the rapidly increasing price affordability and constantly improving hardware and software as leading to “super maximized market demand.”

“This is a lethal combination which we haven't seen play out in any modern market before,” he said.

Some companies cut prices but most keep it flat or increase them, while some improve products quickly, Palihapitiya noted. "But no one has actually given you more for less on such a big ticket purchases so frequently, he said.

Price Cuts Bearish? Wealth manager Ram Ahluwalia chimed in and offered a different take. Price cuts are bearish, he said. “Less revenue, earnings and margin and lower return on invested capital,” he added.

Apple is raising prices for its next iPhone, which is a “sign of moat, dominant position,” Ahluwalia said.

“Buffett quality businesses raise prices..,” he added.

Palihapitiya said the move isn't bearish. “While it is definitely less earnings per car it is not bearish for total earnings which is where the earnings cadence has been focused on.”

Tesla ended Friday's session down 5.06% to $245.01, according to Benzinga Pro data.

Photo by Featureflash Photo Agency on Shutterstock

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next: Tesla’s Aggressive Price Cuts, Fisker’s Houdini Trunk, VinFast’s Rise And Fall, And More: Biggest EV Stories Of The Week

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga