By Geoffrey Smith

Investing.com -- So what happens next?

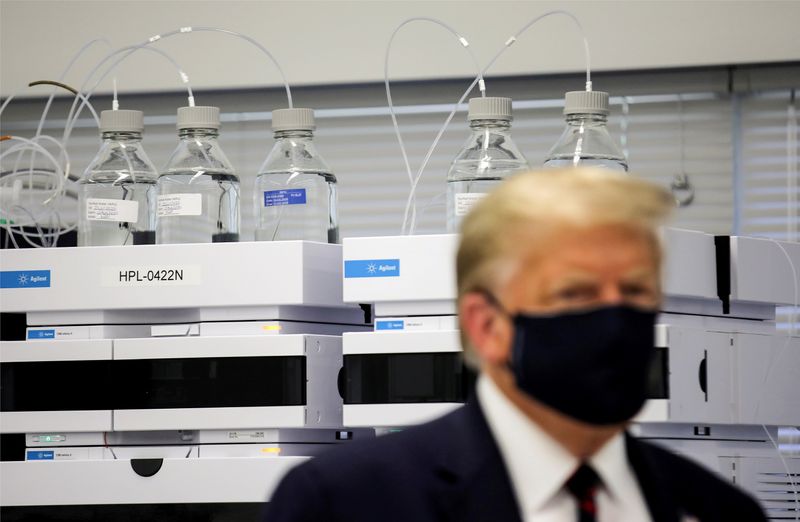

Investors have reacted badly to the news of President Donald Trump's positive test for Covid-19 with a knee-jerk sell-off across asset classes. So far, it looks like a textbook case of markets adding a blanket uncertainty premium to more or less everything. But exactly what risks need to be priced in?

For now, at least, there is no disruption to the functioning of the U.S. government, which removes the biggest and most important element of political risk. White House Doctor Sean Conley said in a published memo that Trump and the First Lady were both "well" after their test, adding that "I expect the President to continue carrying out his duties without disruption while recovering."

If Trump's condition were to worsen, the normal course of action, under the 25th Amendment of the U.S. constitution, would be for him to hand over executive authority to Vice President Mike Pence, and to take back the reins when he returns to health. Both Ronald Reagan and George W. Bush (twice) have done this in recent history. The White House said overnight that Pence had been tested but has not so far announced the results of his test.

Given the advances since the spring in containing Covid symptoms, notably through the use of the generic steroid dexamethasone, and given the assurance of top-class medical attention, it seems unlikely that both Trump and Pence could be incapacitated, although Trump's age and weight do profile him as a high-risk case. If both were to be incapacitated, then executive authority would pass to House Speaker Nancy Pelosi, which would represent a very clear step up in political risk, given the radical shift in power relationships this would entail, so close to the November elections.

The implications of Trump's illness for the outcome of the elections themselves are far less clear. His campaign schedule for the next week is clearly gone, given the need to isolate for at least a week. The next presidential debate is due in only five days, so either Trump Zooms in from the White House or Pence goes to Utah to take on Joe Biden. What happens after that depends entirely on the speed of his recovery.

Opinion polls have suggested so far that Trump is on course for defeat in November. Unless he can make a convincing return to the public stage more or less immediately after quarantine, the question marks that will hang over his health situation can only hurt his chances further. The question is then whether poor health either forces Trump to withdraw, or whether it could serve as a pretext for him to withdraw and return to a highly profitable life of sniping from the political sidelines without having to suffer the stigma of defeat (albeit while losing his current immunity from prosecution).

The Republican Party has already made its nomination and has no formal machinery for withdrawing it on health or any other grounds. Nor is there any historical precedent for having to name a replacement candidate.

As such, it's for Trump to choose whether or not to withdraw. Given the closeness of the election, Pence would surely be the likeliest to assume the mantle of nominee if he did. Pence may not be able to command the same broad coalition of voters as Trump, but by the same token, he doesn't energize the resistance to Trump to anything like the same degree either. Irrespective of how the presidential election goes, it isn't impossible that Trump's absence from the ballot could tip some closely-contested Senate seats next month, allowing the GOP to keep control of the upper chamber.

So many questions, so few clear answers. All that can be said with certainty is that, given the extraordinary pressure of the political deadlines, the answers won't be long in coming.