By Geoffrey Smith

Investing.com -- Hopes of an early end to the global shortage of semiconductors just went up in smoke, literally.

A fire at a factory owned by Japan’s Renesas Technologies, one of the world’s biggest suppliers of chips to the auto industry, is threatening to make matters much, much worse for its core customer base in the near future.

Chief executive Hidetoshi Shibata told a press conference on Sunday that he’s afraid of “a massive impact on chip supplies” and said the company would “pursue every means possible” to keep disruptions to a minimum.

Shibata told the conference that the fire had damaged some 2% of the factory’s chipmaking equipment as well as halting the production of 300 millimeter wafers.

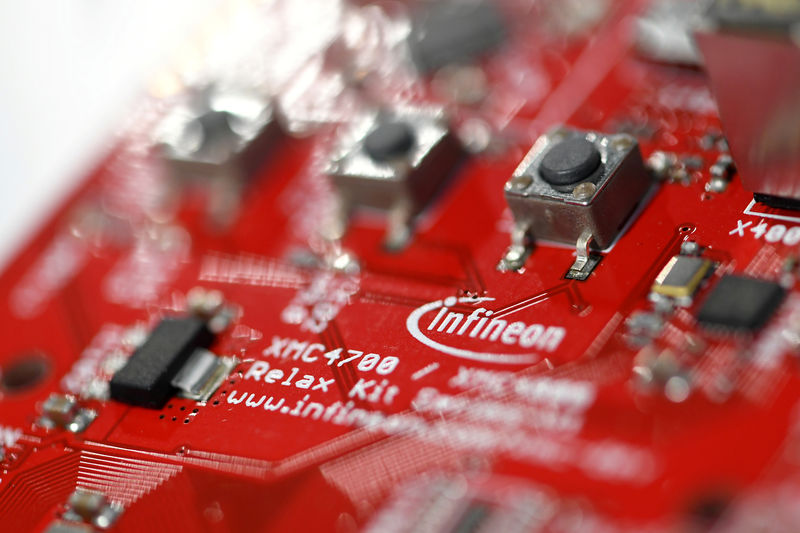

Shares of rival chip suppliers were clear beneficiaries in morning trading Europe. Infineon (DE:IFXGn) stock rose 2.8%, while STMicroelectronics (PA:STM) stock rose 1.4% and NXP (NASDAQ:NXPI) stock rose 2.0%.

ASML Holding (NASDAQ:ASML), the Dutch company that makes chipmaking equipment, also added 2.3% as traders upped their bets on a permanent expansion of capacity by the industry in response to the shortage.

The sector’s gains stood out on a morning when pandemic fears had set the tone. Germany is set to discuss tightening and extending lockdown restrictions through mid-April later Monday in response to a surge in Covid-19 cases since the winter lockdown was eased at the start of the month.

At the weekend, Ford Motor (NYSE:F) had said it would idle more of its U.S. factories due to the shortage, which has been aggravated by the cold snap that took chip production facilities in Texas offline. The shortage is now so acute that auto groups are having to cut back on production even of their highest-margin products.

Ford – which has already said the shortage could take anything up to $2.5 billion of this year’s profits - said its Ohio assembly plant will close temporarily next week, while its truck plant in Louisville, Kentucky will only work two of three shifts. Both plants will return to full output in the week of March 29.

Last week, Ford said it would assemble its chief money-spinner in North America, the F-150 pickup truck, without certain parts and then hold them “for a number of weeks” until they can be completed and shipped.

Meanwhile, RAM owner Stellantis (NYSE:STLA) said at the weekend that will do the same for its 1500 Classic trucks at the assembly plants at Warren, Mi., and Saltillo in Mexico.

The chip shortage isn’t only affecting carmakers, although it is hitting them harder than many industry segments as chipmakers prioritize higher-value market segments. Apple (NASDAQ:AAPL) has already postponed the launch of its iPhone 12 due to the issue, while Samsung (KS:005930) warned last week that it may have to push launch of its latest Galaxy Note smartphone to 2022.