BEIJING (Reuters) - Criminal prosecution of 26 people involved in China's biggest alleged online fraud - a nearly 60 billion yuan (6.97 billion pounds) case involving online peer-to-peer lender Ezubao - has started in Beijing, the official Xinhua news agency reported on Friday.

Ten individuals, along with Ezubao's parent companies Yucheng Holdings and Yucheng Global, are charged with fraudulent fund-raising, the news agency said. Sixteen other individuals face charges of illegally taking public deposits.

Other charges include smuggling precious metals, illegal possession of weapons and undocumented border crossings, Xinhua said.

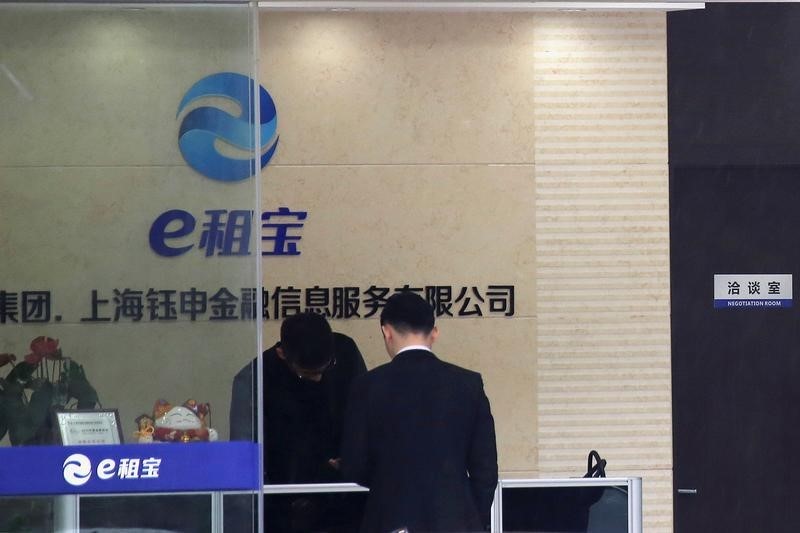

Ezubao, once China's biggest P2P lending platform, allegedly collected 59.8 billion yuan of funds from investors through fake investment projects it advertised on its website and failed to repay 38 billion yuan. It collapsed in February, with executives saying the firm was "a complete Ponzi scheme", which used investor funds to support lavish lifestyles for its executives.

The alleged scam has put the spotlight on risks in China's fast growing and loosely regulated wealth management product industry. The authorities have since August unveiled a slew of new regulations aimed at strengthening the online finance industry.

More than 1,700 problematic P2P lending platforms will "have to exit" the market, a regulatory official said at the time.

China's peer-to-peer industry has boomed in recent years. Outstanding P2P loans jumped 153.5 percent to 956 billion yuan by the end of September, a record high, according to a report by domestic industry portal P2P001.