By Julia Love

SAN FRANCISCO (Reuters) - Apple Inc's (O:AAPL) first-ever drop in quarterly iPhone sales has spurred Chief Executive Tim Cook to turn the spotlight on prospects for its services business, but the field is rife with competition and may prove challenging for a brand based on gadgets.

Second-quarter earnings saw services emerge as Apple's second-largest business after the iPhone for the first time, topping iPad and Mac sales, which both fell.

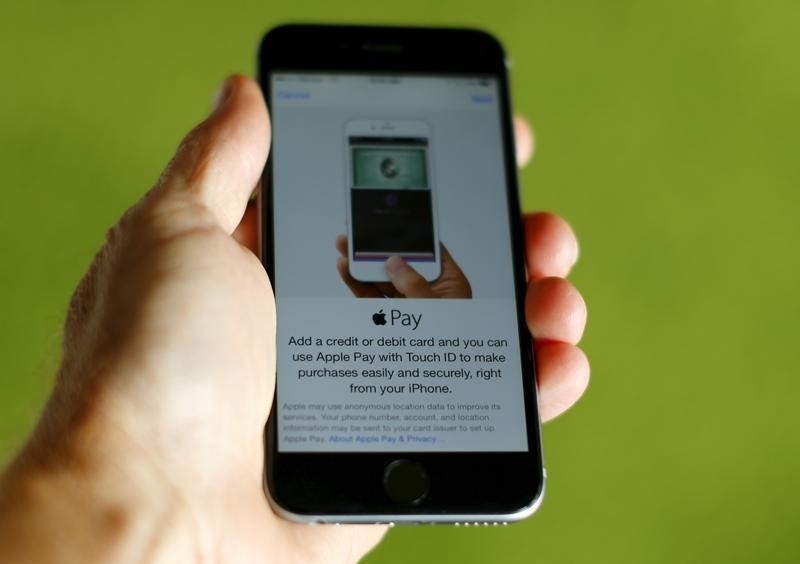

The App Store, Apple Music, storage centre iCloud and mobile wallet Apple Pay and other services generated nearly $6 billion (4.1 billion pounds) in revenue, up 20 percent from the previous year. And executives have cheered the progress they are making in subscriptions, touting Apple Music's 13 million paying subscribers.

The size of Apple's installed base with 1 billion devices in consumer hands suggests it has plenty of room to grow in services. Services also promise a recurring revenue stream, unlike hardware sales.

But analysts say Apple faces an uphill battle in carving out the same sort of position in services that it has achieved with its hardware. The $6 billion in services revenue also pales in comparison to iPhone sales which accounted for about two-thirds of the company's $50.6 billion quarterly sales.

Firms such as music service Spotify, cloud storage rivals Google (NASDAQ:GOOGL) and Microsoft Corp (O:MSFT) and map makers have claimed major audiences among iPhone users, even when Apple has offered its own products as a default.

Also raising the stakes for its services business has been Apple's decision to release in March the smaller, much cheaper iPhone SE - a move that is seen as trading revenue per device for broader adoption of its phones.

"For the strategy to really make a lot of sense, you want to be more aggressive in building that services revenue," said Colin Gillis, an analyst with BGC Partners.

Apple may also have to speed up its game.

"Apple has settled into this annual upgrade cycle for hardware and software," said analyst Jan Dawson at Jackdaw Research. "That's quite different than the way that say Facebook (NASDAQ:FB) pushes out updates to its app or Google makes changes to its search engine – they do that almost in real time."

Gillis at BGC Partners calculates that margins for Apple's services businesses are not as strong as the iPhone.

"I don't think any one is ever going to find that kind of sweet spot," he said.

Apple Chief Financial Officer Luca Maestri said on Tuesday services achieve a similar level of profitability for the company as the average of its other businesses.

Pushing ahead in services in China - Apple's second largest market - may also be challenging due to regulatory concerns. Chinese regulators have demanded that Apple halt its sales of books and movies in the country, the New York Times reported last week.

"They need (services) in China – it has to be part of the growth story," said analyst Ben Bajarin of Creative Strategies.