By Dhirendra Tripathi

Investing.com – Energy stocks were lower across the board in Monday’s premarket as crude prices fell and major investment banks cut their forecasts for China’s GDP amid rising cases of COVID-19 in the world’s second-largest economy.

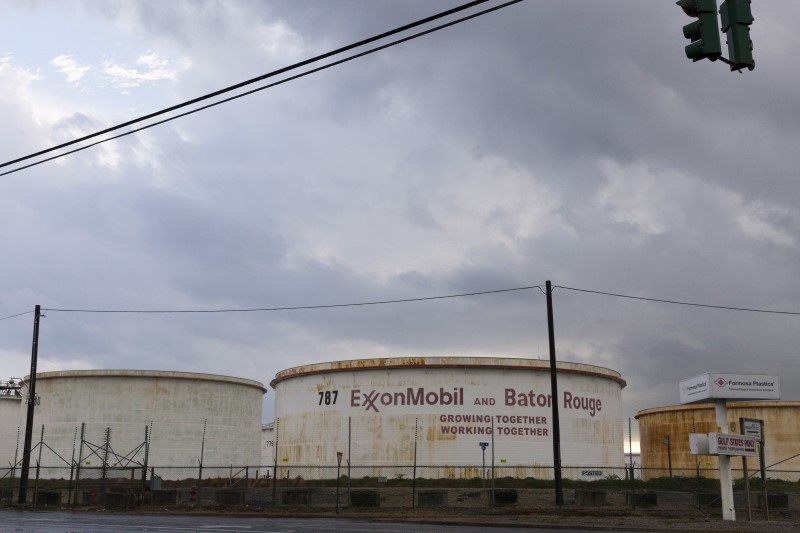

Shares of integrated oil companies as well as standalone explorers fell. Shell (LON:RDSa) ADR fell the least. It was down 1%. Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX) and BP (NYSE:BP) fell around 1.4% each. Occidental Petroleum (NYSE:OXY) shed 2.7% while Marathon Oil (NYSE:MRO) traded 3.8% weaker.

Brent fell 4% to $67.80 a barrel by 0515 ET after a 6% slump last week for the biggest weekly loss in four months. Crude futures fell 4.4%, to $65.28 after plunging nearly 7% last week, their sharpest weekly decline in nine months.

Crude oil imports in China, the world’s biggest energy consumer, fell in July and were down sharply from the record levels of June 2020, adding to concerns that recovery in major economies of the world is going to be a long and painful process.

Wall Street banks JPMorgan), Goldman Sachs and Morgan Stanley all cut their China growth forecasts on Monday after the country reported lower than expected import and export numbers, Reuters reported.

JPMorgan (NYSE:JPM) reduced its quarter-on-quarter growth estimate for the country’s third quarter to 2% from 4.3% and trimmed its full-year forecast to 8.9% from 9.1%.

Goldman cut its quarterly estimate to 2.3% from 5.8% and to 8.3% versus 8.6% for the full year. Morgan Stanley (NYSE:MS) lowered its quarterly growth forecast to 1.6%.

On Monday China reported 125 new COVID-19 cases, up from 96 a day earlier, reviving fears that the virus is here to stay even as governments battle vaccine hesitancy while pushing for higher availability of the shots. Infections hit daily records in Malaysia and Thailand.

China's export growth slowed more than expected in July as floods rage in parts of the country. Import growth was also weaker than expected.