By Samuel Indyk

Investing.com – Shares in Anglo-French company Novacyt jumped over 17% on Friday after the company provided an update on the progress of its R&D programmes to address evolving Covid-19 testing demands.

The company announced that its wholly-owned subsidiaries Primerdesign and Microgen Bioproducts have been included in the Public Health England National Framework Agreement, meaning its full range of clinical products, including tests within its accredited portfolio, can be purchased by Public Health England.

“The successful inclusion of Primerdesign and Microgen Bioproducts in the PHE National Framework Agreement, coupled with the Company's investment in its commercial infrastructure to deliver new products and establish a direct sales force, means Novacyt is well positioned to develop a long-term commercial position in the UK market,” the company said in a statement.

Covid-19 R&D update

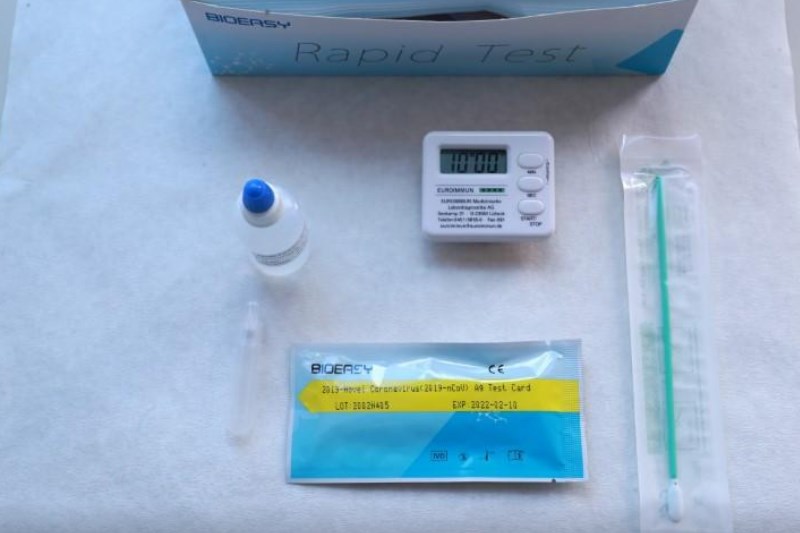

The company announced expansion of its PathFlow lateral flow test portfolio and has plans to launch a test to differentiate between Covid-19 antibodies in Q3 this year.

Novacyt (LON:NCYT) also announced they have expanded their genesig, PROmate and SNPsig polymerase chain reaction (PCR) portfolios.

“The continued development and expansion of our COVID-19 portfolio demonstrates Novacyt's ability to match the rapid evolution of SARS-CoV-2 with real-time bioinformatics surveillance and accelerated product development,” said Novacyt CEO Graham Mullis.

“We are also pleased to be included in the PHE national framework, which allows PHE and NHS hospitals to purchase our accredited products without the need for direct contract awards.

“We look forward to the opportunity to expand our support of diagnostic testing in the UK through our established infrastructure and building a long-term future in this important market, as well as in international markets as we continue to invest in our direct commercial operations.”

The update comes after a disappointing month for shares. On 9th April, the company provided a trading update and confirmed the UK’s Department for Health and Social Care had decided not to agree and extension to the previous supply contract. Shares fell over 30% and had fallen to a low of 361.00 pence per share earlier this week, after trading above 700.00 pence prior to the announcement.

At 13:22BST, shares in Novacyt were trading higher by 17.5% at 435.51 pence per share.