By Claire Milhench

LONDON (Reuters) - Sovereign wealth fund (SWF) assets jumped 13 percent year-on-year to $7.45 trillion (5.24 trillion pounds) in March 2018 helped by a strong performance in global equity markets, a report from research provider Preqin showed on Thursday.

In the previous two years SWF assets have grown slowly or stalled, with low interest rates, low oil prices and volatile stock markets taking a toll, but global equities (MIWO00000PUS) returned around 20 percent in 2017, giving funds a boost.

Wealth in the sector remained concentrated, with the 10 largest funds managing $5.49 trillion, or 74 percent of total SWF assets globally.

But growth broadened out, with 71 percent of funds seeing assets increase over the past 12 months, up from 51 percent a year ago.

With hydrocarbon-funded SWFs making up 51 percent of total industry capital, the recovery in oil prices over the last 12 months has helped replenish coffers.

Some oil-dependent states had to draw down from their rainy-day funds in prior years to close budget gaps after oil prices plunged to under $30 a barrel in January 2016. But Brent crude futures (LCOc1) are now trading at around $70 a barrel.

Norway's oil-backed Government Pension Fund Global is still the largest SWF in the world, with total assets of $1.06 trillion. This fund accounted for a fifth of the $866 billion year-on-year increase, Preqin said, adding that most of its gains came from its public equities portfolio.

The fund was able to double its return on its total investments in 2017, beating its own benchmark.

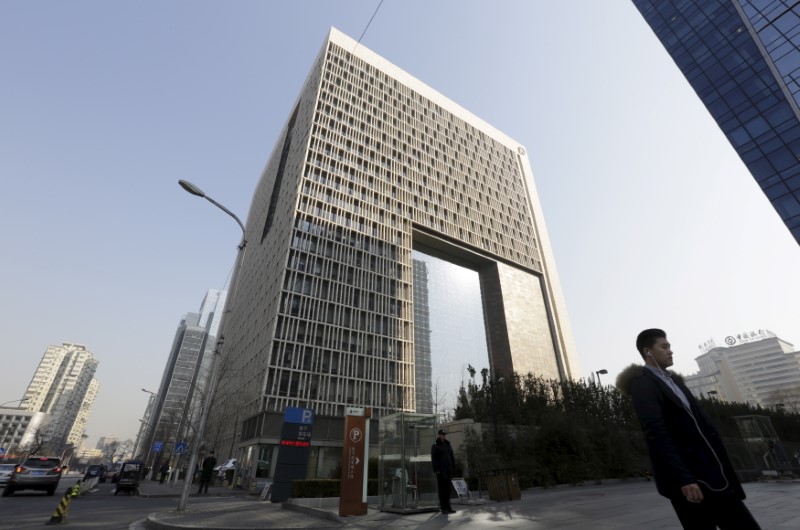

China Investment Corporation (CIC) has also experienced a significant growth in assets, with its returns largely boosted by stronger-than-expected Chinese economic growth, Preqin said.

On the debit side, Russia's Reserve Fund ceased operations at the start of 2018 after Russia's finance ministry fully spent the fund's capital to cover budget shortfalls. The remaining capital was distributed to the National Wealth Fund.

SWF appetite for alternative assets has continued to grow, with 76 percent of funds now investing in at least one alternative asset class, up from 74 percent in 2017. Real estate and infrastructure are the most popular, with 62 percent and 64 percent of funds having exposure to these respectively.

SWFs now account for at least 15 percent of the global alternatives market, according to a recent report from State Street Global Advisors (SSGA).

Norway's finance ministry has said its SWF should not be given permission to invest in unlisted companies.

But others, such as Saudi Arabia's Public Investment Fund, have become increasingly active in private markets, not least through its tech-focused joint venture with Softbank.