Benzinga - by Zacks, Benzinga Contributor.

GE HealthCare Technologies Inc. (NASDAQ: GEHC), along with Heart Hospital of New Mexico at Lovelace Medical Center (HHNM), announced HHNM as the first location in the United States to install GE HealthCare's latest Allia Image Guided System Pulse. The Allia IGS Pulse system is expected to provide excellent image quality and improve workflow for the diagnosis and treatment of cardiovascular diseases (CVDs).

HHNM expects to use the Allia IGS Pulse system in its cardiac electrophysiology lab to plan, guide and monitor the outcomes of electrophysiological procedures, such as cardiac ablations and cardiac catherizations, among others.

The latest installation is expected to strengthen GE HealthCare's foothold in the CVD treatment space.

Significance of the Installation According to a report by the American Heart Association, heart disease has been the leading cause of death in the United States for decades. Per the report, nearly half (48.6%) of all people over the age of 20 years have some type of CVD, including coronary heart disease, heart failure, stroke and, most notably, high blood pressure.

Per GE HealthCare's management, the collaboration with HHNM for the first U.S. installation of the Allia IGS Pulse System will likely address current healthcare challenges and provide optimal experiences for patients and their providers.

HHNM's management believes that as New Mexico's only hospital exclusively dedicated to heart care, it will be able to provide innovative treatment options for the patients and keep them close to home for care.

Industry Prospects Per a report by MarketsandMarkets, the global electrophysiology market was valued at $8.2 billion in 2023 and is anticipated to reach $15.1 billion by 2028 at a CAGR of 13%. Factors like the increasing prevalence of CVDs and technological advancements are likely to drive the market.

Given the market potential, the latest installation is expected to provide a significant boost to GE HealthCare's business.

Recent Developments This month, GE HealthCare, along with MediView XR Inc., announced the successful first installation and clinical cases using the OmnifyXR Interventional Suite at North Star Vascular and Interventional in Minneapolis, MN.

The same month, GE HealthCare inked an agreement with Salud Digna. The agreement aims to deploy digital solutions to improve the efficiency of care protocols for clinicians on Computed tomography, Magnetic resonance and ultrasound systems across Mexico.

Last month, GE HealthCare collaborated with Medis Medical Imaging. The collaboration is aimed at helping advance precision care in the diagnosis and treatment of coronary artery disease. Both companies are expected to focus on the integration of Medis Quantitative Flow Ratio into GE HealthCare's cath lab environment built around the Allia Platform to enable a seamless user experience.

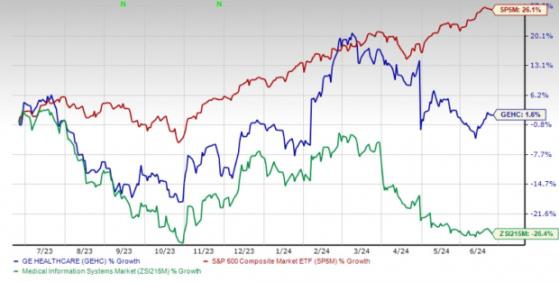

Price Performance Shares of GE HealthCare have gained 1.6% in the past year against the industry's 26.4% decline. The S&P 500 has witnessed 26.1% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks Currently, GE HealthCare carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. (NYSE: DVA), LeMaitre Vascular, Inc. (NASDAQ: LMAT) and Ecolab Inc. (NYSE: ECL).

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA's earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%.

DaVita's shares have gained 47.9% compared with the industry's 16.4% rise in the past year.

LeMaitre Vascular, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 18.5%. LMAT's earnings surpassed estimates in each of the trailing four quarters, with the average being 10.1%.

LeMaitre Vascular has gained 19.8% against the industry's 1.8% decline in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. ECL's earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab's shares have rallied 34.6% against the industry's 10.8% decline in the past year.

To read this article on Zacks.com click here.

Read the original article on Benzinga